Tag: Anti-Money Laundering

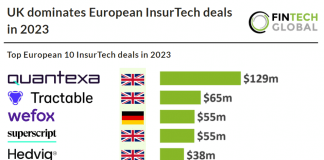

UK dominates European InsurTech deals in 2023

Key European InsurTech investment stats in 2023:

• European InsurTech deal activity totalled at 126 deals in 2023, a 44% reduction from the previous year

•...

Refine Intelligence launches with $13m, introducing innovative AML solution

Refine Intelligence, a FinTech company specialising in Financial Crime Greenflagging, announced its launch, marking a significant advancement in anti-money laundering (AML) practices.

The rise of money mules in UK fraud: Prevention and detection

Fraud in the UK has become a significant concern, with 40% of crimes being fraudulent. Money muling is at the forefront, where fraudsters utilise synthetic or real mule accounts for financial gain. The UK government, recognizing the seriousness, plans to publish an action plan to combat this issue.

Understanding proliferation financing: Key steps for compliance and risk management

Proliferation Financing (PF) is becoming an increasingly important aspect of the compliance landscape, akin to well-known areas like anti-money laundering (AML) and counter-terrorism financing (CTF). Recently, regulators, particularly in the UK, have begun implementing stricter measures to help businesses identify and mitigate PF risks.

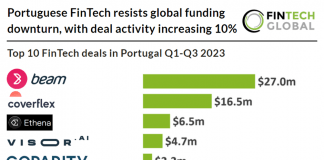

Portuguese FinTech resists global funding downturn, with deal activity increasing 10%

Key Portuguese FinTech investment stats in Q1-Q3 2023:

• Portuguese FinTech deal activity reached 21 transactions during the first nine months of 2023, a 10%...

PSP growth acceleration: Overcoming compliance hurdles in the FinTech sector

The landscape for Payment Service Providers (PSPs) is rapidly evolving, with a pressing need to scale operations effectively while managing Anti-Money Laundering (AML) compliance...

Harnessing the chaos: Proactive risk strategies for thriving in 2024

In the fast-paced world of corporate governance, 2024 looms with unprecedented challenges. As we peer into this future, it's evident that the previous years'...

PEPs: The banking and finance VIP challenge

Politically Exposed Persons (PEPs) have been a longstanding concern in the world of banking and finance, with their identification being a crucial element of anti-money laundering (AML) regulatory requirements for over two decades. Recent events, such as Russia's invasion of Ukraine, have propelled PEPs into the spotlight, as even prominent figures in British politics found themselves denied access to their bank accounts due to their PEP status, as Moody's Analytics discussed in their recent white paper.

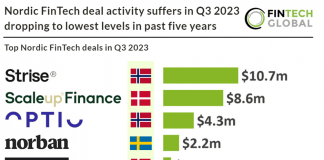

Nordic FinTech deal activity drops to lowest levels in past five...

Key Nordic FinTech investment stats in Q3 2023:

• Nordic FinTech deal activity reached eight deals in Q3 2023, a 77% drop from Q3 2022

•...

iCore Technologies taps Flagright to enhance security measures on digital products

Flagright, a global leader in AI-powered AML (Anti-Money Laundering) compliance solutions, has announced that it has onboarded iCore Technologies as its latest customer.