Key Portuguese FinTech investment stats in Q1-Q3 2023:

• Portuguese FinTech deal activity reached 21 transactions during the first nine months of 2023, a 10% increase compared to the same period last year

• Portuguese FinTech investment reached $58m in Q1-Q3 2023, a 8% increase from 2022

• Blockchain & Digital Asset technologies was the most active FinTech subsector in Portugal with six deals in during the first three quarters of the year

Portuguese FinTech has defied the global funding drop during Q1-Q3 2023. In the first three quarters of 2023, Portuguese FinTech deal volume reached 21 transactions, reflecting a 10% uptick compared to the same period in 2022. Investment in Portuguese FinTech companies during Q1-Q3 2023 amounted to $58m, marking an 8% rise compared to the preceding year.

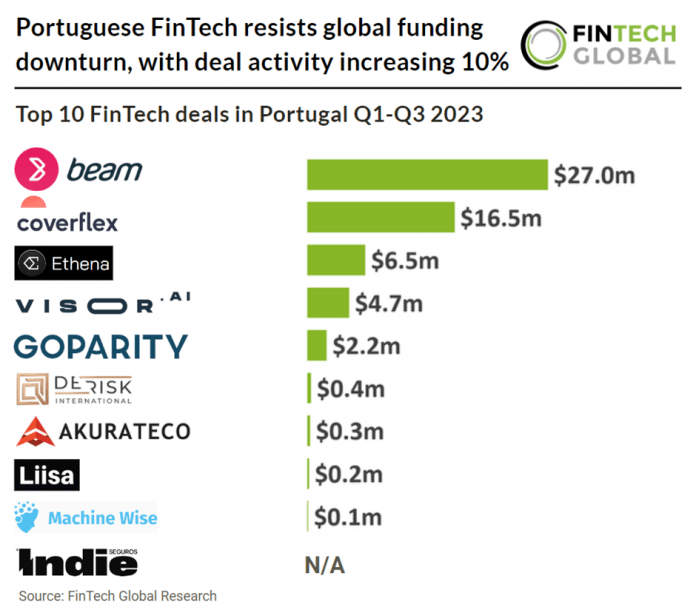

Beam, a global payments acceptance platform, had the largest Portuguese FinTech deal in Q1-Q3 2023 after raising $27m in their latest Series B funding round, led by Alex Cheiman. Beam is disrupting the FinTech sector by utilizing blockchain and digital currency technologies to revolutionize payments and retail technology. This significant investment is expected to propel Beam’s mission to redefine traditional payment and marketing concepts using emerging technologies. The company’s vision is to create a seamless and user-centric experience, and this funding will further enhance its capabilities. Beam’s unique approach has garnered strong investor support, and it is well-positioned to drive innovation in the rapidly evolving financial landscape.

Blockchain & Digital Asset technologies was the most active FinTech subsector in Portugal with six deals in Q1-Q3 2023, a 29% share of deals. RegTech was the second most active with five deals, a 24% share of all investments and InsurTech was the third most active with four deals.

Starting from July 15, 2023, Notice no. 1/2023 from the Bank of Portugal will be in effect, supplementing the Anti-Money Laundering (AML) Legal Framework by specifying procedures and requirements for compliance with AML and counter-terrorist financing obligations for entities dealing with virtual assets. While there are no specific regulations tailored to virtual currencies, regulatory measures concerning digital currencies and assets are emerging, especially in the context of AML regulations. The Bank of Portugal has clarified that virtual currencies are not recognized as legal tender in Portugal, and their acceptance as a form of payment is not mandatory. However, they are considered an optional means of payment, similar to other assets, and can be used in transactions if mutually agreed upon by the parties involved. This aligns with a European Court of Justice decision recognizing Bitcoin as a contractual means of payment.