Key European FinTech investment stats in Q1 2024:

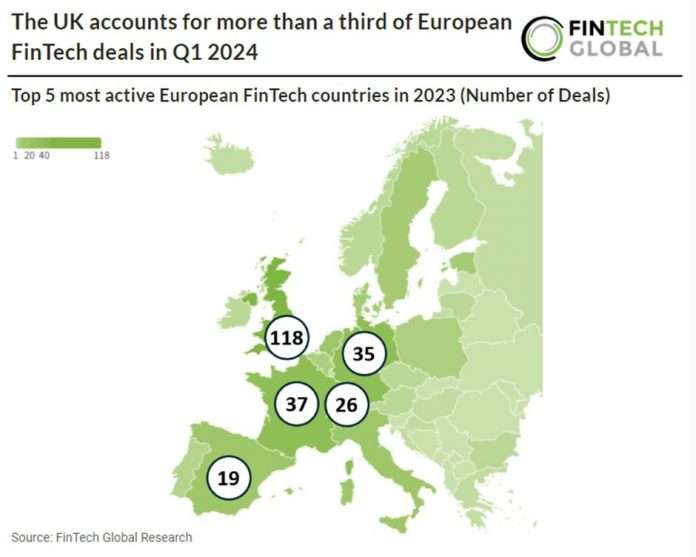

• European FinTech deal activity totalled at 333 deals in Q1 2024, a 41% reduction from the previous year

• European FinTech companies raised a combined $2.4bn in Q1 2024, a 23% drop from Q1 2023

• Blockchain & Digital Assets was the most active FinTech subsector with 67 transactions, a 20% share of deals

In the first quarter of 2024, the European FinTech sector witnessed a notable decline in deal activity, with only 333 deals recorded, marking a significant 41% reduction compared to the previous year. Additionally, despite continued investment, European FinTech companies collectively raised $2.4bn during this period, indicating a 23% drop from the funding levels observed in Q1 2023.

Monzo, a digital bank, had the largest European FinTech deal in Q1 2024 after raising $430m (£340m) in their latest venture round, led by CapitalG. Following this round, the company has reached a post-money valuation of $5bn (£4bn). In this latest funding round, Monzo is defying the current funding market, notably with substantial involvement from Google. CapitalG, the growth fund under Google’s parent company Alphabet, alongside participation from GV, Google’s venture fund. Additionally, HongShan Capital, formerly known as Sequoia Capital China, joins as an investor, alongside existing backers like Passion Capital and Tencent. Monzo reported profitability in the first two months of 2023. For the year ending February 2023, it reported net operating income of £214.5m, almost doubling YoY from £114m. Losses reduced slightly, to £116.3m from £119m the previous year.

Blockchain & Digital Assets was the most active FinTech subsector with 67 deals, a 20% share of deals. RegTech was the second most active FinTech subsector with 60 deals, a 18% share of deals. Banking Infrastructure was the third most active FinTech subsector with 48 deals, a 14% share of deals.

The latest European FinTech regulation comes from The EU Council and Parliament which have reached a provisional agreement on key aspects of the anti-money laundering package aimed at safeguarding EU citizens and the EU’s financial system against money laundering and terrorist financing. Vincent Van Peteghem, the Belgian Minister of Finance, highlights that this agreement forms a crucial part of the EU’s new anti-money laundering system, enhancing the coordination and effectiveness of national efforts in combating financial crime. The agreement entails comprehensive harmonization of rules across the EU, addressing loopholes exploited by criminals, and enhancing due diligence measures for various sectors including the crypto industry, luxury goods traders, and the football sector. It also imposes stricter regulations on cash payments, establishes rules for beneficial ownership transparency, and mandates enhanced due diligence for transactions involving high-risk third countries. Additionally, the agreement strengthens the responsibilities and capabilities of Financial Intelligence Units (FIUs), granting them direct access to relevant information for better detection and prevention of money laundering and terrorist financing activities.