• UK FinTech deal activity totalled at 118 deal in Q1 2024, a 40% drop from Q1 2023

• UK FinTech companies raised a combined $1.1bn in Q1 2024, a 31% reduction YoY

• Blockchain & Digital assets active UK FinTech subsector in Q1 2024 with 23 deals

In the first quarter of 2024, the UK’s FinTech sector witnessed a notable decline in deal activity, with only 118 deals recorded, marking a substantial 40% drop compared to the same period in 2023. During the same period, the amount of funding secured by UK FinTech companies also experienced a downturn, totalling $1.1bn, reflecting a significant 31% reduction YoY.

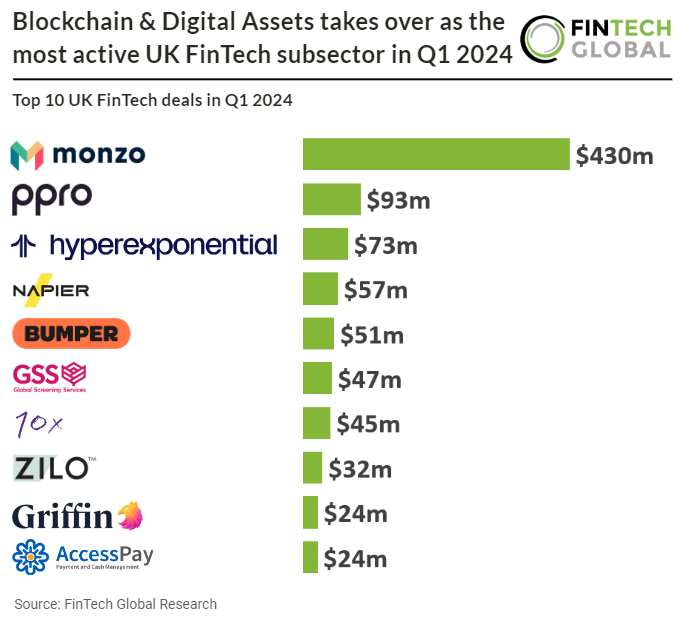

Monzo, a digital bank, had the largest UK FinTech deal in Q1 2024 after raising $430m (£340m) in their latest venture round, led by CapitalG. Following this round, the company has reached a post-money valuation of $5bn (£4bn). In this latest funding round, Monzo is defying the current funding market, notably with substantial involvement from Google. CapitalG, the growth fund under Google’s parent company Alphabet, alongside participation from GV, Google’s venture fund. Additionally, HongShan Capital, formerly known as Sequoia Capital China, joins as an investor, alongside existing backers like Passion Capital and Tencent. Monzo reported profitability in the first two months of 2023. For the year ending February 2023, it reported net operating income of £214.5m, almost doubling YoY from £114m. Losses reduced slightly, to £116.3m from £119m the previous year.

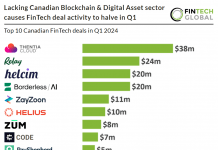

Blockchain & Digital Assets active UK FinTech subsector in Q1 2024 with 23 deals, a 19.6% share of total deals. In November 2023, the UK government issued its feedback on the previously conducted consultation regarding the proposed implementation of a Digital Securities Sandbox (DSS), expressing its intention to primarily maintain the consulted approach. The DSS marks a pioneering step as the inaugural financial market infrastructure sandbox authorized under the provisions of the Financial Services and Markets Act 2023. By the close of 2023, the statutory instrument to establish the DSS was presented before Parliament: the Financial Services and Markets Act 2023 (Digital Securities Sandbox) Regulations 2023. Anticipate further developments on the DSS throughout 2024.