Tag: Banking Infrastructure

European FinTech seed deal activity in Q1 2024 almost halves with...

Key European FinTech seed deals stats in Q1 2024:

• European FinTech seed deal activity reached 161 deals in Q1 2024, a 49% drop YoY

•...

The UK accounts for more than a third of European FinTech...

Key European FinTech investment stats in Q1 2024:

• European FinTech deal activity totalled at 333 deals in Q1 2024, a 41% reduction from the...

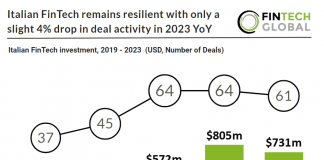

Italian FinTech remains resilient with only a slight 4% drop in...

Key Italian FinTech investment stats in 2023

• Italian FinTech deal activity reached 61 transactions in 2023, a 4% reduction from 2022

• Italian FinTech companies...

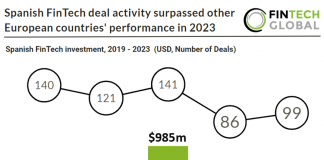

Spanish FinTech deal activity surpassed other European countries’ performance in 2023

Key Spanish FinTech investment stats in 2023

• Spanish FinTech deal activity totalled at 99 transactions in 2023, a 19% reduction from 2022

• Spanish FinTech...

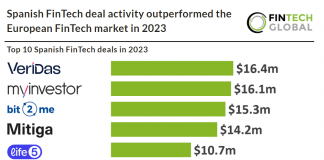

Spanish FinTech deal activity outperformed the European FinTech market in 2023

Key Spanish FinTech investment stats in 2023

• Spanish FinTech deal activity totalled at 99 transactions in 2023, a 19% reduction from 2022

• Spanish FinTech...

Intergiro teams up with Silverflow for cutting-edge card processing technology

Intergiro, a Swedish FinTech providing payment and banking infrastructure, has unveiled a groundbreaking partnership with Silverflow, a cloud platform specialising in global card processing.

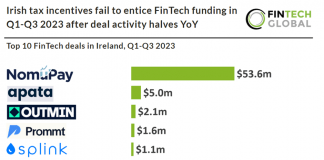

Irish tax incentives fail to entice FinTech investment in Q1-Q3 2023...

Irish FinTech investment stats in Q1-Q3 2023:

• Irish FinTech deal activity totalled at 20 transactions during the first nine months of 2023, a 52%...

Banking infrastructure innovator, Episode Six, clinches $48m in Series C funding

Episode Six (E6), a global FinTech specialising in enterprise-grade payment processing and digital ledger infrastructure, has announced it has raised $48m in a Series C funding round.

US-based Core10 closes Series B to support digital transformation

US-based Core10, which offers lending and account opening products, has raised $6.5m in its Series B funding round.

Temenos, Mbanq partner to expand BaaS

Temenos has expanded its existing relationship with Mbanq, a US-based banking-as-a-service (BaaS) provider, to accelerate the adoption of BaaS in the US.