Key Spanish FinTech investment stats in 2023

• Spanish FinTech deal activity totalled at 99 transactions in 2023, a 19% reduction from 2022

• Spanish FinTech companies raised a combined $160m in 2023, a 65% drop from the previous year

• Banking Infrastructure was the most active Spanish FinTech subsector with 17 funding rounds, a 19% share of total deals

In 2023, the FinTech landscape in Spain witnessed a drop in deal activity, with a total of 99 deals recorded, marking a 19% reduction compared to the previous year. This was much better than the European average which saw a 36% drop in FinTech deal activity. Additionally, Spanish FinTech firms faced a significant decline in fundraising efforts, collectively raising just $160m in 2023, which represented a substantial 65% drop when compared to the funding they secured in the preceding year.

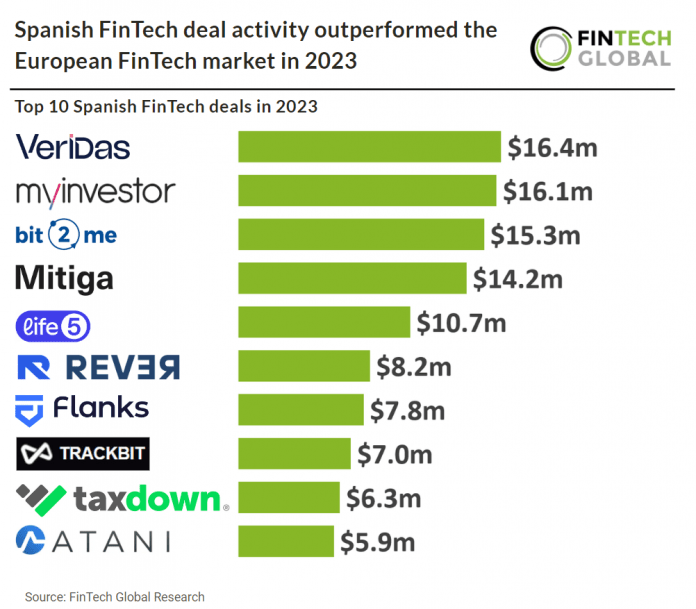

VeriDas, an identity verification platform, had the largest FinTech deal in Spain 2023, raising $16.4m in their latest Series A funding round. The funding will be used to expand their products globally. VeriDas, in its announcement, expresses its intention to enhance collaboration by joining the OIX community, facilitating the exchange of insights and best practices within the organization’s global network. With clients spanning 25 countries, the company recognizes the significance of streamlined identity technology that empowers individuals to navigate both their digital and physical realms seamlessly and securely. “The world needs identity technology that allows consumers and citizens to move through their digital and physical worlds without friction or fear,” says Veridas CEO Eduardo Azanza. “For this to be possible, we must foster community innovation and contribute to the goal of a holistically adopted secure and reliable identity verification solution.” Highlighted by a recent evaluation by the National Institute of Standards and Technology (NIST), Veridas achieved a notable second position globally in the domains of face and voice authentication. Hailing from Navarra, the company additionally obtained the LenelS2 factory certification for seamless integration with the OnGuard access control system. Notably, Veridas expanded its age verification software capabilities through the introduction of the Facial Age Validation service, leveraging selfie biometrics to offer a robust solution.

Banking Infrastructure was the most active Spanish FinTech subsector in 2023 with 17 deals, a 18% share of all transactions. This was followed by Blockchain and Digital Asset technologies with 15 deals, a 15% share. Lending Technology was the third most active with 12 deals, a 12% share of total deals.

IBERCLEAR, the Spanish Central Securities Depository (CSD), is subject to (EU) Regulation No. 909/2014, on improving securities settlements in the European Union and on central securities depositories, and to the Royal Legislative Decree 4/2105, 23 October, by which it is approved the consolidated text of the Securities Market Act (LMV). Internal testing phases are planned for Q4 2023 through to Q2 2024, with community testing scheduled closer to the migration date. The focus of these tests will be on ensuring harmonization across market participants and resolving unmatched trades pending at migration. It is essential for market participants to address these issues to avoid penalties associated with late matching and settlement.