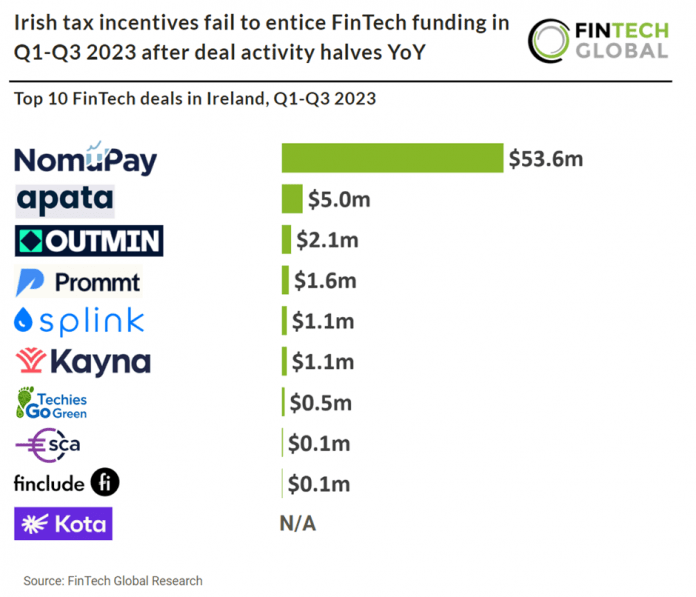

Irish FinTech investment stats in Q1-Q3 2023:

• Irish FinTech deal activity totalled at 20 transactions during the first nine months of 2023, a 52% reduction from the same period in 2022

• Irish FinTech companies raised a combined $65m in Q1-Q3 2023, a 86% drop from the same period the previous year

• Banking Infrastructure was the most active FinTech subsector with six deals

Irish FinTech activity has almost ground to a halt in 2023 after deal activity has reduced for its fifth consecutive year. Irish FinTech deal activity totalled at 20 deals in Q1-Q3 2023, a 52% reduction from the same period in 2022. Irish FinTech companies raised a combined $65 during the first three quarters of 2023, an 86% drop from the same period the previous year.

NomuPay, a unified payment platform, had the largest Irish FinTech deal in the first three quarters of the year after raising $53.6m in their latest Series A funding round, led by Finch Capital and Outpost Ventures. NomuPay’s growth journey is experiencing a remarkable boost due to this substantial investment. The company has made significant strides, successfully onboarding new clients since Q4 2022, and is actively expanding its presence in key markets. Moreover, NomuPay continuously extends its uP Platform to include new markets while allocating resources to product development, aiming to further enhance its offerings. Peter Burridge, former head of operations payouts at PayPal and CEO of NomuPay, says “Every growing international enterprise knows the problem of ‘multiples’, when it comes to payments. There are multiple countries, multiple payment types, different payment use cases in each nation, a variety of channels, and an endless list of changing regulations. As a result, expansion slows down. Companies have to maintain countless technical integrations and vendor relationships, while reconciling global payments. “In the face of continued technological, market, method and data fragmentation, we provide companies with an ‘all access pass’ to global payments’, enabling enterprises to continue to expand globally, and to future-proof payment strategies.”

Banking Infrastructure was the most active Irish FinTech subsector with six deals. This was followed by PayTech with four deals, a 20% share of deals and RegTech and WealthTech were joint third with three transactions each.

There have been significant changes to the R&D tax credit in Ireland, effective from January 1, 2023. The payroll tax restrictions previously applied to the refundable element of the R&D tax credit have been removed, making it fully refundable within four years. Additionally, a pre-trading company can now qualify for the refundable tax credit, rather than carrying the R&D tax credit forward as a non-refundable credit. These changes also include additional reporting requirements related to the breakdown of R&D expenditure