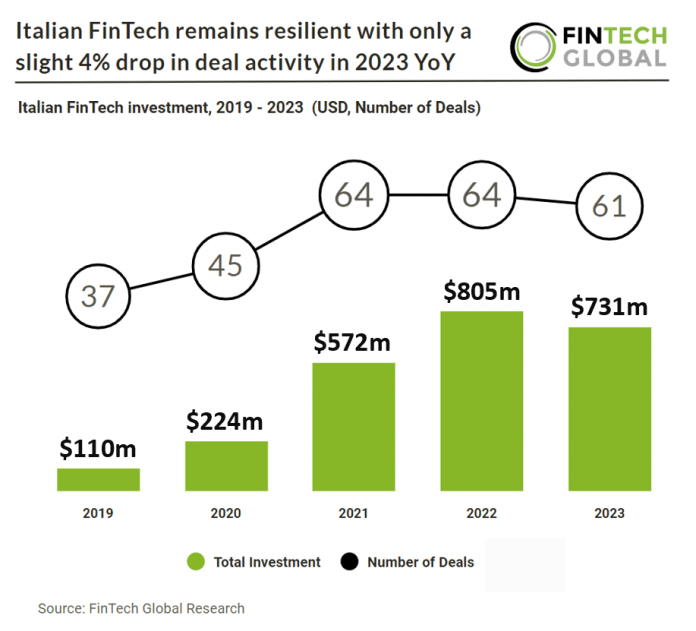

Key Italian FinTech investment stats in 2023

• Italian FinTech deal activity reached 61 transactions in 2023, a 4% reduction from 2022

• Italian FinTech companies raised a combined $731m in 2023, a 8% drop from the previous year

• Lending Technology was the most active Italian FinTech subsector with 11 deals

In 2023, the FinTech sector in Italy experienced a slight decline in deal activity, with a total of 61 deals recorded, marking a 4% reduction compared to the previous year. Italian FinTech companies also faced a decrease in funding, raising a total of $731m in 2023, reflecting an 8% drop compared to their fundraising efforts in the preceding year. Italy’s FinTech investment in 2023 was dominated by one deal from Team System which accounted for 88% of total funding.

Team System, which offer a wide range of digital services for businesses including, online payments, accounting and current account management, had Italy’s largest FinTech deal in 2023 after it raised €600m in their secondary market funding round, led by Silver Lake.

Silver Lake’s strategic investment represents a major achievement for the company as it pursues the digital transformation of businesses and accountants in Italy and Spain. TeamSystem’s groundbreaking software platform, encompassing core business applications, financial technology, and AI tools, has brought about a transformative shift in business operations. It empowers clients to streamline their processes, enhance efficiency, and facilitate growth. Notably, since H&F’s initial investment in TeamSystem in 2016, the company’s customer base has surged from 200 thousand to approximately 1.8 million, underscoring its remarkable growth trajectory.

Lending Technology was the most active FinTech subsector with 11 transactions, an 18% share of total deals. Blockchain & Digital asset technologies and Banking Infrastructure were the joint second most active FinTech subsectors with nine deals each, a 14% share of total deals.

In an effort to safeguard the interests of financial savers, the Italian regulatory authority CONSOB has issued a directive to block websites and associated pages that offer financial services without the necessary authorization. CONSOB has possessed the authority to instruct Internet service providers to restrict access to unauthorized websites within Italy since July 2019. On January 18, 2024, CONSOB publicly announced the blacklisting of three unauthorized websites and their affiliated pages, emphasizing the risks associated with these prohibited platforms. The websites and related pages subjected to the blackout include Blackridge Capital Management Ltd, Alphascrypto and Fast-MNG. It’s worth noting that the ban enforcement process is ongoing, and there may be a delay of several days before the blackout takes effect due to technical considerations. It is also worth mentioning that last month, the number of websites placed on CONSOB’s blacklist reached a total of 1000.