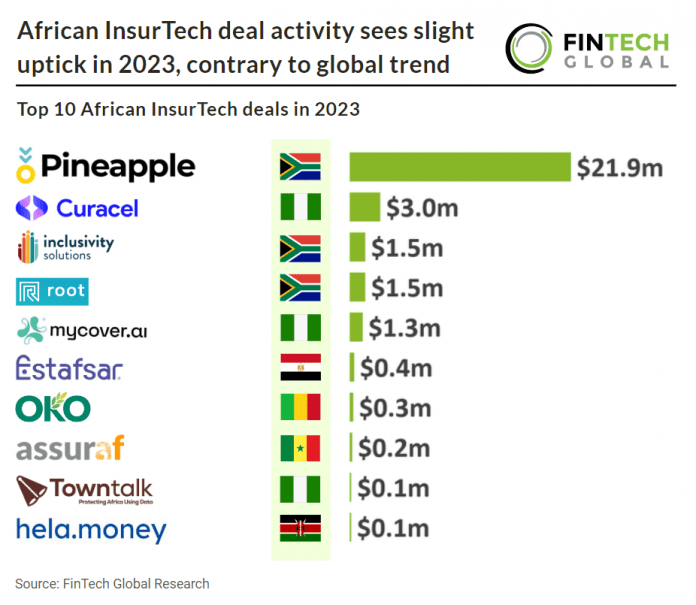

Key African InsurTech investment stats in 2023:

• African InsurTech companies raised a combined $30.4m in 2023, a 53% reduction from 2022

• African InsurTech deal activity reached 17 deals in 2023, a 13% increase YoY

• Nigeria was the most active African InsurTech country with six deals in 2023

In 2023, African InsurTech companies faced a notable shift in funding, with a combined total of $30.4m raised, marking a significant 53% reduction from the previous year. However, amidst this funding downturn, the sector displayed resilience in terms of deal activity, witnessing a 13% YoY increase with a total of 17 deals struck.

Pineapple, an African InsurTech company offering a range of insurance products, had the largest African InsurTech deal in 2023 after raising $21.9m in their latest Series B funding round, led by Futuregrowth Asset Management, Mineworkers Investment, Talent Holdings. Pineapple attributed the new funding to strong growth and sustainable claims ratios, surpassing industry standards for a relatively new insurance portfolio. “This funding round stands as a testament to our tech and AI-powered operating model, enabling our mission to offer affordable and comprehensive insurance to all South Africans,” Pineapple co-founder and CEO Marnus van Heerden said. The group’s technology and AI-powered operating model allow it to service customers at 20% of the cost of traditional insurance providers, enabling them to pass this cost saving in insurance premium savings to customers. “Their (Pineapple’s) exceptional growth and customer-centric model exemplify a potent combination of technology and market understanding,” Amrish Narrandes, Head of Futuregrowth Asset Management’s Private Equity/Venture Capital, said.

Nigeria was the most active African InsurTech country with six deals in 2023, a 35% share of total deals. This was followed by Kenya and South Africa with three deals each, a 17% share of total deals.

On May 17th, 2023, in Lagos, Nigeria, the National Insurance Commission (NAICOM) unveiled operational guidelines for an insurance regulatory sandbox, aiming to advance insurance penetration and financial inclusion through innovative approaches in the country. These guidelines are crafted to assess various aspects within the insurance value chain, such as solicitation, distribution, product development, underwriting, and claims processing, before their public release. Additionally, specific provisions within the guidelines cater to Takaful and Retakaful insurance operators, aligning with Islamic principles of risk-sharing and ensuring protection against unforeseen losses. FSD Africa, with support from the UK government, has been aiding NAICOM in enhancing its regulatory capabilities to promote market stability, innovation, and policyholder protection in line with international standards. The introduction of the regulatory sandbox aligns with NAICOM’s strategic goal of fostering product and service innovation, while also ensuring professionalism and adherence to best practices among insurance operators.