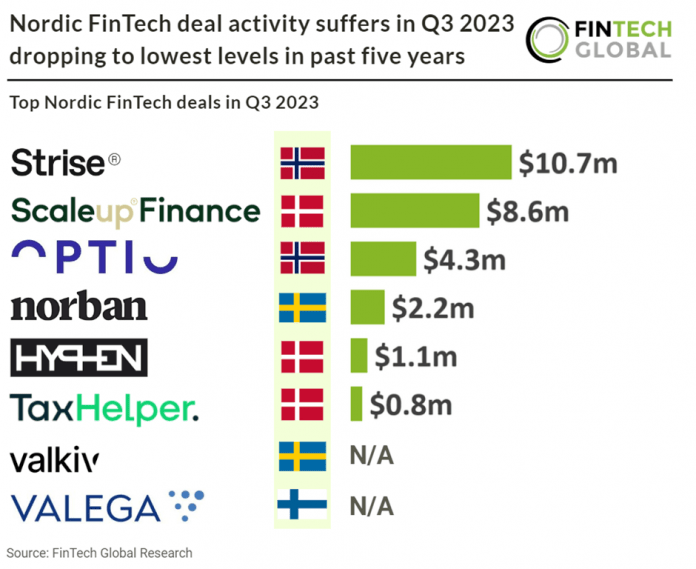

Key Nordic FinTech investment stats in Q3 2023:

• Nordic FinTech deal activity reached eight deals in Q3 2023, a 77% drop from Q3 2022

• Nordic FinTech companies raised a combined $26m in Q3 2023, a 97% reduction YoY

• Denmark was the most active Nordic country in Q3 2023 with three deals

Nordic FinTech deal activity experienced a significant decline in Q3 2023, reaching its lowest quarter in the past five years. In Q3 2023, Nordic FinTech deal activity recorded only eight deals, marking a substantial 77% decrease compared to Q3 2022. In Q3 2023, Nordic FinTech enterprises collectively secured $26m in funding, reflecting a staggering 97% YoY decrease. Notably Klarna did have a $800m deal in Q3 2022 which skews results. When removing the Klarna deal investment dropped by 88%.

Strise, which provide AML intelligence, had the largest Nordic FinTech deal in Q3 2023 after raising $10.7m in their latest Series A funding round, led by Atomico. The Norwegian company plans to use the funds to bring its anti-money laundering (AML) and know-your-customer (KYC) services to the U.K., and to expand its customer base. “While compliance teams often rely on static data, through continuous monitoring and entity matching, Strise provides comprehensive, real-time KYC and AML checks, and flags high-risk business changes or newly-sanctioned companies for both human review and automatically, depending on the company’s risk profile,” the announcement said.

Denmark was the most active Nordic country in Q3 2023 with three deals, a 37.5% share of deals. Norway and Sweden were the joint second most active with two deals each, a 25% share of total deals.