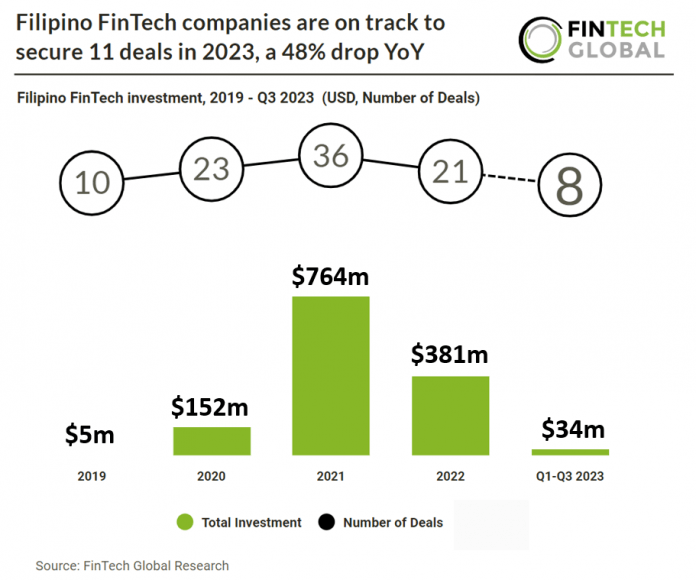

Key Filipino FinTech investment stats in Q3 2023

• Filipino FinTech companies raised eight deals in Q1-Q3 2023, a 50% reduction from the same period the previous year

• Filipino FinTech companies are on track to raise a total of $43m in 2023, an 89% drop from 2022

• Lending Technology was the most active FinTech subsector in Q1-Q3 2023 with three deals

Filipino FinTech has seen a shortfall in deal activity and investment during 2023 with both on track to fall YoY. In 2023, Filipino FinTech companies are projected to secure funding for 11 deals, reflecting a 48% decrease compared to the previous year, 2022. In the first three quarters of 2023, Filipino FinTech companies secured eight deals, marking a 50% decrease compared to the same period in the previous year. In 2023, Filipino FinTech companies are expected to secure a total of $43m in funding, reflecting an 89% decrease compared to funding received in 2022.

UnionDigital Bank (UD), which provides digital banking services, had the largest FinTech deal in Q1-Q3 2023 after raising $16.2m in their latest corporate funding round from The UnionBank of the Philippines. This funding infusion will play a pivotal role in driving the bank’s expansion efforts, particularly in the realm of digital loans soon to be introduced within the UD app. This development will empower UD to broaden its digital loan offerings through its app and APIs, delivering customers swift access to credit and a seamless loan application process. UD disclosed that it achieved net profits during the first quarter of 2023, thanks to its ecosystem-driven business approach. The digital bank also forged partnerships with mWell, integrating financial services into the offerings for their 1.5m customers and 5,000 doctors and health professionals, as well as with HUAWEI, tapping into their 7m customer base and array of services. “This approved funding indicates UnionBank’s confidence in our strategic growth plan and strong financial performance. We will use this to fuel our growth trajectory and allow us to better serve the financial needs of our customers. Nearly 70% of our customer base comprises individuals with limited means at the base of the income pyramid – these are the people we want to help and include in the financial system.” said Henry Aguda, President and CEO of UnionDigital Bank.

Lending Technology was the most active FinTech subsector in Q1-Q3 2023 with three deals – a 37.5% share of total deals. PayTech and Blockchain & Digital Assets were the joint second most active FinTech subsectors with two deals each, a 25% share of deals.

In June 2023 The BSP started deploying coin deposit machines, or CoDMs, in partner retail establishments across the Greater Manila Area to encourage the public to deposit their idle coins in the CoDMs and to promote efficient coin recirculation in the country. The Bangko Sentral ng Pilipinas (BSP) is urging Filipinos to convert their accumulated idle coins into e-wallet credits or shopping vouchers using Coin Deposit Machines (CoDM) available at select shopping malls in the country. BSP Deputy Governor Bernadette Romulo-Puyat highlighted the success of CoDMs, which have collected 42.4 million coins valued at P114.9 million in less than four months since their launch on June 20th. She explained that the CoDMs serve two purposes: to improve coin circulation in the country and to encourage people to convert the coins they have saved into E-wallet credits (i.e., GCash and Maya) and shopping vouchers. Fit coins collected through the machines are issued to partner retailers who use these for their daily transactions.