Key European FinTech investment stats in Q3 2023:

· European FinTech deal activity reached 233 deals in Q3 2023, 56% drop YoY

· European FinTech companies raised a combined investment of $1.24bn in Q3 2023, a 72% reduction from Q3 2022

· RegTech was the most active European FinTech subsector with 50 deals.

European FinTech has experienced a notable decrease in activity, marked by a substantial YoY decline in both deal activity and investment during Q3 2023. In the third quarter of 2023, European FinTech saw a significant drop of 56% in deal activity compared to the corresponding period in the previous year, with companies in the region completing a total of 233 transactions. The total investment secured by European FinTech companies in Q3 2023 amounted to $1.24bn, reflecting a substantial 72% decrease when compared to the levels observed in Q3 2022.

Bunq, a Dutch neobank, had the largest FinTech deal in Q3 2023 after raising $111m (€100m) in their latest Venture funding round, led by Pollen Street Capital. This latest funding puts Bunq at a €1.65bn valuation, exactly the same valuation the neobank had in 2021 when it raised $228m. The newly acquired funds enable the mobile bank to expedite its global expansion efforts and sustain its impressive growth trajectory. Currently, the company boasts a customer base of nine million, marking a substantial increase from 5.4 million just one year ago. Furthermore, it has witnessed significant growth in customer deposits, now holding €4.5 billion, a notable contrast to the €1 billion held two years prior. While most of its customers are located in Europe, the CEO, Niknam, believes that the U.S. presents an equally substantial opportunity. In April of this year, the company initiated the process of obtaining a banking license in the U.S. Its aim initially will be to target the various expats from Europe who have moved to the U.S. but still have roots in Europe. “I have experienced how complicated things are in the U.S.,” he said. “You can’t survive without a bank account, but getting one without a U.S. tax ID [or credit history there] can be mind-bogglingly difficult.” Similarly, he believes that offering services to U.S. residents who have moved abroad to Europe presents another opportunity that’s much easier than opening local bank accounts.

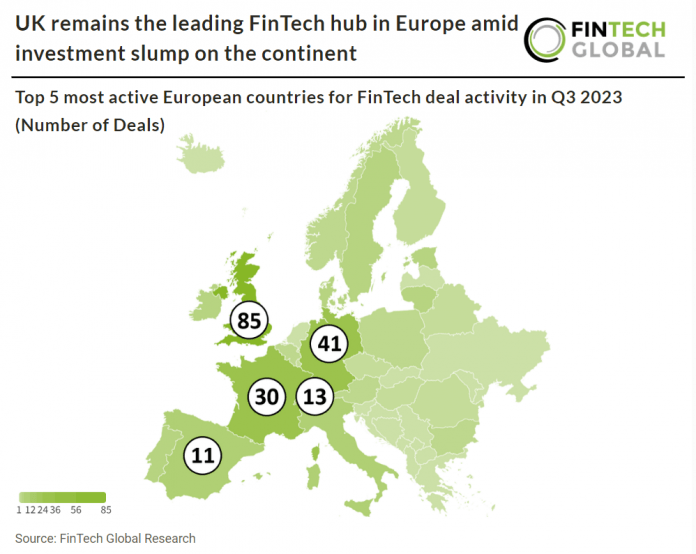

The UK was the most active European FinTech country in Q3 2023 with 85 deals, a 38% share of deals. Germany was second with 41 deals, a 18% share and France was third with 30 deals, a 13% share.

RegTech was the most active European FinTech subsector in Q3 2023 with 50 deals, a 17.8% share of deals. Notably Blockchain & Digital Assets has fallen to the 4th most active FinTech sub sector in Q3 2023 with 33 deals, a 11.7% share of total deals.

In May 2023 the European Council adopted new rules on markets in crypto-assets. MiCA, or the Markets in Crypto-Assets Regulation, is a regulatory framework introduced in the European Union. The introduction of MiCA is expected to drive increased institutional involvement in the European digital asset market, with major banks likely to offer various digital asset related services within the next four years, addressing regulatory uncertainties that have hindered their entry into the space. The regulation aims to protect investors and promote transparency by establishing comprehensive rules for issuers and service providers in the digital asset sector. These rules encompass utility tokens, asset referenced tokens, stablecoins, trading venues, and digital asset wallets. The framework also emphasizes compliance with anti-money laundering regulations. By harmonizing regulations across the EU, MiCA seeks to enhance financial stability, encourage innovation, and make the digital asset sector more appealing, addressing the limitations of national legislation in certain member states.