bunq, Europe’s second-largest neobank and a sustainability-driven company, has reported a net profit of €53.1m for the year 2023.

This milestone marks the first full year of profitability for bunq, signalling the robustness and sustainability of its business model. The impressive financial performance of the challenger bank is setting the stage for an ambitious global expansion strategy.

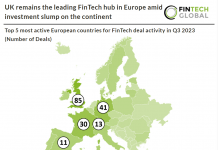

In a strategic move to broaden its horizons beyond the European Union, bunq has submitted its application for an E-Money Institution (EMI) license in the UK. This move is set to capitalise on the significant market potential in the UK, including an estimated 2.8 million British digital nomads. Despite the complexities introduced by Brexit, bunq has maintained its service to UK users under relevant regimes. The bank is now gearing up to reintroduce its services in the UK, promising local payment account openings in just 5 minutes.

bunq’s founder and CEO, Ali Niknam, emphasised the strategic importance of the UK market, stating, “The UK is home to the second-highest number of digital nomads globally, so naturally, we want to be there. We want to truly make their life easy, that’s why we’re excited to reintroduce bunq to the Brits and enable them to bank like a local all across Europe.”

The journey to profitability is not just a financial milestone for bunq; it also signifies the bank’s robust position in a fiercely competitive market. As one of the first neobanks to achieve structural profitability globally, bunq boasts a substantial user base of 11 million as of the end of 2023. The bank’s strategic focus and technological prowess underscore its commitment to broadening its footprint, particularly in the UK, which Niknam describes as a bridge between Europe and the rest of the world, and a crucial market for bunq.

bunq’s financial growth is further highlighted by its gross fee income, which saw a 20% increase in the last quarter of 2023 compared to the same period in 2022. Furthermore, user deposits experienced a significant surge, growing nearly fourfold from €1.8 billion to almost €7 billion by the year’s end. The last quarter also saw a remarkable 488% growth in gross interest income compared to the same period the previous year.

In addition to its financial achievements, bunq continues to innovate in the FinTech space with the recent launch of Finn, its Generative AI platform. Since its inception, Finn has already assisted bunq users in addressing nearly half a million queries, covering a range of topics from budgeting to transactions, demonstrating bunq’s commitment to leveraging technology for enhancing customer experience.

Keep up with all the latest FinTech news here.

Copyright © 2024 FinTech Global