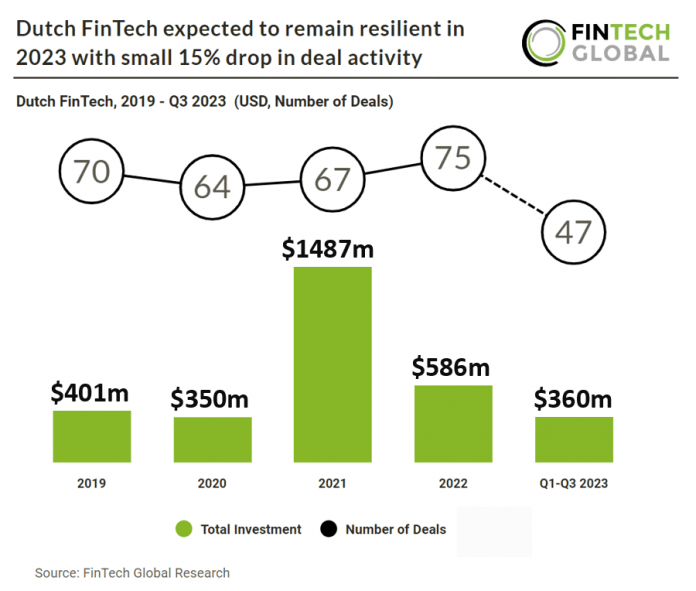

Key Dutch FinTech investment stats in Q1-Q3 2023:

• Dutch FinTech deal activity is expected to reach 63 transactions in 2023, a 15% reduction from 2022

• Dutch FinTech funding is projected to hit $480m by the end of the year, a 18% drop from 2022

• Dutch FinTech investment bolstered by large deals over $50m with 70% of investment coming from just three deals in Q1-Q3 2023

Despite the drop in both Dutch FinTech investment and deal activity, the declines are much smaller compared to the average 55% deal activity drop in Europe indicating a very resilient Dutch FinTech sector. Dutch FinTech deal volume for 2023 is projected to decrease by 15% compared to 2022, with an estimated total of 63 deals. Dutch FinTech investment for 2023 is forecasted to amount to $480m, reflecting an 18% decline from the previous year’s figure in 2022. In the first three quarters of 2023, Dutch FinTech investment was significantly boosted by substantial deals exceeding $50m, with 70% of the total investment can be attributed to just three prominent transactions.

Bunq, a neobank, had the largest Dutch FinTech deal in Q1-Q3 2023 after raising $111m (€100m) in their latest Venture funding round, led by Pollen Street Capital. This latest funding puts Bunq at a €1.65bn valuation, exactly the same valuation the neobank had in 2021 when it raised $228m. The newly acquired funds enable the mobile bank to expedite its global expansion efforts and sustain its impressive growth trajectory. Currently, the company boasts a customer base of nine million, marking a substantial increase from 5.4 million just one year ago. Furthermore, it has witnessed significant growth in customer deposits, now holding €4.5 billion, a notable contrast to the €1 billion held two years prior. While most of its customers are located in Europe, the CEO, Niknam, believes that the U.S. presents an equally substantial opportunity. In April of this year, the company initiated the process of obtaining a banking license in the U.S. Its aim initially will be to target the various expats from Europe who have moved to the U.S. but still have roots in Europe. “I have experienced how complicated things are in the U.S.,” he said. “You can’t survive without a bank account, but getting one without a U.S. tax ID [or credit history there] can be mind-bogglingly difficult.” Similarly, he believes that offering services to U.S. residents who have moved abroad to Europe presents another opportunity that’s much easier than opening local bank accounts.

Anti-money laundering (AML) and counter-financing terrorism (CFT) compliance is a significant concern in the Netherlands. The publication of the FATF’s evaluation report in August 2022 is expected to lead to stricter Dutch AML regulations. Additionally, the European Commission introduced four new AML proposals in July 2021, including the establishment of a new Anti-Money Laundering Authority (AMLA) and Anti-Money Laundering Regulation (AMLR). This EU AML package is anticipated to take effect in 2024. Under the current EU AML Directive implemented in the Dutch AML Act, entities must conduct customer due diligence, monitor customer activity, and report suspicious transactions to the national financial intelligence unit (FIU). As of March 27, 2022, Dutch entities are obligated to register their ultimate beneficial owners (UBOs) and UBOs must cooperate. Furthermore, entities must identify the UBOs of their customers and report any discrepancies in UBO information. A separate UBO register is set to apply to trusts and similar legal structures, expected to become effective by the end of 2022.