Canadian FinTech seed investment stats in Q1-Q3 2023:

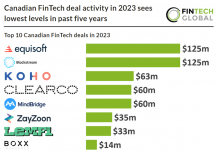

• Canadian FinTech seed deal activity reached 63 deals, a 53% reduction from Q1-Q3 2022

• Combined investment from Canadian FinTech seed deals totalled at $47m in the first three quarters, a 84% drop YoY

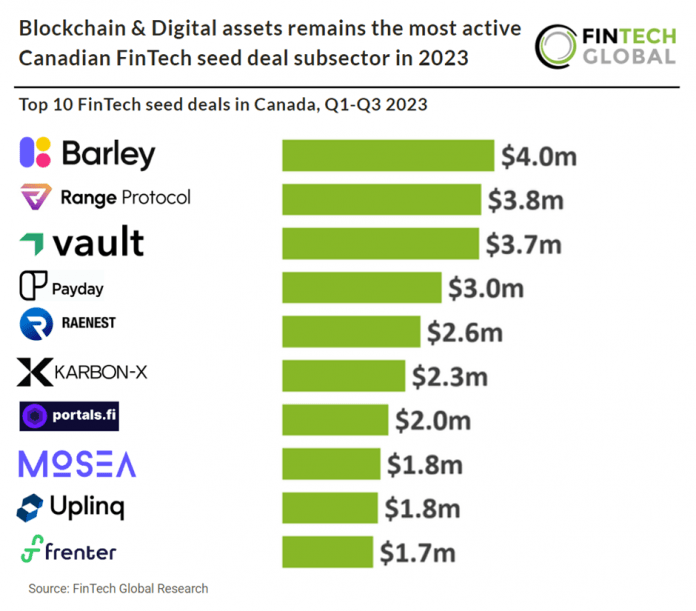

• Blockchain & Digital assets remained the most active subsector for Canadian FinTech seed deals with 11 funding rounds

Canada’s FinTech sector has seen a major drop in innovation with a huge reduction in investment and a significant decrease in deal activity at the seed stage. Canadian FinTech seed deal activity declined significantly in the first nine months of 2023, with only 63 deals recorded, marking a 53% reduction compared to the same period in 2022. The cumulative investment in Canadian FinTech seed deals amounted to just $47m in the first three quarters of 2023, reflecting an 84% YoY decrease.

Barley, a compensation management platform, had the largest Canadian FinTech seed deal in Q1-Q3 2023 after raising $4m in their seed round, led by Golden Ventures. Barley will use its funding for product development and to expand its go-to-market teams. Barley established a strong market foothold while in private beta, bringing on early customers such as Affinity, Flinks and Properly, and launching integrations with popular HR and ATS platforms such as ADP, BambooHR, Greenhouse and Lever. “Compensation is a company’s biggest expense, but comp management is often treated as a mere admin task. In 2023, companies have software tools for every important part of their business, but pay decisions are still made in scattered spreadsheets and email threads. That leaves leaders wondering if they are missing the big picture and employees questioning if they’re being paid fairly,” said Barley CEO Jafar Owainati. “Barley was built to help companies create and execute equitable pay strategies, giving people teams and managers the insights and guardrails for what they pay.”

Blockchain & Digital assets remained the most active subsector for Canadian FinTech seed deals with 11 transactions, a 17% share of deals. This was followed by PropTech and PayTech with nine deals each, a 14% share of deals.

The Government of Canada’s Fall Economic Statement laid out a series of changes that will affect the FinTech sector. The government plan to implement a consumer-driven banking framework in 2024, expand Payments Canada membership eligibility, strengthen the competition watchdog, and introduce updates related to the Clean Technology Investment Tax Credit and the Canada Growth Fund. Notably, they intend to amend the Canadian Payments Act to allow more firms to join Payments Canada, empower the Competition Bureau against anti-competitive practices, and work towards open banking legislation in Budget 2024. This represents a significant shift in government policy, according to FinTechs Canada executive director Alex Vronces.