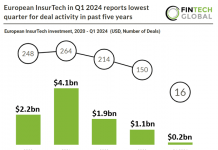

Key European InsurTech investment stats in Q1 2024

• European InsurTech deal activity totalled at 16 transactions in Q1 2024, a 57% drop from Q1 2023

• European InsurTech companies raised a combined $228m in Q1 2024, a 47% reduction from Q1 2023

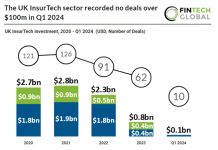

• The UK and Germany were tied as the most active InsurTech countries in Europe in the first quarter with five deals each

In the first quarter of 2024, European InsurTech deal activity experienced a significant decline, totalling only 16 deals. This represents a notable 57% drop compared to the same period in 2023. On the funding front, European InsurTech companies raised a combined total of $228 million in Q1 2024. However, this figure reflects a substantial reduction of 47% when compared to the funding raised during Q1 2023.

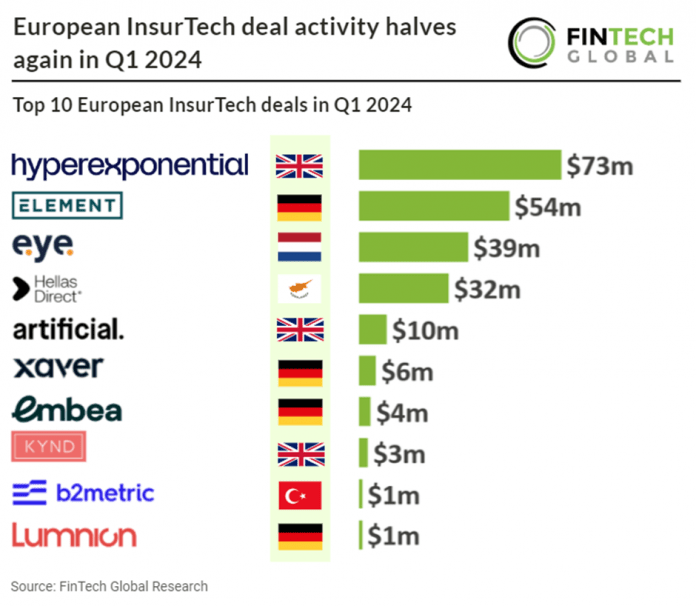

Hyperexponetial, a pricing decision intelligence (PDI) software provider, had the largest European InsurTech deal in Q1 2024 after raising $73m in their latest Series B funding round, led by Battery Ventures. The funds are set to fuel the expansion of the company’s mission-critical insurance pricing platform, and support its strategic expansion into the United States, as it looks to open a New York office later this year.

The UK and Germany were tied as the most active InsurTech countries in Europe during Q1 2024 with five deals each, a 31% share of total deals this quarter. Turkey was the next most active with two deals, a 13% share of deals.

On December 14th the EU Council and Parliament agreed on amendments to the Solvency II directive and introduced new rules on insurance recovery and resolution (IRRD). The amendments to Solvency II aim to strengthen the insurance sector’s role in providing long-term investments to European businesses while enhancing its resilience to future challenges, thereby protecting policyholders. This aligns with the goals of the Capital Markets Union, financing green and digital transitions, and facilitating Europe’s economic recovery from the COVID-19 pandemic. The IRRD seeks to improve preparedness for significant financial distress among insurers and relevant authorities in the EU, enabling timely intervention in crisis situations while safeguarding policyholders and minimizing impacts on the economy and financial system, without resorting to taxpayers’ money.