Tag: COVID-19

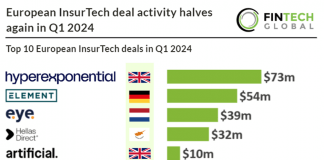

European InsurTech deal activity halves again in Q1 2024

Key European InsurTech investment stats in Q1 2024

• European InsurTech deal activity totalled at 16 transactions in Q1 2024, a 57% drop from Q1...

How digital wallets are revolutionising UK transactions

The UK is on the brink of a transformative period in the payment sector, heralded by the burgeoning adoption of digital wallets. This shift is illuminated in Worldpay®'s Global Payments Report 2024, which underscores the UK's pivotal role in the European digital wallet landscape.

From stagnation to transformation: How pricing reshapes the digital landscape for...

Digital transformations have spurred exponential profitability across various sectors including ridesharing, retail, banking, and travel. However, according to hyperexponential, despite being a data-rich sector, the insurance industry has been slower in achieving this level of growth.

Has the pandemic strangled innovation for financial incumbents?

The pandemic has allowed Big Tech companies such as Google and Amazon to strengthen their grip on financial services, according to The Financial Stability Board.

Two years on: how the pandemic has changed the RegTech sector

When Covid-19 swept the world at the start of 2020, no one had any idea how much the pandemic would change the way we live and work. As in-person restrictions continue to fester two years on, how has the opportunities provided the pandemic impacted the RegTech industry?

How the pandemic supercharged the growth of the digital signature market

A huge challenge for companies and consumers alike during the pandemic was the inability for business matters to be conducted in-person. As countries globally entered lockdowns, the possibility for wet signatures – a signature commonly done with pen and paper – become almost impossible.

UK customers are changing banks due to poor complaints handling processes

Research by global software firm Nuix has found that UK customers are leaving their banks due to complaint mishandlings during the pandemic.

Majority of UK firms attribute recent cyberattacks to tech vulnerabilities

A study by cybersecurity firm Tenable has found that 72% of UK firms have attributed recent cyberattacks to vulnerabilities in technology put in place during the pandemic.

How will hybrid working impact the future of broking?

One of the most potentially longstanding trends to emerge over the past year is hybrid working, with the working model expected to persist as the workforce becomes more accustomed to the work-life balance it offers them.

Why insurers need to leverage digitalisation and InsurTech to get a...

Prior to the Covid-19 pandemic, the insurance sector was already a highly competitive space. Now, with more demand than ever for insurance, the market is going into overdrive.