It was a strong week for FinTech this week, making up for a string of slower weeks. There was a total of $1.3bn invested into the sector across 27 deals.

The four biggest deals of the week raised a total of $788m, which is nearly double the $422m that was raised across last week’s 22 FinTech deals.

It is also worth pointing out that the four biggest deals all came from companies based in different countries. US-based Next Insurance closed the biggest deal, pulling in $265m. It was followed by Brazil’s QI Tech and Saudi Arabia’s Tabby, which both garnered $200m. The final company making up the top four was the UK’s Atom Bank, which secured $123m.

While Tabby is based in Saudi Arabia, it was originally founded in the UAE, but moved its headquarters ahead of its plan to launch on Saudi Arabia’s stock exchange. Whilst on the topic of the UAE, the country proved popular this week. There were two other companies from the UAE to close funding rounds, NOW Money and SpiderSilk.

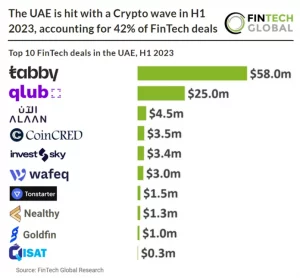

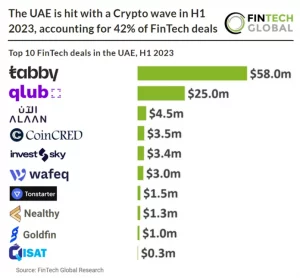

A report from FinTech Global earlier in the year found that cryptocurrency has experienced a lot of support in the UAE this year. Of the 24 deals to close in H1 2023, 42$ of these were for companies operating in the blockchain and crypto sector. Like many countries, the FinTech space in the UAE has seen a drop in deal activity, with there being a 54% decline YoY during the first half of 2023. An even bigger drop was seen in the investment volume, with the country’s FinTech sector experiencing a 72% decline in capital invested.

Looking at the other countries represented in this week’s 27 funding rounds, the US led the charge. The US’ dominance in deal activity has been a common sight and this week the country was home to 12 of the deals.

The second biggest contributor to deals was the UK with five funding rounds completed in the country. Others represented this week were Canada (Arteria AI), Mexico (Verqor), the Netherlands (FERO), Singapore (YouTrip), South Africa (Inclusivity Solutions) and Spain (Twinco Capital), which all recorded one deal.

In terms of sectors, InsurTech held the lion share of deals for the week. There were seven insurance technology companies to raise capital this week. These were Next Insurance, AgentSync, Cowbell, Layr, Sprout.ai, Nuvalaw and Inclusivity Solutions.

Following behind InsurTech was PayTech with five deals. These PayTech companies were Tabby, YouTrip, Railsr, Connectly and Fero.

The marketplace lending and CyberTech sectors each recorded four deals. The marketplace lending companies were QI Tech, Viably, Twinco Capital, and Verqor, while the CyberTechs were Chainguard, Graylog, Xage Security and Spidersilk.

Other companies to raise capital this week were WealthTech companies Atom and Charlie, data & analytics businesses Arteria AI and Accelex, Infrastructure and Enterprise Software platform NOW Money, RegTech solution Aembit and ESGFinTech startup ESG Flo.

On a quick note about ESGFinTech, earlier this week FinTech Global released the second annual edition of the ESGFinTech100 list. The new ranking has named 100 companies that are transforming the fight against climate risk, sustainability, social responsibility and governance challenges. Finalists were selected based on their use of technology to solve a significant industry problem, or their impact on ESG imperatives and/or sustainability enhancements generated for clients.

A recent report from FinTech Global found that the UK dominated ESG FinTech deals during Q3 2023, representing 47% of all deals. There were a total of 17 deals during the quarter, which was a 10% drop on the previous quarter. Companies to close deals over the three month period raised a total of $18.1m.

Here are this week’s 27 FinTech funding rounds.

NEXT Insurance secures $265m partnership deal with Allstate and Allianz X

NEXT Insurance, a “leading technology-first small business insurer”, has unveiled its strategic alliance with Allstate.

This collaboration marries the companies’ prowess in small business insurance to devise and introduce innovative products for a largely untapped market. Further solidifying the bond, there’s a pledge to strengthen its reinsurance affiliation with Allianz. The collaboration is bolstered by a whopping $265m strategic injection from Allstate and Allianz X.

Emerging from a digital and data-centric approach designed to overhaul insurance, NEXT’s very foundation aims to cater to the unique demands of small business proprietors which had been overlooked in the past.

Their integration of state-of-the-art technologies, such as bespoke machine learning algorithms for instant quotes, has streamlined the buying and maintenance processes, offering simpler, more cost-effective, and customised insurance coverage. With the tilt of small business proprietors towards a digital insurance experience, it’s evident that tech-driven insurers are now the benchmark.

The newly-acquired funds will be channelled to hasten NEXT’s journey to profitability while further expanding its distribution reach.

“We founded NEXT because we saw an opportunity to help millions of small and microbusinesses across the U.S. and made it our mission to help entrepreneurs thrive,” Guy Goldstein, CEO and co-founder of NEXT Insurance, stated. “Building on our existing support, we are excited to welcome Allianz X and Allstate as investors, deepen our reinsurance relationship with Allianz Re, and foster a meaningful partnership with Allstate to offer millions of their customers our one-stop-shop small business insurance offering.”

QI Tech secures $200m Series B funding led by General Atlantic

QI Tech, a licensed FinTech and Direct Credit Company (SCD) endorsed by the Brazilian Central Bank, has recently made headlines with its latest funding announcement.

The FinTech secured $200m in its Series B round, which was led by General Atlantic. Additionally, existing QI Tech investor Across Capital participated in the round, doubling its initial investment into the company.

Established in 2018 by visionaries Pedro Mac Dowell, Marcelo Bentivoglio, and Marcelo Buosi, QI Tech aims to revolutionise the credit market. Its primary goal is to simplify loan procedures and shift credit accessibility away from dominant banks. Their comprehensive suite of APIs allows businesses to extend financial products to their consumers, ensuring they’re equipped with digital tools for registration, data validation, credit scoring, and more. To bolster their service offering, QI Tech also manages a brokerage license, facilitating the structure and safeguarding of investment funds in credit rights.

QI Tech has ambitious plans for the newly acquired capital. They aim to amplify their product leadership, scout for strategic M&A opportunities, and solidify their foothold in Brazil’s competitive market while eyeing potential local prospects.

Saudi FinTech Tabby achieves $1.5bn valuation after latest fundraising

Saudi Arabia’s Tabby, a leading buy-now-pay-later firm, is making headlines with its recent valuation and funding accomplishments.

In its latest funding endeavour, Tabby secured $200m in a Series D round, according to a report from Bloomberg.

This funding event saw leadership from Wellington Management, and also attracted participation from Bluepool Capital. Existing investors, including Saudi venture capital firm STV, Mubadala Investment Capital, PayPal Ventures, and Arbor Ventures, reinforced their support for Tabby.

Serving a broad user base, firms like Tabby provide a platform for customers to purchase goods and pay in installments. Tabby boasts a significant regional presence, operating across Saudi Arabia, the United Arab Emirates, and Kuwait. Within this competitive space, it stands tall against competitors like Tamara. Highlighting its influence, Tabby has registered over 10 million users and collaborates with more than 30,000 brands.

In a conversation with Bloomberg News, Tabby’s chief executive officer Hosam Arab elaborated on the company’s intentions for this fresh capital. He mentioned, “We are building and broadening out our consumer and merchant offering.” A considerable portion of the investment will go into expanding product options, primarily focusing on financial services.

Originally founded in Dubai, Tabby transitioned its headquarters to Saudi Arabia, aligning with its aspirations to be publicly listed on the Saudi stock exchange. This move was acknowledged by Saudi Arabia’s Ministry of Investment in September.

UK’s premier app-based bank Atom clinches £100m ($123m) injection

Atom bank, the UK’s pioneering app-based bank, has successfully garnered upwards of £100m in fresh equity capital.

The infusion, sourced from longstanding shareholders including BBVA, Toscafund, and Infinity Investment Partners, has been hailed as the most significant private capital raise by a UK digital bank this year. With these newly acquired funds, Atom aims to expedite lending in the wake of its historically high growth.

Elaborating on Atom’s operational sphere, the bank has innovatively ushered in a new era of banking right from a smartphone. Recent revelations about its annual performance spotlighted its inaugural full year in the black. This revelation was underscored by impressive figures: a 62% surge in revenue, a doubling of its customer base to 224,000, and an uptick in savings deposits to a staggering £6.6bn. Beyond this, the current fiscal year has already witnessed Atom exceeding its previous record for operating profit. Furthermore, it stands out with unparalleled customer service accolades, as evinced by a five-star rating on platforms such as TrustPilot, iOS, and Android, and a commendable NPS score hovering in the high 80s.

The newly amassed capital is slated to fortify Atom’s balance sheet growth. The bank’s ambitious plans include rolling out enhanced offerings for a diverse clientele comprising savers, homeowners, nascent property purchasers, and SMEs. Their offerings promise to be more streamlined, cost-effective, and superior to traditional high street banking alternatives. It’s noteworthy that Atom has already channelled over £4bn to UK homeowners and extended in excess of £1bn to the SME sector.

Initiated earlier this year, this capital raise aligns seamlessly with Atom’s overarching objective of orchestrating a liquidity event in the foreseeable future.

Mark Mullen, chief executive officer at Atom, said: “I’m delighted with this vote of confidence in Atom from our investors, and to have their ongoing backing is a fantastic boost. Atom continues to grow strongly and sustainably. We are a cautious bank with an excellent track record of lending responsibly and successfully. We have a compact business model and we keep tight control over our costs.

Chainguard secures $61m for open source software security boost

Software supply chain security front-runner, Chainguard, has announced the completion of its $61m Series B funding round.

The round was spearheaded by Spark Capital, with contributions from existing investors including Sequoia Capital, Amplify Partners, The Chainsmoker’s Mantis VC, and Banana Capital.

At the core of Chainguard’s operations is its commitment to hardening open source software. The past six months have seen a tremendous upsurge in the company’s annual recurring revenue (ARR), which has tripled. This exponential growth reflects its strengthened and secure container image solution’s increased adoption by both Fortune 500 companies and technology providers. Prominent names such as GitGuardian, Hewlett Packard Enterprise, Sourcegraph, Snowflake, and Replicated have integrated Chainguard’s solution into their operations.

CEO and Co-founder of Chainguard, Dan Lorenc, underscored the pivotal role of securing open-source software. He emphasised Chainguard’s ambition to provide a reliable safety net for all software-building organisations. Lorenc pointed out the expanding chasm in the security of open-source adoption and the mounting challenges faced by enterprises and governments in ensuring compliance and security, especially given the rapid pace of software development.

One of Chainguard’s remarkable expansions has been in its Images solution. This offers a vast inventory of over a million secure container images, enabling developers to craft safe software using familiar tools. Additionally, the solution provides a comprehensive API, helping customers trace changes in vulnerability status between Image versions and ensuring software supply chain security requisites, including Software Bill of Materials (SBOMs) and software signatures.

AgentSync bags $50m to bring funding total to an impressive $161m

AgentSync has announced the successful completion of a $50m funding round, bringing their total funding to an impressive $161m.

This latest round of investment was co-led by existing backers, Craft Ventures and Valor Ventures. Since their Series B funding round in Q4 of 2022, AgentSync has exhibited remarkable growth, with a threefold increase in annual recurring revenue (ARR) and a twofold surge in the number of customers.

The additional $50m in funding will enable AgentSync to intensify its efforts in delivering top-tier products to the nation’s largest and most respected insurance carriers. The company aims to enhance the resilience and efficiency of the insurance industry, meeting the evolving needs and challenges of a rapidly changing market.

AgentSync has established collaborations with over 200 insurance companies, including carriers, managing general agents (MGAs), and insurance agencies, spanning across all sectors of the insurance industry.

The firm is at the forefront of addressing a crucial challenge within the insurance sector: efficient and effective distribution. Their flexible, scalable solutions establish seamless connections between insurance distributors and underwriters, streamlining the delivery of insurance products. The company’s primary focus revolves around developing software-as-a-service (SaaS) and application programming interface (API) solutions that enhance data visibility and operational efficiency for insurers, while also ensuring exceptional experiences for agents and brokers.

Brian Murray, Partner at Craft Ventures, said, “AgentSync has become core infrastructure for hundreds of insurance companies, helping them scale distribution and reduce costs. We are excited to deepen our partnership with the AgentSync team as they continue to upgrade the resilience and efficiency of the insurance industry.”

AgentSync co-founder and CEO Niji Sabharwal, said, “Given the current headwinds sectors of the insurance industry are facing, investing in modern, scalable infrastructure to manage distribution has never been more important. With AgentSync, customers have the flexibility to quickly and intelligently ramp distribution channels up or down as needed. This drives massive distribution channel-related cost savings when efficiently executed through software.

“Helping our customers adapt quickly and manage risk and expenses during tough market conditions is extremely rewarding – especially knowing that they’re building bulletproof distribution infrastructure for when the markets improve.”

Viably’s groundbreaking $50m financial boost for ecommerce wholesalers

Viably, described as a “leading provider of innovative financial solutions for ecommerce”, has successfully secured a $50m debt financing facility from renowned global credit investment manager Viola Credit.

This remarkable financial injection is earmarked for Viably’s latest venture, the “Viably Wholesaler Accelerator”. This new capital solution promises to radically alter the way ecommerce wholesalers manage their finances for their Amazon operations.

Wholesalers form a crucial component of Amazon’s vast selling network, coming in as the platform’s second largest selling strategy. A significant issue they face is the substantial capital invested in inventory, which restricts their expansion capabilities and hampers their cash flow. Viably’s newly-introduced solution aims to tackle these challenges head-on.

Viably’s product features include an adjustable credit limit that evolves with the wholesaler’s business, expertly timed working capital deployment that coincides with the cash cycle of wholesalers, and a strategic repayment plan that complements the cash flow cycle of wholesalers.

Digital multi-currency wallet giant YouTrip lands a whopping $50m in Series B

YouTrip, “Singapore’s leading multi-currency digital wallet”, has successfully raised $50m in their Series B funding round.

A trailblazer in the FinTech industry, YouTrip made its debut in 2018 with an ambitious vision: to furnish everyone with an intelligent, more convenient method of paying in foreign currencies. Regardless of pandemic-related travel restrictions, the company pivoted to e-commerce, enabling users to continue saving on FX transactions from the safety of their homes. Their user-centric approach also stood out when travel resumed, with many turning to YouTrip as their preferred payment companion for overseas journeys.

The fresh capital is earmarked for some robust plans. YouTrip aims to enhance their user experience by introducing new products and features that mesh well with their current offerings. This is expected to make overseas spending or transactions in foreign currencies even more seamless.

Additionally, a significant portion of the funds will be directed towards technological enhancements, ensuring that their products are both intuitive and reliable. A broader vision of the company encompasses expanding into fresh markets and introducing new wallet currencies, providing users an opportunity to lock in superior FX rates for an extended range of currencies.

Twinco Capital secures €50m ($53m) debt facility to bridge trade finance gap

Spanish firm Twinco Capital made headlines as it recently secured a €50m facility with BBVA Spark, aiming to enhance its growth trajectory.

The funding comes as a response to the massive $2.5 trillion global trade finance gap that predominantly impacts SMEs in emerging nations, thereby curbing their potential for tapping into new commercial avenues.

Twinco Capital, distinctively led by female leaders in the European FinTech landscape, pioneers a novel sustainable supply chain finance solution. The company stands out with its unique offering that encompasses purchase order funding. To date, they have extended a commendable $250m in funding, targeting suppliers situated in the budding markets.

The company’s mission revolves around transforming the financing methods of global supply chains. Their distinctive approach integrates innovative environmental and social criteria into their supplier financing model. Roberto Albaladejo, head of BBVA Spark, articulated, “We are very pleased to support Sandra and Carmen, two entrepreneurs who have reinvented, with Twinco, the way supply chains are financed on a global scale.”

With the freshly acquired funds, Twinco envisages bolstering its portfolio’s growth. The capital is anticipated to aid in expanding their customer base and geographical reach. Sandra Nolasco, CEO of Twinco Capital, mentioned, “We are thrilled to partner with BBVA Spark to help customers build truly sustainable and competitive global supply chains.”

Diving deeper into its operational mechanics, Twinco Capital collaborates primarily with large corporations in the retail and apparel domains. They offer expedited funding to these entities’ suppliers across the globe, assuring a transparent and smooth transactional experience. A critical component of their success recipe is their avant-garde risk model, which synthesises the conventional financial risk perspective with business performance and ESG metrics.

Graylog garners $39m to amplify its security product growth

Graylog, the “Security Information and Event Management (SIEM) and log management firm”, successfully secured $39m in funding to further fuel its substantial growth trajectory.

Leading the charge in this investment round was new investor Silver Lake Waterman, with commendable backing from existing investors Piper Sandler Merchant Banking and Harbert Growth Partners.

Graylog, in its essence, has been integral in the security domain. They offer Graylog Security, a distinctive SIEM solution designed for mid-sized enterprises. This solution empowers businesses to detect and react to cyber threats, thanks to its advanced security analytics, AI-driven alerts, and efficient threat hunting across various environments – cloud, hybrid, and on-premise. A testament to its efficacy, Graylog Security now constitutes over half of the company’s new clientele.

With this fresh influx of funds, the company aims to expedite product development, enhance its unique selling propositions, amplify global go-to-market endeavours, and pave a sustainable path to profitability.

Arteria AI announces $30m Series B led by GGV Capital U.S.

Arteria AI, a leading applied AI company, has successfully secured $30m in its latest funding round, bringing its overall total to $50m.

The Series B round, which was oversubscribed, was led by GGV Capital U.S. and saw participation from all major existing investors, which include Illuminate Financial, Information Venture Partners, BDC Capital, and Citi.

The new funds are planned to be utilised to expedite go-to-market activities and further enhance its AI technology in the realm of financial services.

Arteria AI is a trusted partner of numerous prestigious financial institutions, including several global Tier 1 banks. They empower these organisations with AI-enabled software that brings documentation processes into the digital age. This transformation is conducted at an enterprise scale, resulting in increased speed and efficiency in areas such as trading, lending, and asset management.

The firm’s innovative platform eliminates the need for manual processes by structuring data from the outset of the documentation lifecycle. It surfaces data and insights through intelligent workflow tools, facilitating faster decision-making for all stakeholders. By connecting documentation processes to the automation lifecycle, Arteria enables true straight-through-processing in core business activities across the enterprise.

Shelby Austin, CEO and co-founder of Arteria AI, said, “We are thrilled to partner with GGV U.S. on our mission to address the documentation challenges in financial services. This milestone is proof positive that we are driving real and recognisable value throughout our customers.”

Cowbell, InsurTech leader, secures new funding after a 49% YoY growth

Cowbell, a foremost entity in the realm of cyber insurance tailored for small- and medium-sized enterprises (SMEs), has made headlines with its announcement of substantial growth momentum and a $25m investment.

This development follows the company’s most profitable quarter and underscores its consistent corporate expansion. So far, Cowbell has amassed a commendable $148m in funding.

The fresh investment was spearheaded by Prosperity7 Ventures and saw active participation from a mix of new and existing backers.

Impressively, Cowbell has expanded its customer base by 49% in 2023, compared to the previous year. Moreover, the company’s trajectory towards profitable growth has been promising, as evidenced by its 43% ultimate loss ratio recorded in 2022.

Recent studies have shed light on the alarming fact that 72% of SMEs, who currently lack cyber insurance, believe that a significant cyberattack could obliterate their business. Addressing this pressing concern, Cowbell has effectively bridged the insurability chasm for this pivotal market. In 2022, the company achieved a 2.5x surge in premiums, thereby safeguarding SMEs against the constantly evolving landscape of cyber threats.

Enhancing its global presence, Cowbell has inaugurated its operations in the UK market, introducing Prime One for UK SMEs. The company’s standout features, such as its integrated technology platform grounded in AI, and a continuously monitored risk pool encompassing 38 million businesses from the US and UK, have set it apart from competitors. Highlighting the indispensable nature of robust cyber insurance policies for SMEs, Cowbell’s dedicated service, Cowbell 365, has thwarted ransom threats in 74% of instances and curtailed ransom payments to a mere 26% of the initial demand.

Railsr returns to FinTech scene with £20m ($24m) after admin saga

After facing administrative challenges, embedded finance FinTech, Railsr, has made a triumphant return to the industry with £20m in funding.

UK-based firm Railsr is poised to secure a funding of $24m (£19.8m), as revealed by Sky News.

Railsr, which was sold and rebranded as the trading name for a new entity known as Embedded Finance in March 2023, previously encountered multiple challenges. These include two significant rounds of layoffs in the US and rumours about potential financial struggles, which led to whispers of a hasty sale to a Nigerian FinTech.

The freshly acquired funds are aimed at propelling Railsr’s growth in a demanding fundraising climate, ensuring sustainable development for the FinTech firm.

Before its rebranding, Railsr underwent serious financial stress. Informants from within the company and insights from both staff and customers shared with AltFi, alluded to severe cash flow problems during the latter part of 2022. This was especially alarming given a pronounced $46m Series C funding round that had been announced just a month before.

Railsr’ new CEO Philippe Morel commented on the funding, “With this substantial new investment secured in a much tougher fundraising environment, we are very well placed to grow sustainably.”

Charlie secures $23m to redefine banking for those aged 62 and over

Charlie, a player in banking services catering exclusively to individuals aged 62 and above, has recently announced a successful funding round.

The FinTech firm secured a significant $23m in its Series A funding. Taking the lead in this investment was TTV Capital, with notable contributions also coming from FPV. Other seed investors, including Better Tomorrow Ventures, were active participants. It’s noteworthy to mention that the capital is a mix of $16m in equity and $7m in debt.

Delving deeper into Charlie’s operations, it serves retirees and those on the cusp of retirement. The firm’s suite of features empowers these individuals to optimise their limited resources. This includes faster access to Social Security checks, a tempting 3% earning on deposits with no underlying monthly fees or minimums, and US-based customer support. Furthermore, Charlie champions a user-friendly digital interface, highlighting transparency and accessibility.

The recent influx of funds will be channelled towards propelling company growth. A significant portion is earmarked for the development and roll-out of financial fraud protections. These anti-fraud tools, designed with the distinct needs of older Americans in mind, come at a crucial time, considering the alarming $28bn pilfered from them annually.

It’s undeniable that older Americans face financial challenges unique to their age group. Most financial products on the market target those in full-time employment, neglecting the needs of those in their twilight years. Adding to the gravity of the situation, a substantial 52% of seniors feel unprepared for the impending phase of asset deaccumulation. The gap between the services available and the actual needs of the elderly is sizeable, and Charlie aims to bridge this.

Xage Security captures $20m funding amid surging cybersecurity demand

Xage Security, described as the “real-world zero trust cybersecurity company”, has secured $20m in a new funding round.

The investment brings the Xage’s total funding to a staggering $80m. Key investors taking part in this round included well-established names like Piva Capital, March Capital, SCF Partners, Overture Climate Fund, Valor Equity Partners, and Chevron Technology Ventures.

Additionally, new investor Science Applications International Corporation joined the roster.

Catering to businesses spanning critical infrastructure sectors – from healthcare to government and energy to manufacturing, Xage Security is no stranger to the evolving demands of cybersecurity. At its core, Xage’s Cybersecurity Mesh has been meticulously engineered to provide zero trust access management and data security in multifaceted environments. Their solutions seamlessly integrate with current infrastructures, both physical and digital, without the need for any major revamps.

The influx of this capital will be strategically channelled into bolstering research & development efforts and amplifying Xage’s go-to-market (GTM) operations. These moves are poised to fortify global clients, empowering them to effectively manage and transform their OT, IT, and cloud operations securely.

Highlighting their global outreach, Xage recently unveiled a new office in Singapore to complement their Middle East expansion, further cementing their commitment to the Asia Pacific market. With this expanded footprint, Xage aims to cater to a growing customer base that includes prominent infrastructure operators.

Workload identity and access management startup Aembit raises $16.6m

Aembit, the “Workload Identity and Access Management (IAM) Company”, has received an investment from CrowdStrike, through its CrowdStrike Falcon Fund.

This significant investment wraps up Aembit’s seed funding round, which it recently revealed closed on $16.6m.

The seed round secured backing from Ballistic Ventures, Ten Eleven Ventures, and Okta Ventures.

As an extension of this substantial investment, Aembit and CrowdStrike are forging a partnership to undertake technical integration with go-to-market alignment. This crucial collaboration aims to deliver customers with a thorough Zero Trust strategy, focusing on evaluating the identity and health of workloads before granting access to high-security resources.

Delving into the core of Aembit’s offerings, the company is centred on implementing Zero Trust principles to workload-to-workload deployments. This involves an intricate blend of workload identity, risk evaluation, and policy-driven access. Such a combination ensures that businesses can seamlessly integrate identity security throughout their applications, sparing their development and operations teams the undue pressure.

As enterprise applications become more decentralised, spanning software that the company develops to databases and even APIs from clientele and partners, it’s apparent that many corporations are placing their trust in secrets and secret managers. This trust is precarious, as these systems are not only fragile but also cumbersome to maintain. Plus, they don’t cater to the dynamic nature of creating, implementing, and auditing workload access policies.

FinTech innovator Accelex secures $15m in FactSet-led funding round for AI automation

Accelex, described as a trailblazer in AI automation for private markets data acquisition, reporting, and analytics, has garnered a commendable $15m in a Series A funding round.

Taking the lead in this investment endeavour is FactSet, a renowned digital platform and enterprise solutions provider in the global financial sector. Alongside FactSet, existing investors Illuminate Financial, AlbionVC, SixThirty Ventures, and Expon Capital also contributed to the funding.

Diving deeper into the company’s core operations, Accelex stands out by addressing a pressing concern in the investment sector. While transparency remains paramount for investors, private market investments often grapple with unorganised content. This frequently leads to costly and inaccurate manual processing.

Accelex, with its pioneering data science, has transformed this landscape. It efficiently automates workflows right from the document acquisition stage to reporting and analytics. In partnership with FactSet, Accelex aims to introduce groundbreaking solutions to the alternative assets sector. The overarching goal is to grant clients an in-depth insight into what drives their investment performance.

In terms of the company’s vision for the newly acquired funds, Accelex plans to use the capital to broaden its operational horizon, amplify its product features, and fortify client relations.

Layr’s leap forward: securing $10m to modernise insurance tech for brokers

Layr, an InsurTech company for independent commercial insurance brokerages, has secured $10m in its recent funding round.

Cota Capital led this investment endeavour, with notable contributors such as The K Fund, HSCM Ventures, Sandbox Industries, and Flyover Capital, showing their support.

Layr has been at the forefront of revolutionising the insurance tech landscape. Their platform is designed to bring a digital and data-driven shift to the intricate manual workflows inherent in small business insurance. Through their innovative solutions, brokers can effectively serve up to six times more small business clients, elevating their business units to high-profit margins.

The raised funds are earmarked to enhance Layr’s platform functionality tailored for brokers and amplify their go-to-market operations. The primary goal is to support independent insurance brokerages by harnessing Layr’s cloud-based tools, ensuring a significant rise in broker profitability and heightened customer satisfaction in small business insurance tasks.

Layr’s founder and CEO, Phillip Naples, remarked, “One of every four dollars in the GDP goes through the insurance industry, yet it’s glacially slow to change. Many of the tools to distribute and service insurance products are outdated, using the same technology as when I entered the industry 20 years ago. Layr’s changing that for underwriters, brokers, and policyholders.”

Dubai-based cybersecurity firm SpiderSilk secures $9m

SpiderSilk, a Dubai-based cybersecurity AI startup, is making significant strides in the rapidly evolving world of cyber defense.

The firm announced a successful $9m funding round, spearheaded by Wa’ed Ventures, the $500m Kingdom-based venture capital fund of Aramco, according to a report from Wamda. The round also saw active participation from STV and Global Ventures.

The essence of SpiderSilk revolves around addressing the critical challenges in the cybersecurity realm. Established in 2019 by co-founders Rami El Malak and Mossab Hussein, the company offers an innovative AI-powered cyber defense platform, coupled with state-of-the-art continuous exposure detection technologies.

The capital from this funding will be channelled towards expanding SpiderSilk’s cyber defense technology offerings in Saudi Arabia, catering to the growing market need for top-notch cybersecurity solutions in the region.

Connectly bags $7.85m to accelerate AI-powered conversational commerce

Connectly, a leader in conversational commerce, has announced a successful $7.85M in a bid to to accelerate AI-powered conversational commerce.

The funding round was led by Volpe Capital, and also received support from RX Ventures and Saurabh Gupta, managing partner of DST Global.

This latest financial tranche has taken Connectly’s overall capital raised to an impressive $17.5m, as they look to develop their plug-and-play solution which is designed to help businesses create effective messaging campaigns and automate two-way conversations with leads and loyal customers, regardless of the messaging platform.

At the core of Connectly’s platform is Sofia AI, an AI sales assistant that seamlessly integrates with businesses’ backend systems. Sofia AI offers a range of capabilities, including tailoring AI-powered suggestions for customers to discover products they’ll love, engaging and assisting customers across various messaging platforms (such as Instagram, WhatsApp, SMS, or webchat), and gaining deeper customer insights.

Stefanos Loukakos, co-founder and CEO, Connectly, said, “This investment marks a critical milestone in Connectly’s journey. Not only does it provide us the opportunity to expand our platform and continue developing state-of-the-art AI models, but it also marks our entrance into the U.S. market. What’s more, this funding round will aid our expansion onto new messaging platforms and further our position as a leader in conversational AI. This is just the beginning of an exciting new chapter for us.”

Gabriel Marcassa, partner at Volpe Capital, said, “We believe in the transformative power of artificial intelligence to enhance customer interactions. Connectly’s innovative approach to AI-powered conversational commerce truly sets them apart in the market. The impact reaped by its customers across diverse industries is as substantial as the market opportunity that lies ahead. We are thrilled to support Connectly as they expand their presence in Latin America and enter into new markets.”

Verqor secures $7.5m to revolutionise Mexico’s agri-FinTech space

Verqor, a pioneering FinTech firm committed to the digitalisation of Mexico’s agricultural sector, is making significant strides in the industry.

The company recently announced the successful raising of $7.5m. This impressive funding feat was achieved through a pre-Series A round led by Yara Growth Ventures, which contributed $4m. Several esteemed participants, including Accion Venture Lab, SP Ventures, Glocal, and Amplifica Capital, added their support. Additionally, Verqor procured $3.5m in debt funding from Co_Capital and Addem Capital.

Verqor is changing the agricultural landscape by offering cashless credits to farmers, empowering them to purchase essential farming inputs like fertilisers, agrochemicals, and organic products. Notably, a majority of its users, 55% to be precise, have accessed credit for the first time through Verqor.

This financing model by Verqor allows farmers to cater to up to 90% of their production costs, thereby enhancing the quality of produce and elevating their income with each crop cycle. With a unique underwriting process tailored to the sector’s specific needs, Verqor stands out by assessing a farmer’s real capacity to repay, leveraging data such as supply chain and weather trends, and NDVI factors.

The recently acquired funds are earmarked to bolster Verqor’s operations within Mexico. The company is setting its sights on creating the nation’s most extensive network of agricultural supplier partnerships. This would not only cement Verqor’s position as a preferred payment method for clients but also act as a bridge connecting suppliers, farmers, and produce purchasers.

The tech advancements by Verqor aim to expedite the credit approval process, making it seven times swifter than conventional financing avenues, redefining the traditional agribusiness operations in Mexico.

Despite Mexico’s position among the top ten global food producers, a staggering 90% of its farmers remain deprived of formal financing. This lack restricts their capacity to invest, compromising productivity, margins, and the global food supply.

Insurance automation firm Sprout.ai secures £5.4m ($6.6m)

Sprout.ai, an “AI-led insurance claims automation company”, has successfully secured an investment of £5.4m in a recent investment round.

Spearheading this round were notable venture capital investors Amadeus Capital Partners and Praetura Ventures.

In this round, they were joined by a cohort of international investors. These include UK’s Capricorn Capital Partners and Portfolio Ventures Angel Fund, US’s Forefront Venture Partners, and Canada’s Verstra Ventures. Notably, existing investors such as Octopus Ventures, Playfair, and Techstars remained supportive and were active participants in the round.

Diving deeper into what Sprout.ai offers, the firm has designed a unique solution tailored for claims process automation. Their innovative technology assists insurance carriers and third-party administrators (TPAs) in amplifying their operational efficiency. By automating significant segments of the claims procedure, they have been able to reduce claim handling costs by a whopping 50%. Such advancements have led them to service a diverse set of global partners which includes big names like AdvanceCare, MetLife, and Generali.

One of the standout features of their product is its capability to meticulously extract and frame claims information. It then contrasts this with the given policy coverage. The result is a drastic reduction in claims settlement time, turning what used to take weeks into mere minutes.

The newly acquired funds will be funnelled to propel Sprout.ai’s market entry strategies, further its growth trajectory, and persistently innovate in product and AI development. Additionally, they plan on broadening their horizons by venturing into new insurance segments and global domains, with North America being a primary target.

ESG Flo bags $5.25m in seed funding round

FERO clinches $3m investment to redefine online payment journey

FERO, an emerging frontrunner in online payment solutions, has finalised a $3m seed round, with substantial backing from renowned investors including Coatue, Volta Ventures, and Antler.

With a keen focus on addressing a significant gap in the online market, FERO will use the fresh capital to expand and enhance its payment solution so it can combat the staggering $5trn annual revenue that merchants forego at the critical checkout stage.

The duo behind FERO, Craig Savage and Maximilian van Boxel, enriched their insights into the convolutions of payment processing during their stints at Ekata, a revered global payments fraud solution, and later at Mastercard following Ekata’s acquisition.

A concerning trend has emerged in the digital shopping landscape. Despite reaching the checkout stage, a vast majority of online shoppers frequently leave without sealing the deal. This widespread, generic checkout experience, which unfortunately doesn’t cater to individual needs, is largely to blame for these missed conversions. During their involvement in Antler’s founder residency in 2022, the brains behind FERO recognised a golden chance to craft tailored purchase preferences. Their aim Making the payment journey as frictionless and user-friendly as possible.

Voicing his concerns, FERO’s Co-Founder and CEO, Craig Savage said, “As a payments data scientist, I was shocked when I started to uncover the level of abandonment during the checkout and payment journey. Today, upwards of 45% of customers place items in their shopping cart, but never finalise their purchase due to payment related issues. This translates to over $5.2 trillion of lost revenue per year. We founded FERO to help retailers deliver a more seamless and customised shopping experience to their customers.”

Nuvalaw lands $3m funding to revolutionise P&C insurance claims resolution

LegalTech Nuvalaw, the multi-award-winning claims resolution platform that specialises in online negotiation and arbitration of P&C insurance claims, has announced a successful raise of $3m in a pre-series A financing round.

The funding was prominently led by London’s Semantic Capital, a private investment holding entity that places its bets on innovative, software-driven solutions with unique intellectual properties. The financing consisted of a mix of equity and debt.

Nuvalaw, in conjunction with its UK joint venture partner Trust Arbitration, has managed to secure a commendable clientele, comprising eight significant insurers and seven major law firms. Their joint accolades include winning the Insurance Times Claims Partner Of The Year Award, Claims Achievement Award at the Claims Excellence Awards, and the Legal Claims Partner Of The Year at the Insurance Times Awards.

This newly acquired funding will be channelled to further enhance Nuvalaw’s already flourishing presence in the UK market. The aim is to expand their cloud-based claims resolution platform, integrating AI technology to tackle a broader spectrum of legal issues. The move into the US market by Nuvalaw has been highly anticipated, especially given the country’s notorious litigation and claims resolution expenditures.

At present, the average waiting duration for personal injury claims in the UK can extend up to 546 days, leading to claimant dissatisfaction, increased operational expenses for insurers, and liquidity issues for claimant lawyers. Nuvalaw’s innovative platform efficiently streamlines and organises all documentation and interactions online. This has resulted in compressing the lengthy resolution process of intricate insurance claims from over a year to just a few days, generating savings of almost 80% in parallel costs.

Nuvalaw’s Chief Executive Willie Pienaar said, “The backing of Semantic Capital is a great vote of confidence in the future of Nuvalaw. It will enable us to build on the successes of the last few years and help take Nuvalaw to the next stage of our business development internationally, including looking at building new products in the UK and how we can support US-based insurers and claims firms to slash their costs and speed up claims resolution.”

Goodwell backs InsurTech Inclusivity Solutions with $1.5m extension round

Inclusivity Solutions, an award-winning InsurTech, has successfully concluded an extension round of investment.

According to Techonomy, the extension round, led by impact investor Goodwell Investments, saw a funding infusion of $1.5m. Goodwell’s reputation for supporting growing African businesses that cater to the essentials for low-income demographics is well-known.

This isn’t the first time the investment firm has shown its faith in Inclusivity Solutions. In 2019, Goodwell spearheaded Inclusivity Solutions’ Series A funding round.

A trailblazer in its niche, Inclusivity Solutions harnesses the power of technology in tandem with strategic partnerships. Their primary objective Making appropriate and affordable insurance accessible to consumers in emerging markets. The way they achieve this is innovative. They integrate simple insurance products into platforms and services consumers are already accustomed to, ensuring protection for life, health, and businesses. Such a move also benefits distribution partners like banks, mobile operators, and digital platforms by paving the way for new customer acquisition, retaining existing clientele, and cultivating fresh revenue avenues.

The funds procured from the extension round are earmarked for specific growth areas. Inclusivity Solutions aims to solidify its presence in at least 12 African markets by 2024’s close. Furthermore, they are keen on investing further in their renowned no-code, open-API platform. This revolutionary platform empowers insurers and distribution partners to roll out a comprehensive suite of insurance products swiftly.

Goodwell Investments’ Managing Partner Els Boerhof shed light on their decision to invest, stating, “Around the world, including in several regions in Africa, access to safe and reliable savings, payments, and loans for un(der)served groups is finally growing. Yet insurance remains the problem. Inclusivity Solutions makes insurance easily available and reliable, and thanks to their technology, highly scalable. They are solving an urgent problem, helping people protect themselves from the unforeseen shocks that are often the root cause of poverty and inequality. That is why we invested. In addition, we are pleased to support an organisation with a woman at the helm. We don’t see enough funding going there yet.”

The company’s outreach strategy primarily involves collaboration with leading African brands, naming a few like Britam, FNB, Orange Money, Safaricom, Airtel Africa, and MFS Africa. Beyond their core tech platform ASPin, they offer partners an array of complementary services encompassing areas like research, design, pricing, analytics, and support in implementation.

UAE FinTech NOW Money secures funding to revolutionise remittance

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global