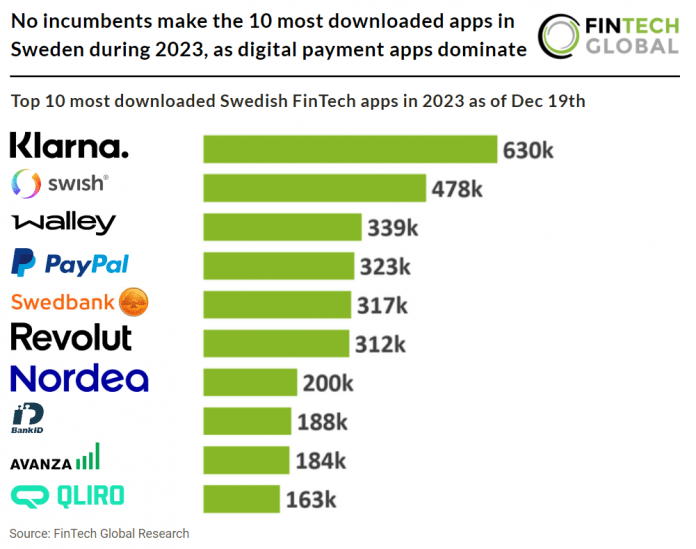

Payment apps took the majority of spots among the most downloaded FinTech apps in Sweden in 2023 with 1.93m downloads combined, a 61% share of all downloads. In 2023, the Swedish digital payments market is anticipated to achieve a total transaction value of $49.7 bn, and it is forecasted to experience significant growth with an annual growth rate (CAGR 2023-2027) of 13.29%. This growth trajectory is expected to culminate in a total transaction value of $81.8 bn by the year 2027. Among the various segments within this market, Digital Commerce stands out as the largest, with a projected total transaction value of $28.7 bn in 2023. The second most active sector based on the list was digital banking which saw a combined 829k downloads, a 24% share of total downloads. The Neobanking market is anticipated to achieve a transaction value of $21.4 bn in 2023. It is also predicted to demonstrate a compound annual growth rate (CAGR) from 2023 to 2027, with an estimated total transaction value of $34.8 bn by the year 2027.

Klarna, a buy now, pay later provider, is the most downloaded FinTech app in Sweden so far in 2023 with 630k app downloads. Regarding its market share and usage in Sweden, Klarna’s monthly active users have shown impressive growth. In January 2019, Klarna had under 20,000 monthly active users, which grew to over 180,000 by January 2020. By September 2021, this number reached approximately 970,000. Globally, Klarna is currently the most popular BNPL service provider, with approximately 147 million active users, substantially more than any other BNPL service. In terms of financial valuation, Klarna experienced a significant fluctuation. Its valuation peaked at $45.6 billion in July 2021 but dropped to $6.7 billion by July 2022. This decrease was attributed to a shift in investor sentiment.