Total FinTech Investment in Canada saw a 73% increase, from $44m in Q1 to $76.2m in Q2

- Canadian FinTech saw a volatile start to 2016. Q1 2016’s 25 deals, the highest of the Q1 2016 – Q2 2017 period, was then followed by the joint lowest of the same period, as Q2 of the same year saw only 9 deals.

- The second half of 2016 was more consistent. The number of investments fell consistently QoQ from 21 deals in Q3 2016 to 9 deals in Q1 2017.

- Total FinTech investments did rise in Q2 2017 compared with Q1, but failed to match the levels set last year. FinTech companies in Canada received only $76.2m in Q2 2017 – a 27.8% decrease YoY compared with Q2 of 2016.

- Despite a fall in total investment YoY more deals were closed in Q2 2017 than the same quarter in 2016. The largest deal Canada received in Q2 went to Toronto-based Robo Advisor Wealthsimple. The company received $37m from Power Financial Corporation in a Series B round back in May.

Despite progressively increasing between 2014 and 2016 total FinTech investments look set to fall in 2017.

- The total amount invested in Canadian FinTech companies grew at a CAGR of 25.6% between 2014-2016. The total number of deals also progressively increased in the same period.

- The first half of this year has seen a slowdown in investments in Canadian FinTech Companies with only $120.2m invested across 20 deals. This amounts to only 21% of the total investments in 2016, suggesting that investments in 2017 will not reach levels set in 2016.

- The largest deal in Canadian FinTech in 2016 went to Real Matters which develops software for the mortgage lending and insurance industries with a focus on Real Estate. The company received $74m in a deal closed in March 2016.

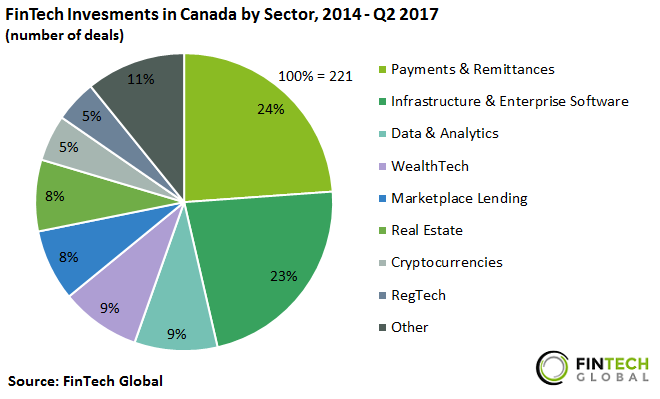

Canadian companies that specialise in Payments & Remittances and Infrastructure & Enterprise Software received the highest number of deals between 2014 and Q2 2017.

- Payments & Remittances and Infrastructure & Enterprise Software companies received 47% of the total FinTech deals closed in Canada between 2014- Q2 2017. In this period $264.6m was invested in Payments & Remittances Companies, whereas Infrastructure & Enterprise Software companies received the slightly higher total of $283.5m

- A further 18% went to companies specialising in Data & Analytics or WealthTech, with both sectors receiving an equal deal share. Despite receiving lower deal shares the Real Estate and RegTech sectors were some of the highest-ranking sectors for total investment, receiving investments totalling $189.0m and $185.9m respectively.

- The largest deal to a Payments and Remittances company in 2017 thus far went to Point of Sale developer Dream Payments, which received $10m in a series A round in march from Fair Ventures, who led the round with co-investment from fellow Canadian investor Real Ventures and US-based Connecticut Innovations.

The 10 most active FinTech investors in Canada participated in almost 25% of deals between 2014 and Q2 2017

- 9% of all investments in Canada between 2014 and Q2 2017 had at least one of the top ten investors as participant.

- Canadian FinTech companies predominantly rely on domestic sources for investment; eight of the top 10 most active Canadian FinTech investors are also Canada-based. US-based duo Nexus Venture Partners and Blockchain Capital are the two exceptions.

- BDC Venture Capital is the most active investor in Canadian FinTech and participated in 9.5% of deals to FinTech companies in Canada between 2014 and Q2 2017. The firm recently participated in a $23.8m Series D round to accounting software company Wave in May 2017.

Toronto is the most active City for FinTech in Canada with 100 deals to FinTech companies based in the city since 2014.

- 74% of deals to Canadian FinTech companies since 2014 went to companies based in the top two cities; Toronto and Vancouver.

- Montréal also received 13 deals with companies such as Blockstream and Lightspeed raising multiple rounds in the Period. Blockstream draws on Blockchain technology to restore trust in financial systems while Lightspeed develops cloud-based point of sale solutions.

- Between 2014 and Q2 2017 a total of $997.8m was invested in the top three Canadian Cities for FinTech. Toronto, Vancouver and Montreal received $596.8m, $201.4m and $199.6m respectively.