FinTech investment in the second quarter of 2017 was three times the amount seen in Q2 of last year

- Swedish FinTech companies received $181m in funding across 25 deals in Q2 2017. The $181m investment is more than three times the $56m invested in Q2 2016.

- The 25-deal haul made Q2 2017 a record quarter for FinTech investments in Sweden. This surge in activity was led by the Payments & Remittances sector which received 13 deals on its own in the period over half of the overall deals.

- Almost two-thirds of Q2 2017 total came from Banking Infrastructure Provider Snow Software, which raised the largest deal in Swedish FinTech so far this year. They raised $120m-worth of private equity financing in late-April courtesy of the Ontario Pension Board and US-based Sumeru Equity Partners.

- Despite high total funding levels, Q2 2017 saw a 12.7% drop in FinTech investments valued below $100m compared to Q1.

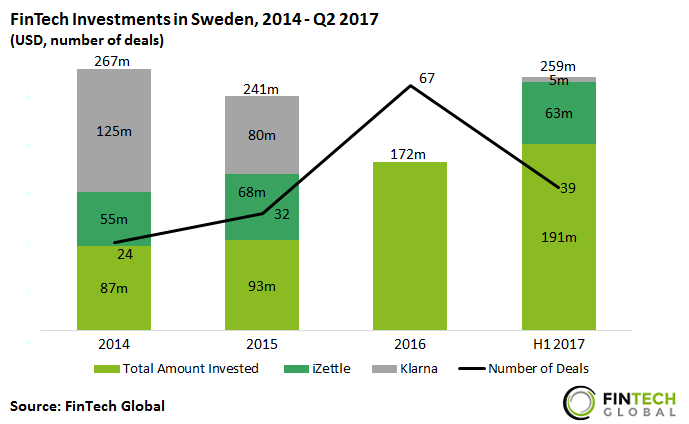

FinTech investments in Sweden are on track to surpass the record funding set in 2014

- 2017 seems almost certain to be Swedish FinTech record year for investment total. The sector has received $261m in funding thus far; a total just $6m shy of 2014 high of $267m.

- Deal activity in Swedish FinTech rose consistently YoY at a CAGR of 40.8% between 2014 and 2016. 2016 was a record year for deal activity in Sweden as the sector received 67 investments more than 2014 and 2015 deal totals combined. 2017 looks set to follow up and be another record-breaking year having already seen 58.2% of 2016 total only six months in.

- Total FinTech investments fell between 2014 and 2016, however this is due to a fall in large deals to FinTech giants iZettle and Klarna. Removing these deals revels that FinTech investments to smaller companies grew at a CAGR of 25.5% between 2014 and 2016.

- The average deal size after the close of H1 2017 in Sweden is $6.6m, making the opening half of this year 40.5% lower than the $11.1m average seen in 2014 the highest year average in the period. The average deal sizes for 2015 and 2016 was $7.5m and $2.6m, respectively.

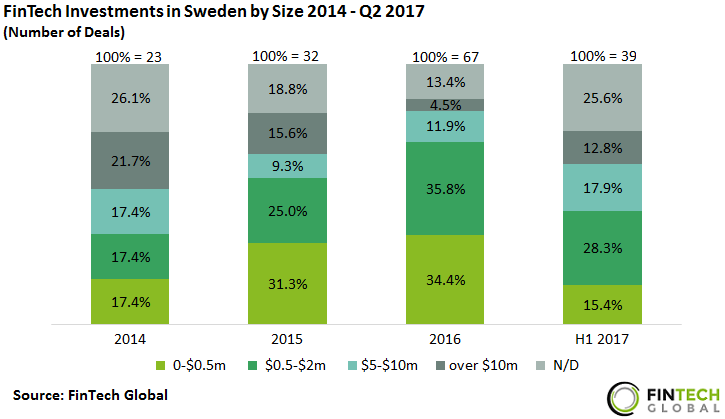

The Share of small deals (valued below $2m) steadily increased between 2014 and 2016 as the early stage segment grew

- The share of deals valued below $2m increased by 35.4% between 2014 and 2017 as more funding is committed to early stage FinTech companies in Sweden. This growth shows the expansion of the FinTech sector in Sweden.

- In 2014 21% of deals were valued above $10m. These deals went to FinTech giants such as Klarna, BIMA, and iZettle. The total amount invested in 2016 fell by almost 30% and this fall in investment is mirrored by a 11.1% fall in the share of investments valued above $10m.

- The first half of 2017 has seen a higher share of deals valued over $10m closed, with the share of deals valued $5-$10m returning to levels set in 2014.

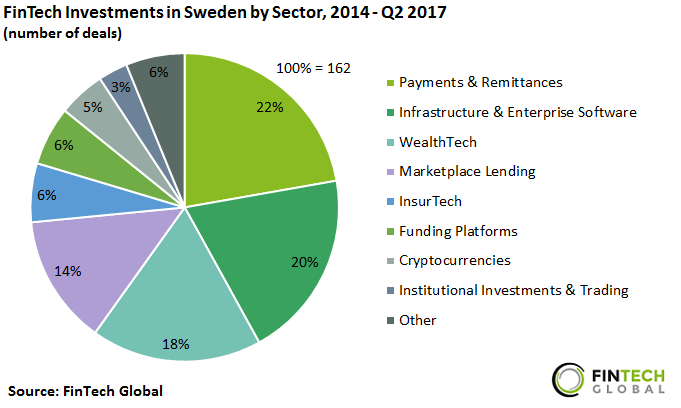

FinTech Companies in Sweden specialising in; Payments & Remittances, Infrastructure & Enterprise Software and WealthTech received 60% of deals between 2014 and Q2 2017

- Payments & Remittances companies received 22% of deals raising a total of $473m worth of funding between 2014 and Q2 2017. Sweden largest FinTech companies operate within the Payments & Remittances Subsector. Since 2016 E-commerce platform Klarna has received more than $246m, while PoS provider iZettle has received $186m.

- Other Swedish FinTech companies operating within Payments & Remittances include e-commerce payments provider Trustly Group an mobile payment company Betalo. In October 2016 Betalo received a $1.16m investment from NFT Ventures and Mattias Weinhandl.

- Companies specialising in Infrastructure & Enterprise Software, WealthTech and Marketplace Lending received just over 50% of deals. The combined investment in these sectors totalled $262m, highlighting the strength of the Payments & Remittances sector in the country.

The Top 10 most active Investors in Swedish FinTech companies participated in 20% of deals since 2014

- NFT Ventures is the most active investor in Sweden contributing to almost 7% of deals since 2014. The firm invest specifically in financial technology start-ups and their portfolio companies based in Sweden include Belato, Toborrow and Mr Shoebox.

- Seven of the top ten investors are based in Sweden, with the remaining three; 83 North, Mastercard and GP Bullhound headquartered in Tel Aviv, New York and London respectively.

- Collector Ventures has been the most active investor in 2017 so far. With investments in mobile payments specialist Mondido, Personal finance company Lanbyte and Risk management firm Nordkap.