803 Mine has launched its ICO token pre-sale as it plans to become the largest cryptocurrency mine in America.

The cap is currently 1.25 Million tokens set at a value of $100 each making the total of all rounds capped at $100m according to its whitepaper. The 803 Token price, or the initial rate, is based on the date of acquisition starting at $25 during the Pre-Sale rounds, which is now, and will adjust upward toward a cap of $100 per 803 Token as the pre-sale round draws to an end. The ICO Token launch will take place on the 1st December and run up until the end of the month.

It accepts 50-plus cryptocurrencies and USD for 803 MINE Tokens and we will be paying all token contributors with their share of the ‘The Mining Fund’ in the cryptocurrency of their choice. All mining proceeds from 803 Mine are deposited into The Mining Fund, a closed-end fund built on a revenue-sharing Ethereum smart contract.

The 803 MINE Token grants 50% access to this fund. 25% is continually put toward increasing production and generating increasing payouts without diluting value for token holders or raising additional capital. Expenses are paid from the 25% of production allocated to the company. This covers any and all expenses – including power.

Contributions will be used to build the infrastructure required to become the ‘largest cryptocurrency mining operation in America’ according to its website. The funds will be spent on tangible assets, hardware, and power. Leveraging economies of scale, our business and government contracts and relations, and our proprietary software and algorithms

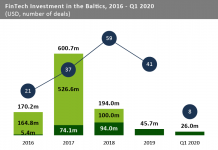

Funding to Blockchain & Cryptocurrencies companies is set to hit a record this year according to data by FinTech Global . Total investment grew between 2014 and 2016, steadily increasing at a CAGR of 14.2%. The increase in investment looks set to continue in 2017 as a total of $412m was invested in the first half of the year. This was partly due to a few large deals including a $107m deal to Blockchain company R3 CEV in May 2017 which made up 26.0% of the total funding in the first half of 2017.

Total investment grew between 2014 and 2016, steadily increasing at a CAGR of 14.2%. The increase in investment looks set to continue in 2017 as a total of $412m was invested in the first half of the year. This was partly due to a few large deals including a $107m deal to Blockchain company R3 CEV in May 2017 which made up 26.0% of the total funding in the first half of 2017.

So far this month, Crypto-wallet Change ended its ICO after pulling in $17.5m from over 5,600 contributions. SparkLabs Group also recently launched a $100m vehicle focused on blockchain and cryptocurrency companies. While Eidoo, which has launched a new ‘blockchain asset experience’, concluded its ICO with $29.7m.

Copyright © 2017 FinTech Global