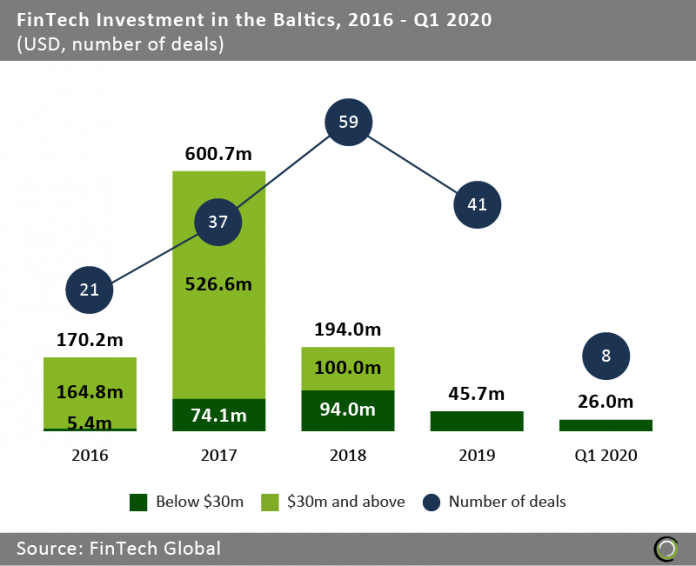

FinTech companies in the Baltics raised $26m in the first quarter of the year across eight deals

- The FinTech industry in the Baltics recorded strong growth in deal activity between 2016 and 2018 as the number of transactions increased from 21 to a record high of 59. Funding peaked at just over $600m in 2017 as Coinverco, a crypto investment management and trading platform, and 4finance, an online lending group, raised $120m and $325m, respectively.

- Despite being a small market, the countries in the region – Latvia, Lithuania and Estonia – possess a high level of technology penetration which has produced a disproportionally high number of tech hardware and software startups.

- However, FinTech investment declined in 2019 with deal activity falling to 41 transaction and funding levels dropping 76.4% to $45.7m. Even if we exclude large deals above $30m, which are volatile over time, from the analysis total capital invested still declined by 51.4%.

- Investment in the region had a strong start to 2020 with $26m worth of funding, a massive increase on the $0.1m invested in Q1 2019. Deal activity also doubled YoY from four transactions last year to eight deals in the first three months of 2020.

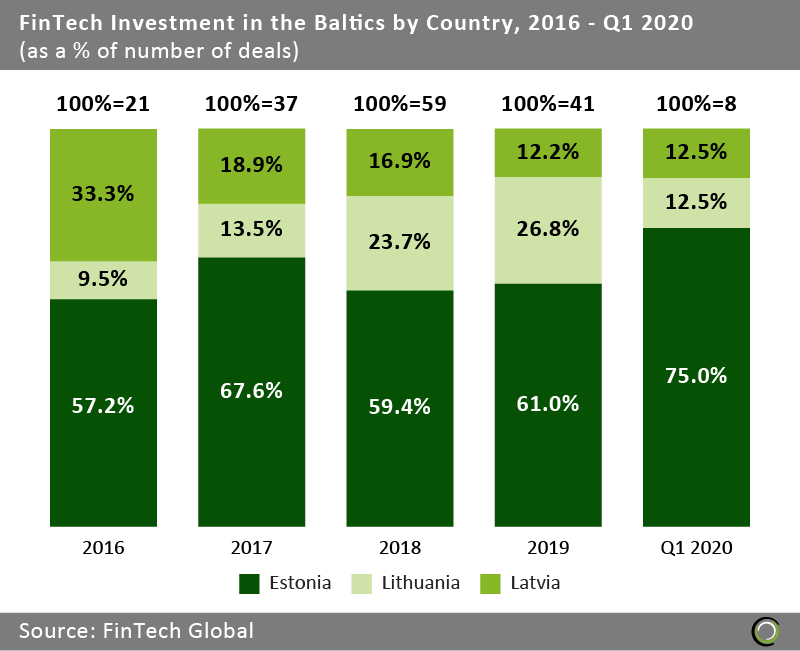

More than three in five of FinTech deals in the Baltics since 2016 have been completed by Estonian companies

- Companies based in Estonia captured 62% of the 166 deals completed by FinTech companies in the Baltics between 2016 and Q1 2020. This is unsurprising given over 99% of financial transactions in the country are occurring digitally, electronic Identification and blockchain are widely used in FinTech applications and the country is home to 80+ FinTechs.

- However, the country’s share of deal activity declined in the last two years from its peak of 67.6% in 2017 as other countries in the region are fostering strong FinTech ecosystem attracting new capital from investors.

- The country that saw the biggest growth in deal activity was Lithuania. Companies in the country completed 26.8% of all FinTech deals in the region last year, a growth of 17.3 percentage points since 2016. The country has made a concerted effort to turn itself into an attractive destination for FinTech companies with government and regulatory bodies developing its economic infrastructure to support the ecosystem. It seems to have paid off as Lithuania is now second in Europe only to the UK in terms of the number of FinTechs that have secured money licences to handle payments.

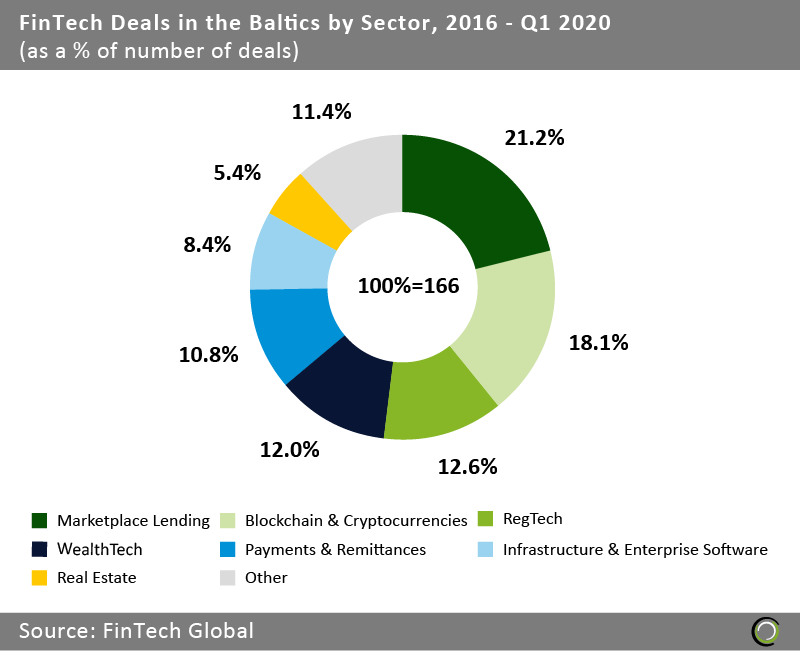

Marketplace Lending, Blockchain & Cryptocurrencies and RegTech companies have completed over half of all FinTech deals in the Baltics

- The Baltics region has a diverse FinTech ecosystem with seven different subsectors attracting over 5% deal share since 2016. However, companies in the region operating in Marketplace Lending, Blockchain & Cryptocurrencies and RegTech have gathered the most interest from investors completing 51.9% of all deals.

- Marketplace Lending companies attracted the largest share of deals in the country over the period raking in 21.2% of all FinTech transactions in the Baltics region. With a population who is considered to be highly tech savvy, as well as more frequent users of mobile phones and digital means of payments, the region is home to some of the first P2P lending platforms in Europe such as Twino, Bondera and Mintos.

- Blockchain & Cryptocurrencies companies also captured a healthy share of deals, accounting for 18.1% of deals in the regions since 2016. This is unsurprising given the fact that the Lithuanian ministry of finance introduced the world’s first security ICO platform open for global-blockchain-businesses in 2017. Additionally, the Baltics have been named “a crypto paradise” for its high concentration of Bitcoin full nodes, strong initial coin offering (ICO) activity, and the fervent support from local governments.

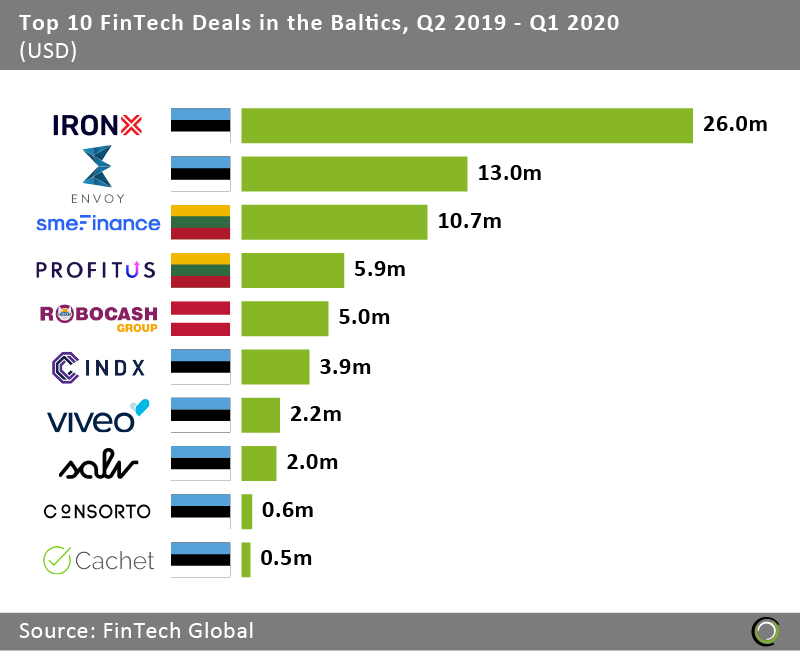

Estonian companies completed seven of the ten largest FinTech deals in the Baltics over the last 12 months

- The top ten FinTech deals in the Baltics completed between 1 April 2019 and 31 March 2020 collectively raised $69.6m, making up 97.2% of the overall investment in the region during the period. The high levels of concentration of capital in large deals is normal given that the average deal size in the Baltics last year was just $2.9m.

- Estonian companies took seven spots on the list with Ironx, a cryptocurrency exchange, and Envoy Group, a blockchain platform for supply chain and trade finance, taking the top spots. Ironx raised $26m via an ICO in April 2019 as it launched to the public, while Envoy took in $13m from Alcedo Digital Ventures in February this year as the company looks to expand into new markets.

- The largest deal of the period outside of Estonia was completed by SME Finance, an online invoice finance company based in Vilnius, which collected €10m in debt financing from Citadele Banka in March 2020. This is the first partnership in the Baltics between a bank and a non-bank lender and the collaboration will offer SMEs in the region account opening and cash management services managed by Citadele.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2020 FinTech Global