Singapore-based AlgoMerchant has reportedly bagged a $2m investment alongside the product launch.

East Ventures took part in the funding, alongside a network of angel investors with fund management and broking experience, according to a report from Tech in Asia.

AlgoMerchant is an investment platform, which allows users to manage deals themselves or with the help from a robo-advisor. The stock trading robo-advisor is designed for retailers, making short to medium term investments after analysing micro-changes in price and volume movements to identify opportunities. Improved risk management is created by the platform, through its automatic monitoring of the companies based on personalised parameters.

The application, which is available on iOS and Android, offers real-time updates on portfolio news, data analytics for stock comparison and ‘AlgoOracle’, which makes predictions on trades.

Last year the company picked up $910,000 in funding from East Ventures, and also took part in Nanyan Technological University’s NTUitive incubator program, the article states.

Financial performance marketing company Investoo Group acquired RoboAdvisors.Com in an undisclosed deal, last month. Over the past couple of months several other robo-advisor solutions have seen contributions, with Aviva acquiring Wealthify and B2B solution Bambu, completing a funding round.

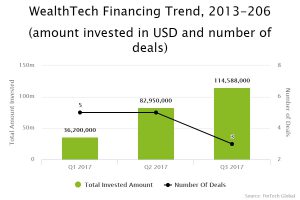

Across 2017, investments into robo-advisor companies has been rising, with the third quarter seeing $114m deployed across three deals. While there were more deals in the opening quarter, funding amounted to just under a third of that in Q3.

Copyright © 2017 FinTech Global