Personal finance platform Fisdom has netted $4m in a Series B round led by Quona Capital’s Accion Frontier Inclusion Fund.

The funding also saw participation from previous backer Saama Capital.

India-based Fisdom is an automated investment management solution. The platform, which is available via desktop, tablet or mobile, cares for a personalised investment account and offers recommended opportunities.

Investment solutions currently available are only for mutual funds; however, in the future the company is looking to expand into insurance, bonds and pension products.

Capital from this raise will used to enhance Fisdom’s technology as well as the expansion of its teams and customer acquisition efforts. The company is also looking to launch more products, such as insurance and NPS.

Quona Capital founding partner Ganesh Rengaswamy said, “In Fisdom, we are thrilled to back a team that is taking a uniquely holistic, customer-centric approach to developing savings, investments, and financial management tools for emerging, underserved consumers.”

This investment follows last year’s Series A round, where Saama Capital led the $1.1m capital injection. Prior to that Fisdom had raised $500,000 from angel investors.

Quona Capital closed its Accion fund earlier in the year on $141m, focusing on FinTechs improving the undeserved. For investments it will focus on emerging markets sub-Saharan Africa, Latin America and Asia, with a primary focus on India and South-East Asia. The firm took part in the undisclosed commitment to South African insurance startup AllLife and marked the vehicle’s first move in the InsurTech space.

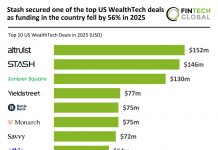

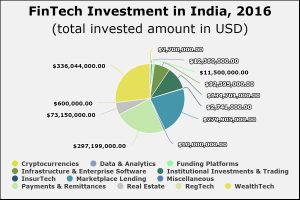

Last year the biggest proportion of funding in India went to the WealthTech sector, with it accounting for more than a third of the total capital deployed in the country. The Indian FinTech sector is dominated by three areas, WealthTech, payments and marketplace lending with it representing more than three quarters of the activity.

Copyright © 2017 FinTech Global