Australia-based Waddle has reportedly raised $50m in debt funding, after its has doubled its lending volume.

The unnamed financier has the ability to support the company’s growth over the next three to five years, according to a report by Business Insider Australia.

Launched in 2014, the company is a cloud-based invoice provider which can integrate with accounting software including Xero, Myob and Quickbooks. The solution allows businesses in Australia and New Zealand to manage cash flow and access cost effective working capital.

Through the platform a client is able to use new invoice data to draw funds when needed, but the solution also ensures all data is secure and users can choose which businesses to send funds.

Equity will be used to support the company’s growth through further automation of credit, operations and user experience, it said. Waddle is also looking to build on its current services, and increasing its team.

Earlier in the week Australia and Dubai signed an agreement to cooperate on FinTech, of which it sees RegTech growing ever more important. The Dubai Financial Services Authority and Australian Securities & Investment Commission signed the deal to partner and promote solutions in each other’s markets.

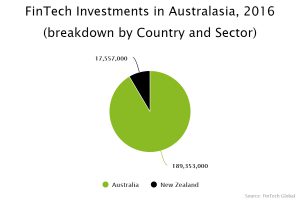

The Australasian FinTech sector was dominated by Australia, with it representing around 91 per cent of the capital deployed. The remaining equity was invested into New Zealand companies. Within Australia, marketplace lending companies have seen the most attention with it pulling in $106.6m in 2016.

Copyright © 2017 FinTech Global