TechCrunch founder Mike Arrington has launched a $100m cryptocurrency hedge fund called Arrington XRP Capital.

So far the vehicle has raised up to $50m, and will begin making investments in the next few weeks. The capital pool will be denominated in XRP, which is currently one of the biggest cryptocurrencies, and investors contribute to the fund in this token, not in dollars or other fiat currencies.

Any distribution, fee or other expense will be made out in XRP, excluding a selection of LPs requesting distributions in different currency. Some of the equity will also be used to back ICOs and some traditional private equity offerings.

The vehicle will look to invest in a range of cryptocurrency assets and related technology, but the main focus is on tokens.

This vehicle will also be managed by former TechCrunch CEO Heather Harde and Geoffrey Arone, who has gained several years of experience in cryptocurrencies.

In a blog post Arrington said, “Some people think this is crazy and that we’re on the edge of a bubble-bursting meltdown in cryptocurrencies values. After all, a year ago the total market value of all cryptocurrencies was just shy of $14 billion. Today it’s over $300 billion. XRP alone has increased from $0.007 to $0.271 (a 38x jump) over the last year. “This is the time for everyone to get the hell out of cryptocurrencies!,” many people argue, “Not jump in with both feet.”

“Others, however, argue that we’re just getting started in crypto. I’m one of those people. A year ago I was just a crypto enthusiast. Now I’ve altered my career path to focus entirely on cryptocurrencies and related technologies.”

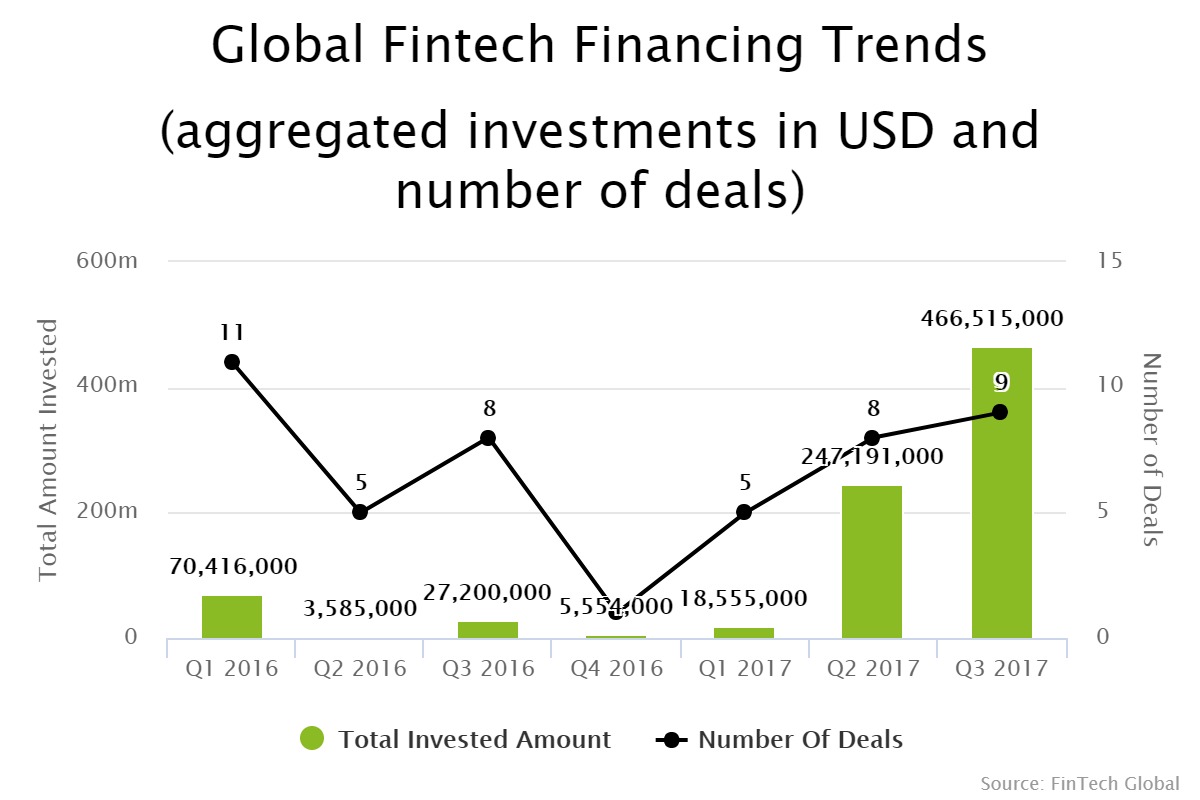

The cryptocurrency sector has seen a colossal rise in funding this year, with the first three quarters alone raising more than seven-times the capital raised in the whole of 2016.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global