Australia-based payments company Credit Clear has raised $10m for its Series A funding round to help expand its invoicing and collections solution globally.

Launched in 2017, Credit Clear’s technology has helped process more than $180m in debt for financial institutions, telecommunications, utilities, government bodies and property agents, in Australia. The machine learning-powered solution helps with global mobile communication, billing and payments, by facilitating transactions in any currency and automatically translating instant messages.

Through the solution a client can offer customers a payment through any digital method and can set up payment plans for weekly instalments.

This equity will help the company expand its international presence, after receiving key interest from the US, Singapore and the UK.

Credit Clear managing director, Simon Scalzo said, “Australia is a great international launch market for fintech products, due to its early adoption of new technology and ideas. With global adoption of fintech services surging dramatically, we plan to continue our rapid growth trajectory into 2018 by opening offices in larger markets, while continuing the evolution of the product to develop new models for digital lending.”

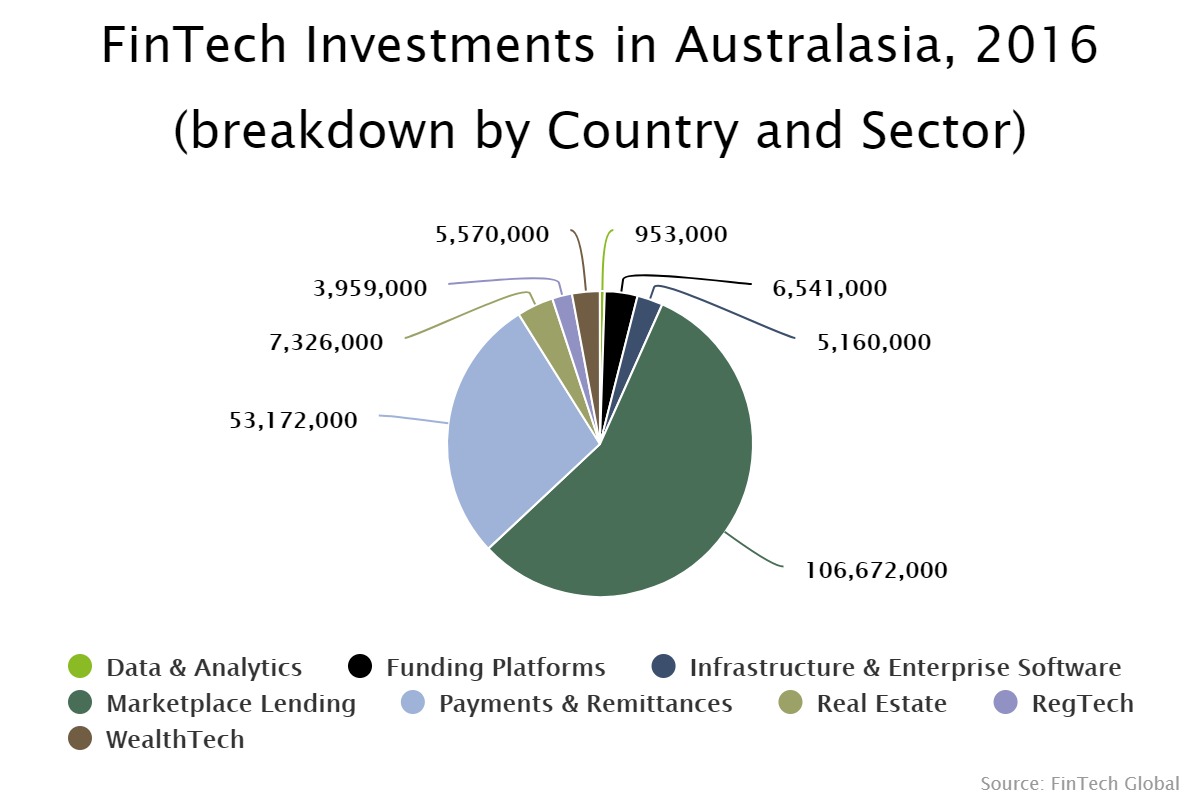

The Australian payments sector saw the second biggest chunk of funding in the countries FinTech ecosystem. Payment companies saw a quarter of all funding last year, but marketplace lending hold the main focus, representing more than half of the activity.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global