WealthTech companies globally raised $907m-worth of funding across 45 investments in the third quarter of the year

- WealthTech investments rocketed in Q3 2017 to $907m which is 1.8x the total amount invested in the previous quarter.

- This growth is largely due to a rise in the number of deals above $100m which increased from 1 to 4 between Q2 2017 and Q3 2017. China-based personal finance platform Feidee secured $200m from KKR & Co. in the largest funding round of this quarter. This equates to 22.1% of the total funding in Q3 2017.

- In contrast to the record high for total amount invested, deal activity in Q3 2017 decreased by 45.1% to just 45 deals, the lowest value since Q1 2015. The decrease in deal activity combined with the increase in deals over $100m resulted in the average deal size tripling from $8.8m in Q2 2017 to $25.9m in Q3 2017.

WealthTech deals in the first three quarters raised over 80% of the total of last year record funding levels

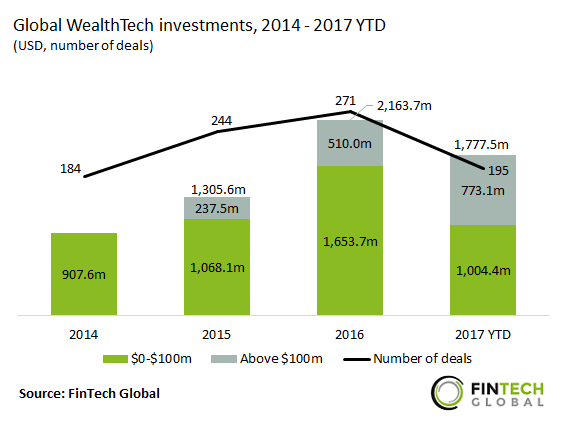

- WealthTech investments increased consistently YoY between 2014 and 2016 at a CAGR of 33.6% reaching a high of $2.16bn in 2016.

- This trend is set to continue in 2017. WealthTech companies received $1.78bn in funding for the first three quarters of the year which equates to 82.1% of the total amount invested in 2016.

- In contrast, deals under $100m are set to fall this year. Between Q1 2017 and Q3 2017, sub-$100m deals raised $1.0bn which is just 60.7% of the $1.65bn invested in deals of the same size in 2016.

- The number of WealthTech deals increased by 1.5x between 2014 and 2016. However, deal activity may fall short this year with the number of deals in the first three quarters of the year equating to 72.0% of the total for 2016.

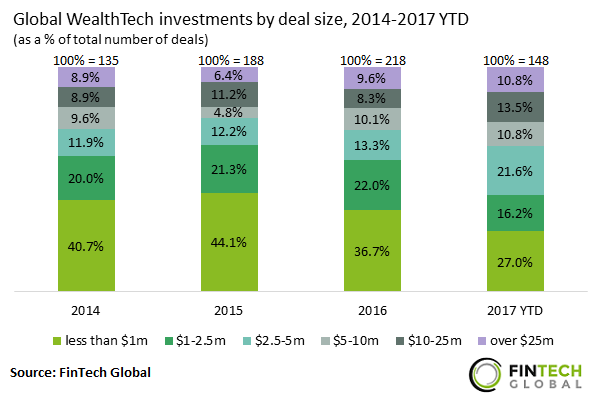

There has been a shift towards larger WealthTech deals since 2015

- The share of WealthTech deals valued below $1m decreased by 7.4% between 2015 and 2016. This decrease looks set to continue in 2017 as the sub-$1m segment lost nearly 10% of deal share in the first three quarters of the year, declining from 36.7% in 2016 to 27% in 2017.

- Deals valued between $1-2.5m also decreased in share between 2016 and 2017, falling from 22% to 16.2%.

- The fall in smaller deals between 2016 and 2017 was mostly offset by a rise in deals valued between $2.5m-5m and $10-25m. These segments both increased in deal share by 1.6x each.

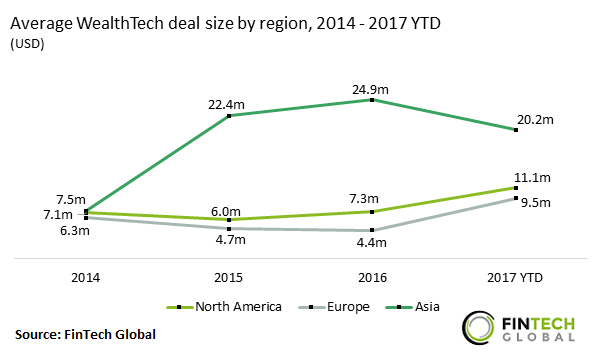

Asia lead over North America and Europe in terms of average deal size has decreased in 2017

- Between 2014 and 2015, the average WealthTech deal size in Asia tripled from $7.5m to $22.4m. Since then, the figure in Asia has remained far above those in North America and Europe.

- Half of the ten largest WealthTech deals in Asia between 2015 and 2017 were mega deals valued over $100m. Eight of these were completed in China, with the remaining two in Hong Kong. The WealthTech industry in China is well positioned to tap into its large middle-class population looking to invest their capital, therefore it attracts significant interest from investors.

- The average deal size in both Europe and North America increased between 2016 and 2017 YTD by 2.1x and 1.5x respectively. During this period, the number of deals valued above $10m increased by 12.5% in Europe and 12.1% in North America, pushing the average higher.

- Between 2016 and Q3 2017, the average deal size in Asia decreased for the first time from $24.9m to $20.2m due a rise in mid-size deals. Deals valued between $2.5-$10m increased by 17.5% during this period. These shifts in average deal size in the different regions have caused the gaps between both Asia & Europe and Asia & North America to decrease by almost 50% in 2017.

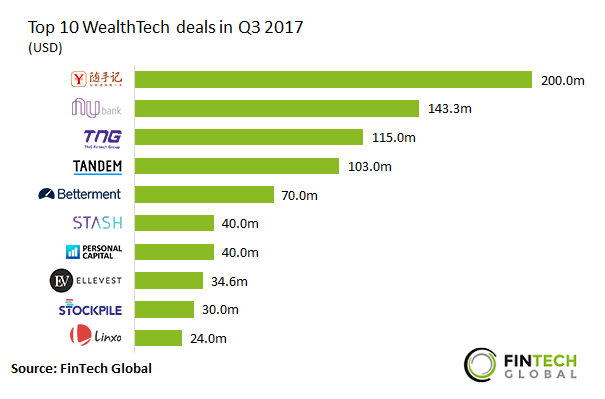

The top 10 WealthTech deals in Q3 2017 account for almost 90% of the total funding for the quarter

- The top 10 deals in Q3 2017 raised nearly $800m in funding which accounts for 88.2% of the total amount invested in the quarter.

- The largest deal of Q3 2017 was the previously mentioned $200m funding round raised by Feidee. Brazil-based digital finance company, Nubank, secured the second largest investment at $143.3m in a debt financing round led by Goldman Sachs and Fortress Investment Group.

- Half of the top 10 WealthTech investments in Q3 2017 went to US-based companies, with the remaining five deals spread between companies in China, Brazil, Hong Kong, the UK and France.