Open banking platform Deposit Solutions has closed a $20m investment round from existing shareholders.

Founded in 2011 the company offers customers an open banking platform for savings deposits. The company’s API helps banks to provide a third-party deposit product to their customers through their existing accounts.

The company has partnered with over 50 banks across 16 countries in Europe, including Deutsche Bank, Atom Bank, MyMoneyBank, AND Oney.

Deposit Solutions plans to use the capital to accelerate its growth and the international expansion of its platform.

e.Ventures managing partner Andreas Haug said, “Deposit Solutions started to build its open banking infrastructure long before FinTech even became a household name and has consistently pursued its vision of transforming the 10 trillion Euro deposit market ever since.”

With this capital injection it brings the total fundraising efforts by Deposit Solutions to around $45.5m, with the company raising around $17m last year.

Earlier in the month the Open Banking Implementation Entity (OBIE) expanded its functionality to cover all PSD2 products. This expansion comes just months before the second Payment Services Directive is launched in January, with a lot of banks and firms rushing to meet the impending regulation changes.

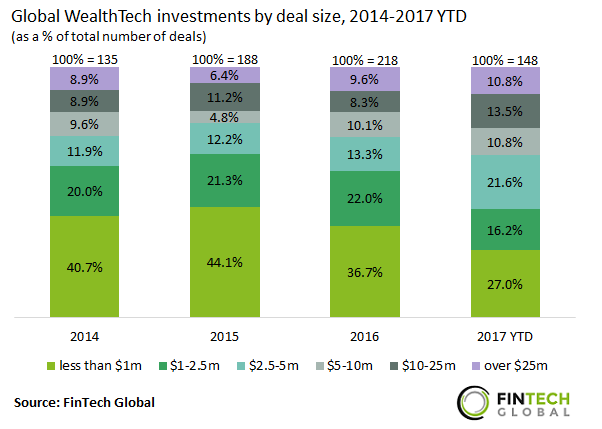

The WealthTech sector has seen a rise in deal size over the years, with deals valued less than $1m have fallen from 44.1 per cent of total investments in 2014 to 27 per cent in 2017. Transactions valued between $2m – $5m and $10m – $25m have seen a 1.6x from 2016.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global