Personal finance solution Earny has bagged $9m in its Series A funding round led by Mayfield.

Participation to the investment also came from Comcast Ventures, and returning backer Science Inc.

Santa Monica-based Earny automatically gets money back for users when purchasing products online, by comparing prices and tracking price adjustments. Most major stores and credit card issuers have a price protection policy, which Earny uses to claim money back for the consumer.

With the capital raised, Earny will look to accelerate its growth, with the company recently announcing a new solution for automating credit card price protection claims on Visa credit cards. Earny users with a price-protected credit card get around 5 per cent back from online spending.

Earny co-founder & CEO Oded Vakrat said, “Now with coverage of all Visa credit cards, and the support from Mayfield and Science Inc., we can use technology to manage the burdensome task of tracking countless price drops and requesting refunds.”

This line of equity brings the total funding efforts by Earny to $11.5m, with the company bagging a $2.5m seed round last year.

Last month saw a host of personal finance solutions pick up funding, with patient financial health solution VisitPay scoring an undisclosed investment, student finance support platform Edmit netting $855k and personal finance app Smartr365 receiving £1m.

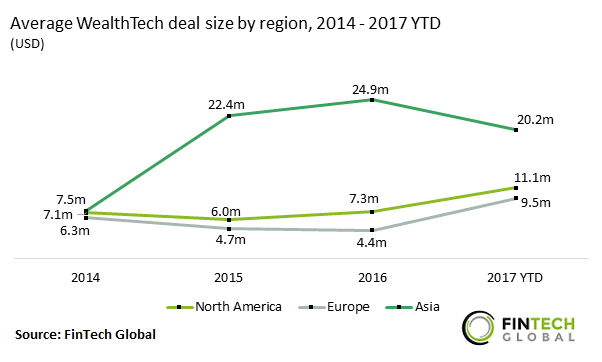

This investment into Earny is just below the average size of deal in a North American WealthTech company in 2017, with the average being $11.1m. However, this transaction is more than the average transaction size for last year. The average capital injection in North American WealthTechs has increased by 1.5x, with the number of deals above $10m seeing a 12.1 per cent rise.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global