Fineqia International has acquired a minority stake in insurance premium financing solution PremFina.

Fineqia has bought the shares from IXL Holdings as part of a settlement of a convertible loan owed by IXL to Fineqia. The sale amounted to around $342,825 and following this deal, the outstanding loan amounts to $946,198.

UK-based PremFina generates loans from financing insurance premiums, to help make insurance more affordable for customers. The loans can be packaged into debt securities and offered on Fineqia’s investment platform.

PremFina pays the upfront payment to insurers, on behalf of the insured party. The policy holder then repays PremFina via monthly instalments including finance fee. The company also serves as a SaaS platform to enable premium finance by insurance brokers.

This investment comes just a couple months after PremFina raised $33m in a equity and debt investments round. Investors included: Talis Capital, Rakuten Capital, Draper Esprit, Thomvest Ventures, Emery Capital and Rubicon Venture Capital. Capital from this round will be used for expansion into global markets.

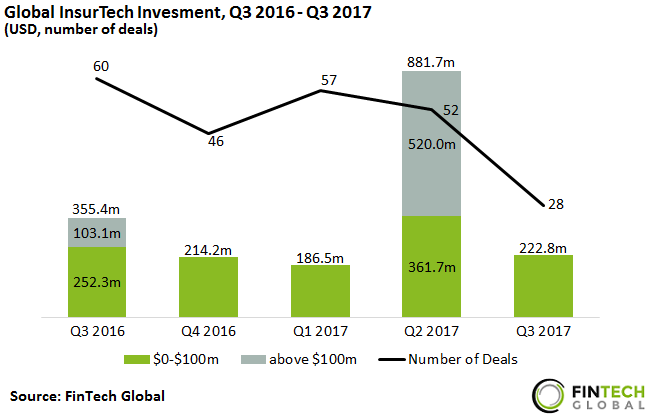

InsurTech funding declined massively in the third quarter of 2017, after the sector saw a sudden surge in activity in the previous quarter. Investments in the sector have fallen by 37.3 per cent to the levels raise in the same quarter last year.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global