Data analytics solution iguazio has launched its APAC regional headquarters in Singapore.

This investment follows on from the company’s recent $33m Series B round, which it closed in July. Participants to the round included Verizon Ventures, Robert Bosch Venture Capital GmbH, the Chicago Mercantile Exchange Group and Dell Technologies Capital, among other venture capital firms. This fresh injection of capital was used to support the company’s global expansion efforts.

The new office will help to support regional demand by supplying training, sales and support to customers and partners in the region.

Founded in 2014, the Israel-based company simplifies data pipeline complexities, while providing turnkey solutions to speed up development and deployment of machine learning and AI. Through the management solution, users are able to process and analyse data close to sources such as IoT sensors and mobile devices.

An example of the platform’s use is, a stock exchange utilising the AI technologies for real-time detection of modern and unfamiliar methods of market manipulation, such as ‘spoofing’. This solution is similar to how banks and credit card companies can benefit from the solution, with the product helping to reduce fraud.

The company has launched this new office to help support its growing demand in the region, with iguazio announcing Singapore-based Grab as a ‘marquee customer.’ Alongside this the company is seeing rapid adopting by financial services, automotive, IoT and telecommunications that require real-time data processing, artificial intelligence and machine learning.

iguazio CEO Asaf Somekh said, “We’ve chosen Singapore as our regional headquarters due to its role as a hub for innovation, opening up a variety of opportunities including cybersecurity, IoT, Smart City, financial services and telematics, making it an ideal location to accelerate iguazio’s APAC operations.”

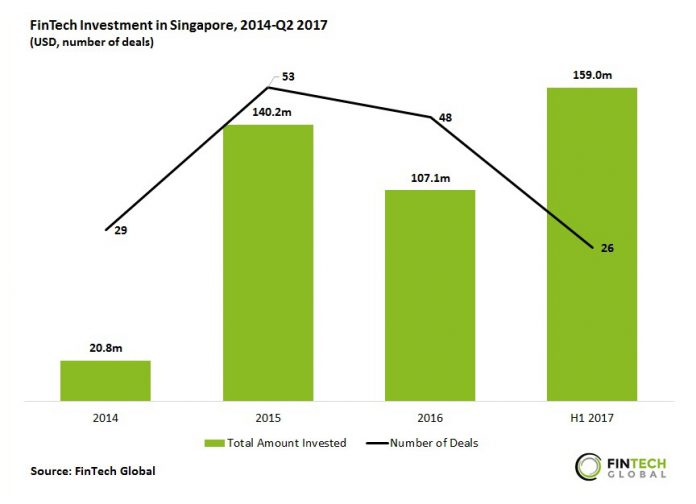

Singapore has seen a record year in funding, with the first half of the year securing 13.4 per cent than the whole of 2016.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global