Brazil-based online lending solution Creditas has netted a $50m Series C funding round led by Vostok Emerging Finance.

Vostok invested $25m to the round, while the remaining equity was provided by existing investors including Kaszek Ventures, Quona Capital, QED Investors, International Finance Corporation and Naspers.

Following the transaction, Vostok hold a minority position and has representation on the company’s board.

Founded in 2012, Creditas is a secured lending platform for Brazilian consumers, which offers loans at affordable rates by using homes and autos for collateral. Using these goods for collateral, allow the company to offer borrowers a lower interest rate, longer repayment term and higher loan amount.

The company’s main source of loans funding is with institutional investors, and so this new line of proceeds will enable Creditas to explore new products and segments. Capital will also be used to develop its technology and expand its portfolio.

Vostok Emerging Finance managing director Dave Nangle said, “We are excited to announce our latest portfolio investment and our fifth in Brazil, reflecting our firm belief that Brazil offers one of the most attractive FinTech market opportunities globally. For us, Creditas represents a unique portfolio opportunity for VEF, as it is the most logical and impressive direct play into Brazils high opportunity secured consumer credit market.”

Over recent months, Vostok has been very active in the FinTech sector, with the firm leading the $40m round into the personal finance platform GuiaBolso in October. The firm contributed $30m of the capital into the Brazilian company, which plans to use the funding for customer and product growth.

During the month Vostok also led a $1.5m funding round into the Pakistan-based payment solution Finja. The company offers users the ability to access a real-time payment solution and a payroll system.

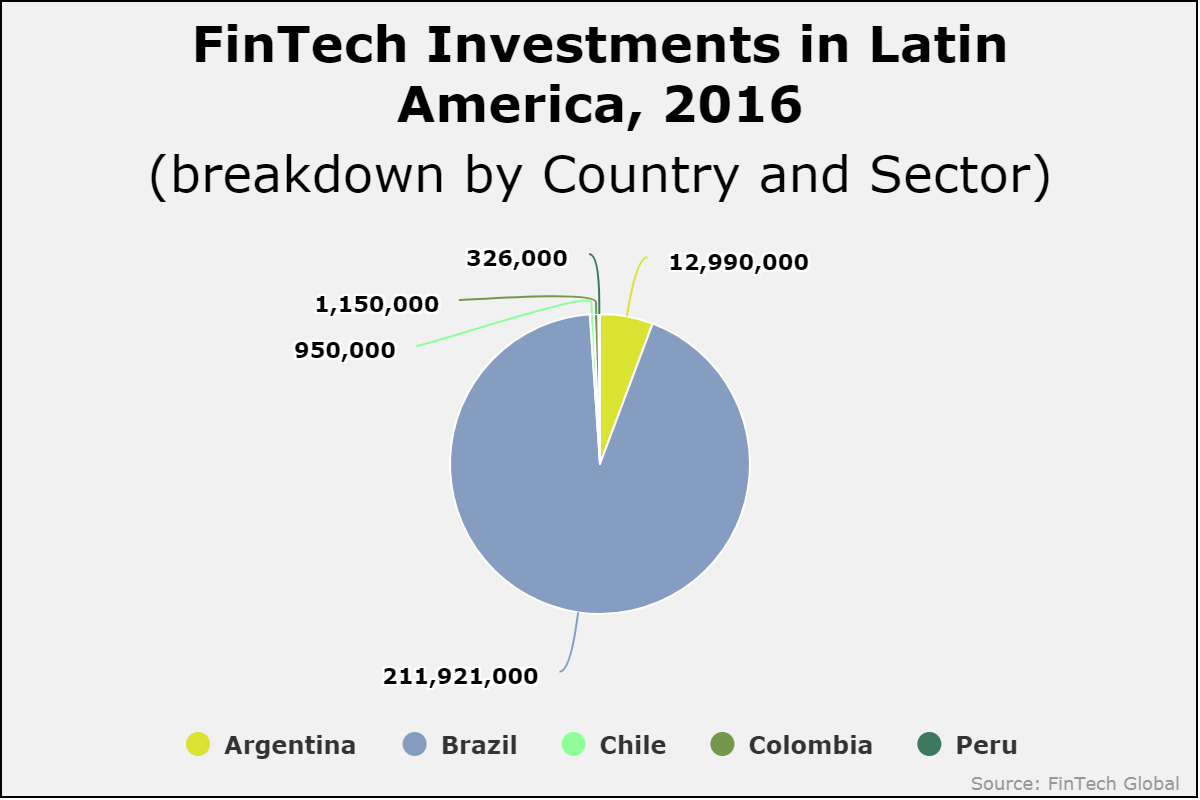

The Brazilian FinTech market has received the most attention in Latin America, with it seeing 93 per cent of the total capital last year.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global