Credit scoring algorithm company Finiata has reportedly closed an €18m equity and debt round.

The financing was split, with €10m being supplied as part of a Series A from DN Capital, Point Nine, Fly Ventures, Redalpine, ENERN, and Kulczyk Investments, according to an article by TechCrunch. The remaining €8m was in the form of debt, it said.

Finiata is a credit scoring system that uses both traditional scoring algorithms and alternative data sources. The algorithm has 10,000 data points at its disposal, to better understand SMEs and help banks and financers make better decisions for financing.

This new branch of funds will be used by the company for expansion across Europe, the article said.

Following this latest investment, Finiata’s total funding has reached around €27m, with the company bagging €5.5m at the start of the year.

At the end of last month, fellow credit scoring solution FinTecSystems raised its own funding. The company secured €4.5m in a round led by Reimann Investors, and hopes to expand it solution to Italy, France and Switzerland. The same week also saw credit scoring solution First Access receive a $7m Series A round led by Bamboo Capital Partners.

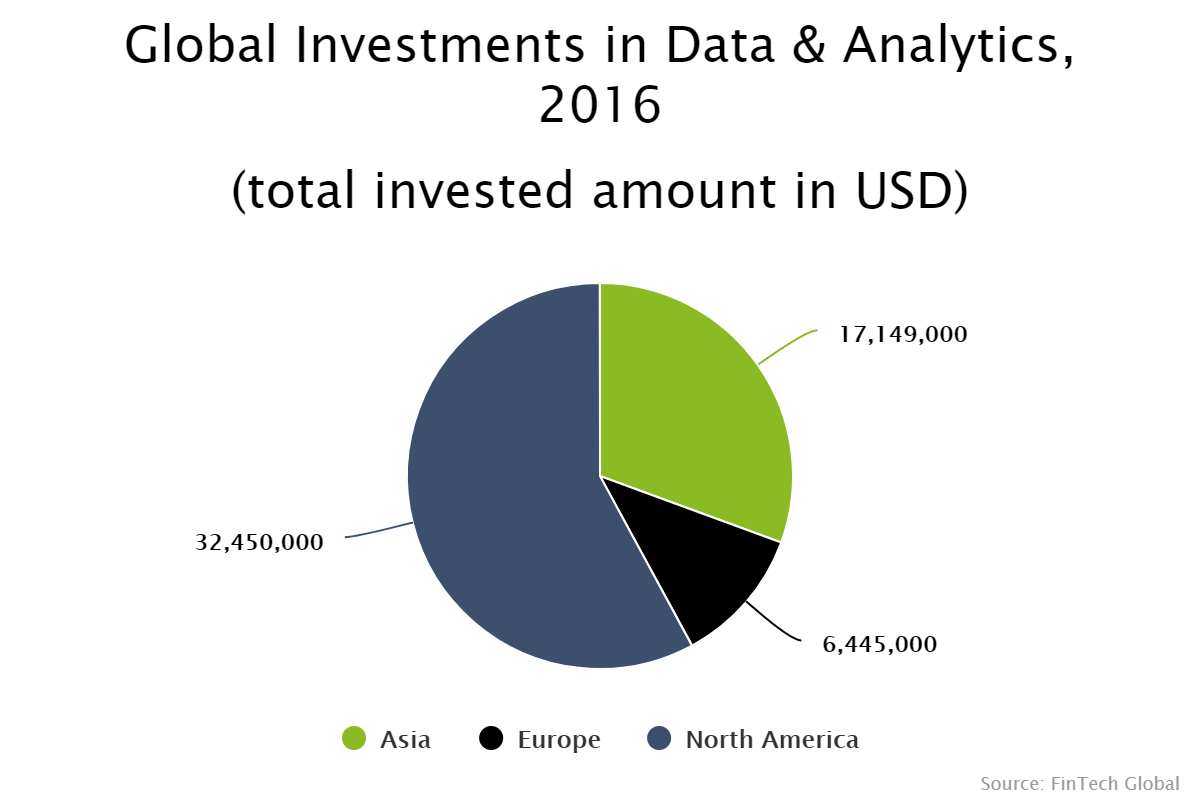

The credit scoring sub-sector was dominated by the North American region last year, with it seeing more than half of the capital. North America saw $32m invested over the year, while the next biggest area was Asia with $17m.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global