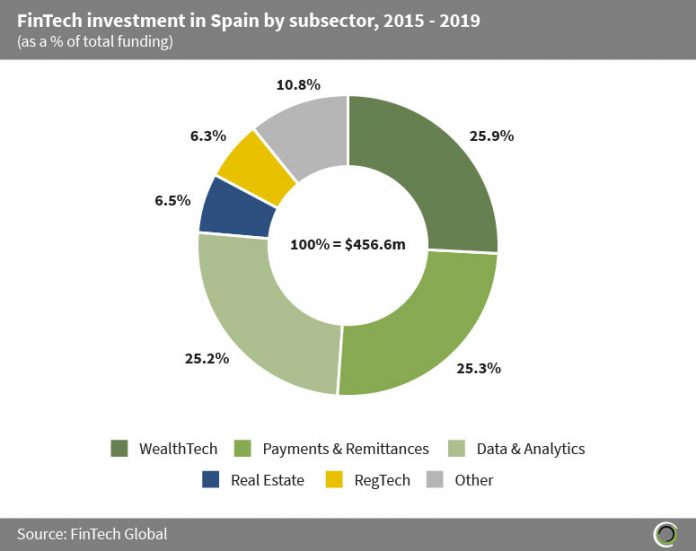

Spanish FinTech companies raised $456.6m across 123 transactions between 2015 and 2019, with three FinTech subsectors (WealthTech, Payments & Remittances, and Data & Analytics) receiving 76.4% of overall Spanish investment during the period.

WealthTech companies captured the lion’s share of FinTech investment in the country with 25.9% raised by companies operating in the subsector since 2015. The implementation of PSD2 made consumer bank account data available to third party organisations, which made it easier for FinTech startups to enter the banking industry and increase competition. This coupled with the increased demand for digital wealth services prompted investors to back the sector heavily.

Data & Analytics was the third most funded FinTech subsector in Spain accounting for 25.2% of investment in the country over the period. The subsectors surge in investment was driven by the digital transformation that both SMEs and financial institutions were undertaking, which involved investment into new technologies to improve efficiency and reduce operational costs.

The Other category contains Marketplace Lending, Funding Platforms, Institutional Investment & Trading, InsurTech, Infrastructure & Enterprise Software, and Blockchain & Cryptocurrencies companies, which collectively raised 10.8% of FinTech investment in Spain since 2015.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global