FinTech Acquisition Corp has acquired and merged with Intermex Wire Transfer, from its owner Stella Point Capital.

The deal is valued at $250m, and is made of $99m in cash and $161m in FinTech Acquisition Corp common stock. Alongside this, FNTE will pay $20m in outstanding debt under the company’s existing credit facility.

Following the merge, the company will continue to be listed on the Nasdaq Stock Market, and Intermex’s management team will continue to lead the company. Intermex’s board of directors’ members will also become directors into the combined company, with FNTE able to appoint an independent observer.

Intermex is an online and retail solution to send money to Latin America, from around the world. The solution has a network of 55,000 payer locations, within 48 US states, and in 17 Latin countries.

Through the company’s technology, a consumer is able to wire transfer, cash checks and money order. The system is compliant and has real-time anti-money laundering processes.

With this merger, the company hopes it will support its growth strategy and the development of its new products and technology.

FNTE board of directors chairman Betsy Cohen said, “Since 2013, Bob has driven both growth and profitability, with transaction volume having increased more than 2.5x, and EBITDA experiencing a compound annual growth rate of almost 40%. Intermex is an omnichannel operation whose proprietary technology assures the highest quality of service.

“The continued expansion of online services, loyalty cards and scalable proprietary processing capacity will drive continued revenue growth and margin expansion. The transformation of this private company will reduce its cost of capital, create a currency for acquisitions, and increase visibility with customers and agents.”

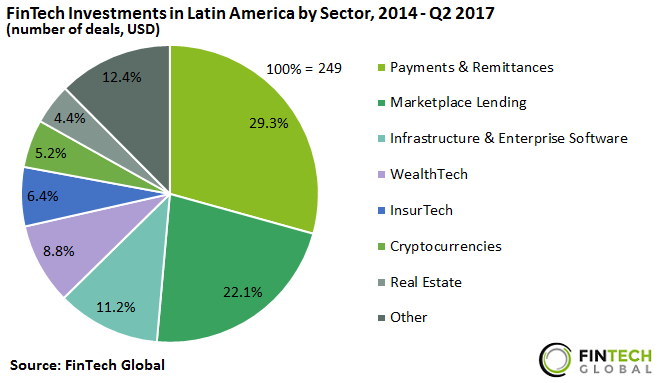

The biggest FinTech sector in Latin America is payments and remittance solutions, with the vertical accounting for 29 per cent of the total transactions. Marketplace lending companies, is the next biggest industry, with the pair representing more than half of the region’s activity.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global