Savings chatbot Chip has stormed passed its crowdsale target, closing the campaign on just over £1m.

The capital came from 3,202 investors, and saw 18.34 per cent of the company’s equity sold through the sale. An initial target for the crowdfund was £600,000 and was raised at a pre-money valuation of £4.8m.

The UK-based company is an AI-powered chatbot for automatic savings accounts, to help consumers save money. A user connects their current account, with the algorithm calculating the amount which the user can afford to save each month, and then automatically putting it in to the savings account.

Since it launched, Chip has helped to process £6.7m, analysed more than 10 million transactions and helped 25,000 consumers.

Next year the company is looking to launch its overdraft feature which will allow users to reduce borrowing costs and maximise savings.

A range of chatbot finance management solutions have raised capital this year. In recent months, UK-based digital health management platform Moneyfarm acquired the personal finance chatbot technology used by Ernest. Moneyfarm is looking to integrate the chatbot technology with its current solution to help its users manage their money and budget.

AI-powered personal finance app Cleo has raised £2.7m from two separate funding rounds during the year. The company’s most recent capital round was a £2m commitment led by LocalGlobe’s Robin Klein and a group of angel investors.

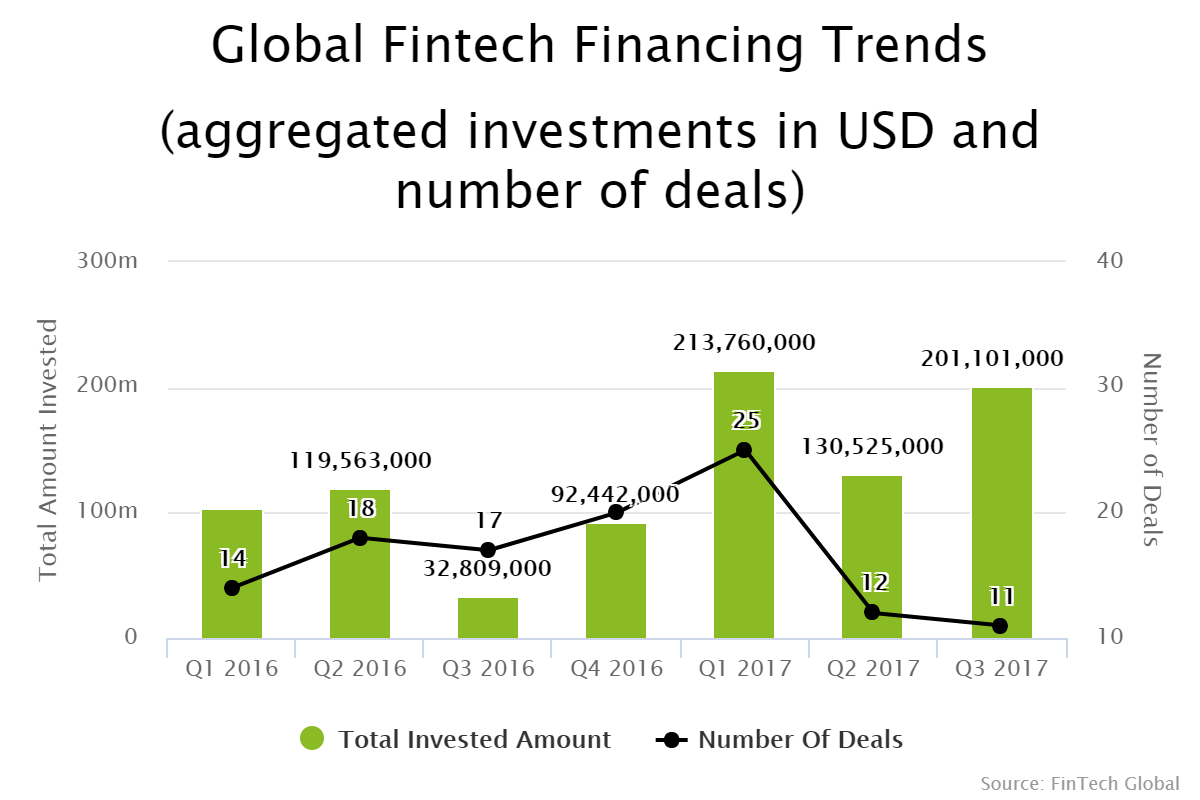

The European WealthTech sector has seen a rise in funding this year compared to 2016, with the first three quarters already seeing $197m more capital invested.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global