Australia-based payroll solution Ascender has reportedly closed a $76.6m funding round from HarbourVest Partners.

The capital was raised through Potentia Capital, which owns the majority stake in Ascender, and comes just ahead of the company’s IPO on the Australian Securities Exchange, according to a report by the Australian Financial Review.

Ascender is a payroll outsourcing solution that utilises software to help companies automate manual tasks. The company also helps to ensure that company’s stay fully compliant with local regulations.

Through the company’s platform, clients gain access to a cloud-based application to connect payroll, HR and enterprise applications.

Following the investments, Ascender is looking to outsource some of its non-core functions in order to receive higher returns and deploy the capital elsewhere, it said.

Earlier in the week, cloud-based company Quinyx landed a $12m funding round from Battery Ventures. The company enables businesses with workforce management services, automating manual processes for payroll, scheduling, time punching and communications.

HarbourVest Partners invested into Investment Metrics alongside Resurgens Technology Partners earlier in the year. While the value of the deal was undisclosed, the company hopes to use it for global expansion.

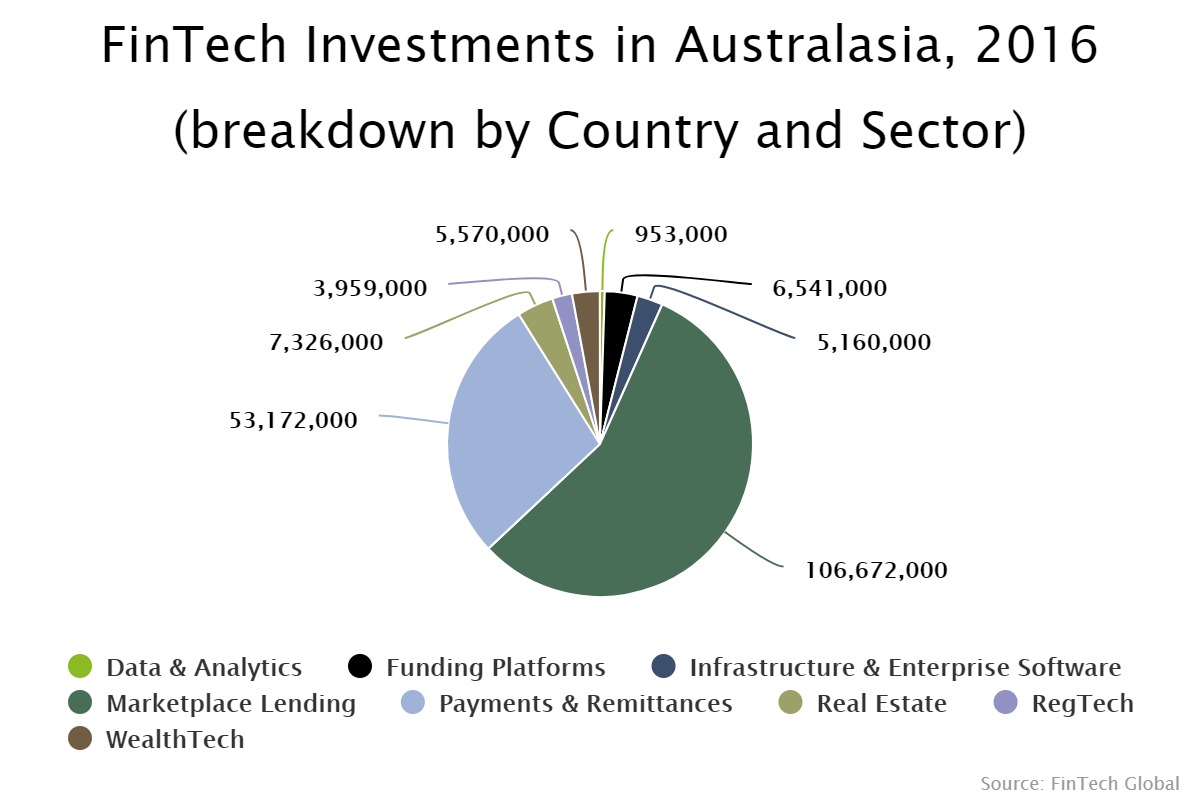

The Australian FinTech sector was dominated by marketplace lending companies in 2016, with it receiving more than half of all capital. The infrastructure and enterprise software sector did not see much attention, and was one of the least funded areas in the region.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global