ThoughtLab conducted a comprehensive survey in September / October 2023 of 250 investment providers. These include broker-dealer/wire-houses, private banks, online trading platforms, wealth management divisions of universal banks and retail or regional banks, independent investment advisory firms, family/multi-family offices, wealth management divisions of investment banks, and robo advisors. Respondents were from the following countries/regions: Australia, China/Hong Kong, Japan, Singapore, Europe, Switzerland, United Kingdom, Germany, France, Benelux, North America, Canada, United States, Middle East, UAE, Saudi Arabia.

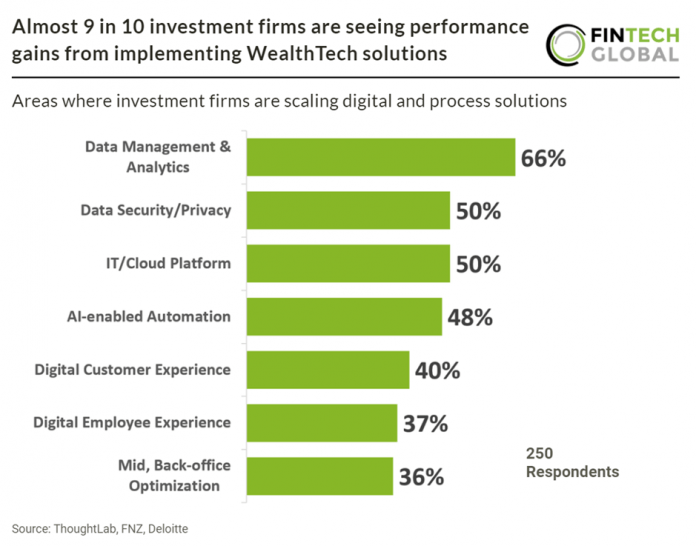

Wealth management firms have made significant advancements in digital innovation, with nearly 9 out of 10 firms either in mid-implementation or advanced stages across various technological and process transformation areas. This marks substantial progress compared to previous studies, indicating a shift from 40%-50% of firms being at mid- or advanced stages in 2021. Notably, progress has been most pronounced in establishing digital foundations for growth, such as advanced data management, AI-driven automation, and modernized cloud-based platforms. However, there’s still room for improvement in addressing people-centric aspects of digital transformation, like enhancing user experience and fostering a digital culture.

There’s also a notable lag in middle and back-office optimization, areas likely to undergo rapid changes with the introduction of next-day settlement processes.

“Adopting an end-to-end wealth platform is a transformative approach that integrates modern technology, business, and investment operations, all in a regulated financial institution. Financial organizations are advised to consider such platforms as strategic partners for their future transformation,” says Din Mustaffa, Group Chief Strategy Officer, FNZ.

In the upcoming three years, the majority of firms intend to enhance their modern IT platforms through the procurement of vendor solutions. To mitigate the risk of technological dependency, firms are shifting away from purchasing from limited groups of major vendors. Instead, nearly half of the firms opt for solutions from various top-tier vendors, and this trend is expected to persist over the next three years.

Technological advancements will streamline the development of in-house solutions. Concurrently, nearly a quarter of firms plan to internally create proprietary solutions, doubling the current rate. This strategy is particularly prevalent among online trading platforms and robo-advisors seeking to distinguish themselves through highly tailored platforms.

Peyman Pardis, Head of Wealth Management, Deloitte Canada, believes that the rise of AI-powered, low-code development tools will make it possible to develop proprietary solutions in-house. “We see investment providers leveraging these technologies to build custom applications at a fraction of the cost, upending the traditional pricing models of narrowly focused SaaS companies,” he says. “Exorbitant seat fees and monopolistic market dominance will slowly give way to a more democratized and affordable software landscape that will support lower costs to serve clients,” he adds.