Tag: Family Offices

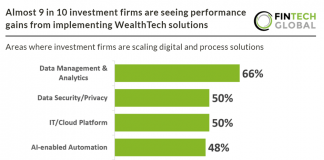

Almost 9 in 10 investment firms are seeing performance gains from...

ThoughtLab conducted a comprehensive survey in September / October 2023 of 250 investment providers. These include broker-dealer/wire-houses, private banks, online trading platforms, wealth management...

InCred set to join unicorn club amidst $60m funding round

InCred Holdings Limited has revealed that it is set to land INR 500 Cr ($60m) in its Series D funding round.

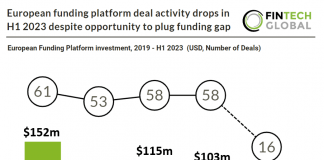

European funding platform deal activity drops in H1 2023 despite opportunity...

Key European Funding Platform investment stats in H1 2023:

• European Funding Platform deal activity reached 16 transactions in H1 2023, a 57% drop YoY

•...

Fee transparency revolution: WealthArc and GreenLock’s game-changing partnership

In the world of finance, many establishments have taken advantage of non-transparent fee systems, resulting in overlapping charges. Such intricate fee regimes often deter Family Offices from meticulously tracking their investment strategy execution fees. In this landscape, custodian banks, with no particular stake in the game, offer minimal assistance in fee monitoring.