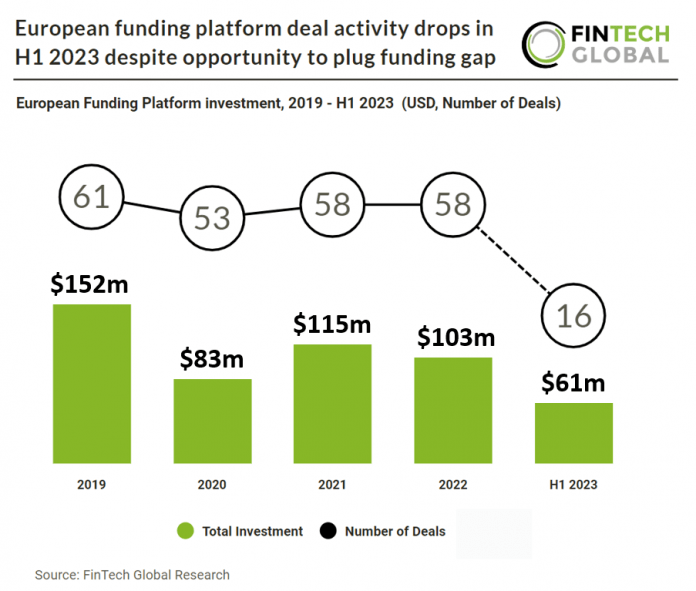

Key European Funding Platform investment stats in H1 2023:

• European Funding Platform deal activity reached 16 transactions in H1 2023, a 57% drop YoY

• Based on current pace, deal activity in the sector is on track to reach 32 funding rounds this year, a 45% reduction from 2022

• In contrast, European Funding Platform investment is expected to reach $122m in 2023, an 18.4% increase from 2022

European Funding Platforms have seen a drop in deal activity during the first six months of 2023 although this is inline with the global drop in FinTech deal activity. European FinTech deal activity dropped 45% in H1 2023 YoY. This is surprising however as funding platforms are uniquely positioned to benefit from the withdraw of venture capital funding. It is clearly a more competitive market when raising funds from institutional investors and startups will likely turn to alternative ways of raising funds such as funding platforms and crowdfunding.

Crowdfunding has become a choice for some larger companies, despite its inconsistent returns and smaller funding amounts compared to venture capital deals. Curve, an all-in-one banking platform, successfully raised nearly £10m in 2021 through crowdfunding after securing institutional backing and a $250m valuation. Moneybox, Qonto, Chip, and Paysend also used crowdfunding in various ways in 2022. Plum, a financial assistant app, secured £1m from investors within just 8 hours during its October 2022 crowdfunding round. Furthermore, Crowdcube offers investment opportunities in other fintech startups like Tred, a carbon-neutral business account, and Stratiphy, an AI-powered investment platform.

In the first half of 2023, deal activity for European Funding Platform fell to 16 transactions, marking a substantial 57% year-on-year decrease. European Funding Platform deal activity is anticipated to hit 32 deals in 2023, signifying a notable 45% decrease compared to last year. European Funding Platforms raised a combined $61m in H1 2023, a 30% increase YoY. Investment in European Funding Platforms is projected to achieve $122m in 2023, indicating an 18.4% rise compared to 2022.

Funderbeam, a UK based funding and trading platform, had the largest European funding platform deal in H1 2023 after raising $40m in their latest Venture funding from VentureWave which acquired the majority stake in the company. The company is looking to break out of Europe and scale globally through VentureWave subsidiary Vestiver, which helps founders to manage their venture stage fundraising process digitally and handle investor relations after securing funding. VentureWave says the group is gearing up to enter the US market in 2024. This acquisition equips VentureWave with the technology to target the full spectrum of global venture investments and secondaries, spanning from early-stage angel funding to pre-IPO secondaries. For FunderBeam, this transaction provides the opportunity to expand its services from angel markets to include institutional clients such as VC funds, family offices, brokers, and investment banks. VentureWave’s chairman, Alan Foy, sees this investment as a transformative moment for the venture markets, emphasizing the potential to place impact at the core of the investment industry.