Key Lending Tech investment stats in 2023:

• European Lending Tech deal activity totalled at 43 transactions in 2023, a 45% decrease from 2022

• European Lending Tech companies raised a combined $761m in 2023, a 15% reduction YoY

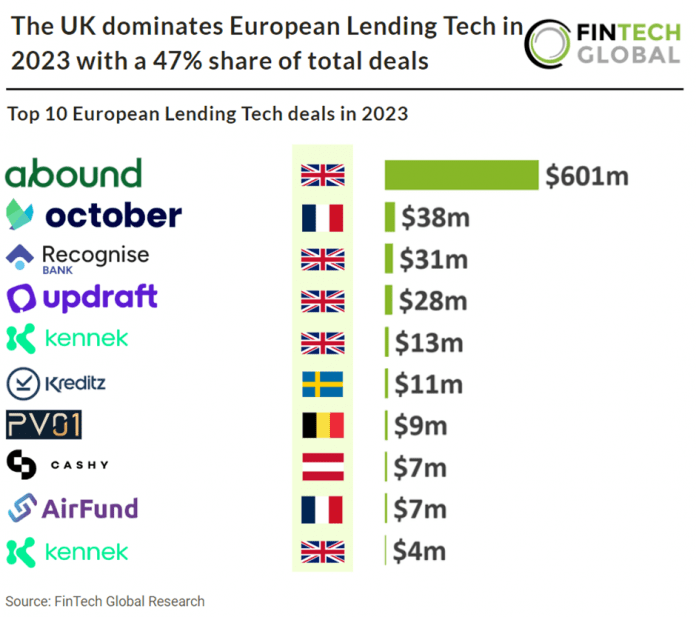

• The UK was the most active Lending Tech country with 20 deals, a 47% share of total deals

In 2023, the European Lending Tech sector witnessed a notable decline in deal activity, with only 43 deals recorded, marking a significant 45% decrease compared to the previous year. This downturn in deal activity reflects a shifting landscape within the industry. Despite the decrease in deal volume, European Lending Tech companies managed to raise a combined total of $761 million throughout the year. However, this figure represented a 15% reduction year-over-year, indicating a somewhat challenging fundraising environment for these companies.

Abound, a consumer lending financial firm, had the European Lending Tech deal in 2023 after raising £500m ($601m) in their latest venture funding round from K3 Ventures, Hambro Perks Ltd. and SR Ventures. The company intends to use the funds to expand the number of customers it lends to, to grow its headcount, and to develop its business-to-business offer. Established in 2020 under the leadership of Gerald Chappell, who serves as the CEO, and Dr. Michelle He, Abound is a financial service that leverages Open Banking and artificial intelligence to offer loans ranging from £1,000 to £10,000, with repayment terms extending up to 5 years. As of now, the company has experienced consistent monthly growth of 30% and has assisted more than 150,000 customers through its platform. It’s worth noting that Abound operates as the consumer-facing division of Fintern Ltd, which also owns Render, the proprietary technology employed by Abound to facilitate intelligent lending solutions.

The UK was the most active Lending Tech country with 20 deals, a 47% share of total deals. This was followed by Italy and Spain with five deals each, a 11.6% share of deals.

In January 2024’s bank lending survey (BLS), euro area banks continued to moderately tighten credit standards for loans to enterprises and households in the fourth quarter of 2023. This tightening trend, especially notable for consumer credit, reflects ongoing risk perceptions and lower risk tolerance among banks. Despite the slight easing observed in some areas, such as housing loans, the overall credit environment remained constrained, contributing to decreased loan growth to firms. The decline in loan demand persisted, primarily driven by higher interest rates and reduced fixed investment, although banks anticipate a small increase in demand for loans to firms in the first quarter of 2024. Demand for housing loans and consumer credit also decreased, influenced by interest rates and consumer confidence, with expectations for a continued decline in consumer credit demand. Overall credit terms tightened further for firms and consumer credit but eased slightly for housing loans. Rejected loan applications continued to increase across all segments, indicating ongoing challenges in accessing credit.

The UK dominates European Lending Tech in 2023 with a 47% share of total deals

Investors

The following investor(s) were tagged in this article.