Tera Funding has closed a $9.3m Series A, the largest to be made to a Korean P2P lending company.

Atinum Investment led the round, while Woori Bank, SBI Investment and Premier Partners also provided the capital for the Series.

South Korea-based Tera is a P2P real estate lending platform, where users are able to invest in in secured bonds to help with the construction of properties. The platform analyses each of the opportunities and conducts risk management to ensure secure investing.

The company has originated over KRW 240.8bn ($226.3m) in loans with the total amount returned to investors reaching KRW 136.9bn ($128m). Through the platform the average rate of return is around 12.45 per cent, according to the company.

Tera Funding CEO Tae-young Yang said, “As we successfully secured series A investment, we will be able to further our vision and focus on finding new talents in real estate, finance and IT sectors to improve our loan evaluation system as well as risk management process to retain our position as no. 1 in real estate P2P lending industry.”

Following this investment, Tera Funding total funding efforts have reached around $10.4m, with the company having previously raised a $1.1m round in 2016. The company previous investment was supplied by Bon Angels Venture Partners and a group of angel investors.

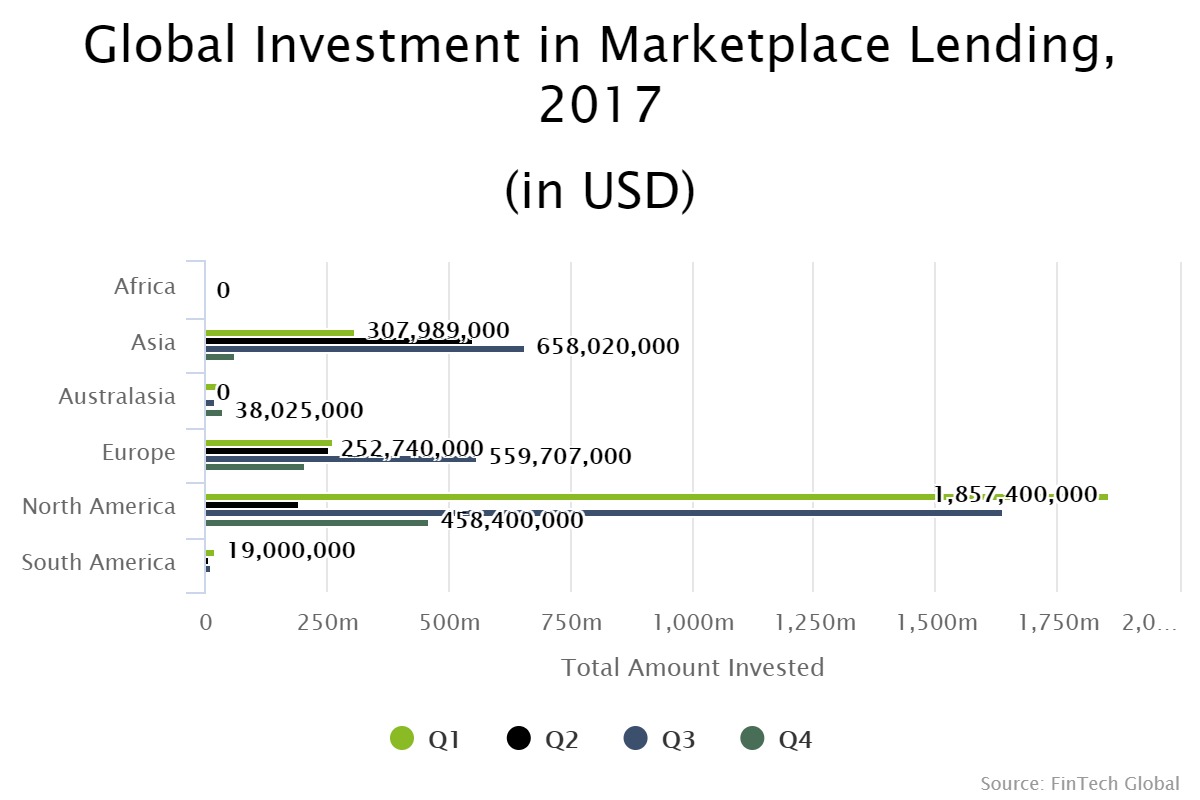

Last year, Asia was the second largest market for the marketplace lending sector, with North America leading the way for investments. Asia received just over a fifth of the funding in to the space, with $1.5bn being invested over the year.

Copyright ? 2018 FinTech Global

Copyright ? 2018 FinTech Global