Rabobank has launched a new €60m strategic investment vehicle which will back early-stage FinTech and food and Agri companies.

Rabo Frontier Ventures will be completely financed by Rabobank Group and will invest and partner with companies that support the banks own development. The firm is looking at four main areas, Financial Cruise Control, Platform Banking, Emerging Technologies and Data4Food.

This new division will support startups, spin-offs and scale-ups, and has already backed several startups that have emerged from Rabobank’s accelerator programme. RFV has backed blockchain technology developer We.trade and spare-change investment app Peaks.

Rabo Frontier Ventures Harrie Vollaard, “We’ve been active in the worldwide FinTech and Food & Agri ecosystem for years and have succeeded in entering into various alliances. RFV provides Rabobank with an added vehicle for working more shoulder-to-shoulder with innovative businesses with the aim of transforming the FinTech and Food & Agri sector and building a sustainable and future-proof banking model.”

Last week, New York Life’s investment division passed the $200m mark for committed capital in early-stage investments. The firm backs companies not only in the insurance space but also FinTech, data and analytics and health and wellness.

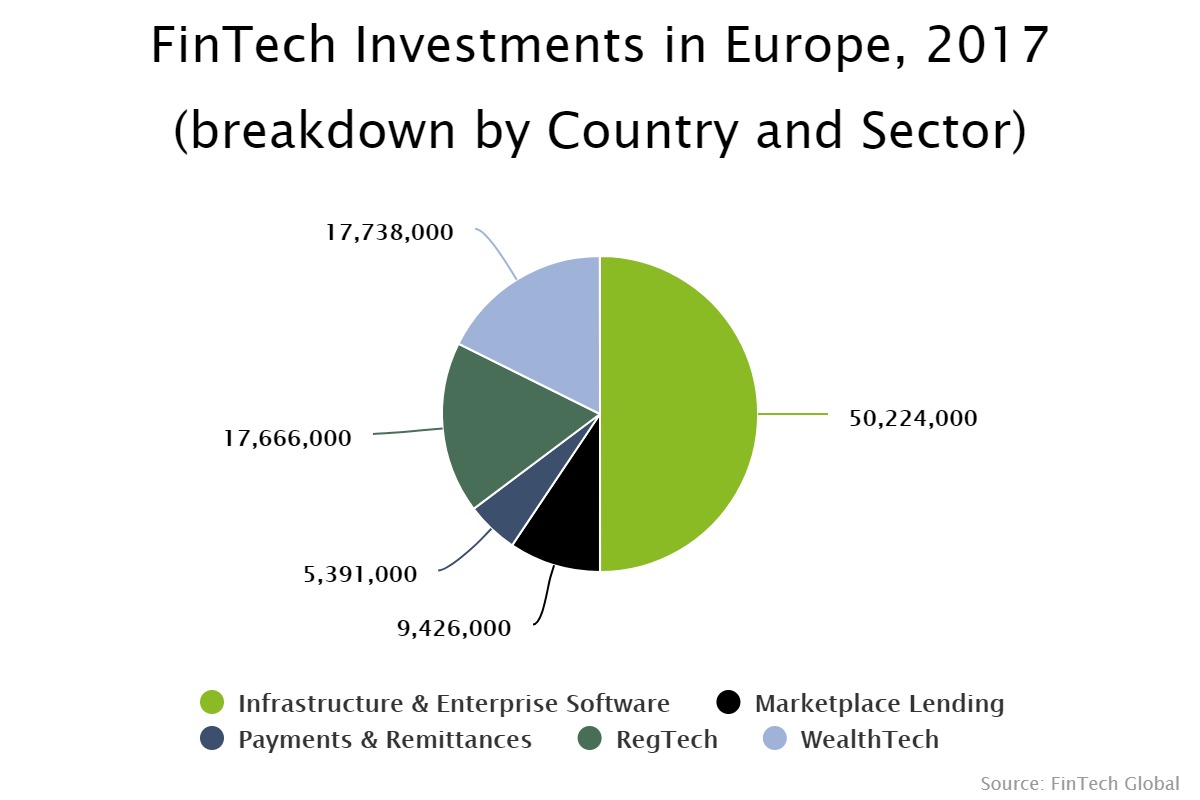

Half of the funding in to the Dutch FinTech sector went to the infrastructure and enterprise software sector. There was $50m deployed to companies in the space, while the second biggest sector was WealthTech, which raised $17m.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global