Big data company Trifacta has raised a $48m funding round from new strategic investors including Google, and New York Life.

Other new backers included Columbia Pacific, Deutsche Börse and Ericsson. Accel, Cathay Innovation, Greylock Partners, Ignition Partners, and Ridge Ventures all returned as investors to the company.

San Francisco-headquartered Trifacta is a data wrangling company that utilises machine learning to speed up data preparation. Through the solution users are able to receive data easier to create better analysis.

The company is used by banks and insurance companies to complete a range of processes including executing advanced consumer analytics, managing risk, detecting fraud, accessing portfolio valuations and improving investment management. The solution can also help clients to keep up with regulation changes, with a tool to speed up regulatory reporting.

Trifacta will use this capital to further its platform development and accelerate its cloud and geographical expansion.

Deutsche Börse managing director Ankur Kamalia said, “Investing in and partnering with Trifacta, an innovator with its leading data wrangling offering, helps us expand our capabilities in data-driven areas such as risk management, investment decision making and trading analytics meaningfully.”

This investment brings Trifacta’s total funding to $124m, with the company’s previous funding round nabbing $35m in 2016. The previous investment received support from Accel Partners, Greylock Partners, Ignition Partners and Cathay Innovation. Trifacta raised the capital to supports its global growth and innovation.

Last week, New York Life Ventures passed the $200m mark for total capital committed in early-stage investments. The firm has kept a focus on the InsurTech, financial services technology, data analytics and health and wellness sectors.

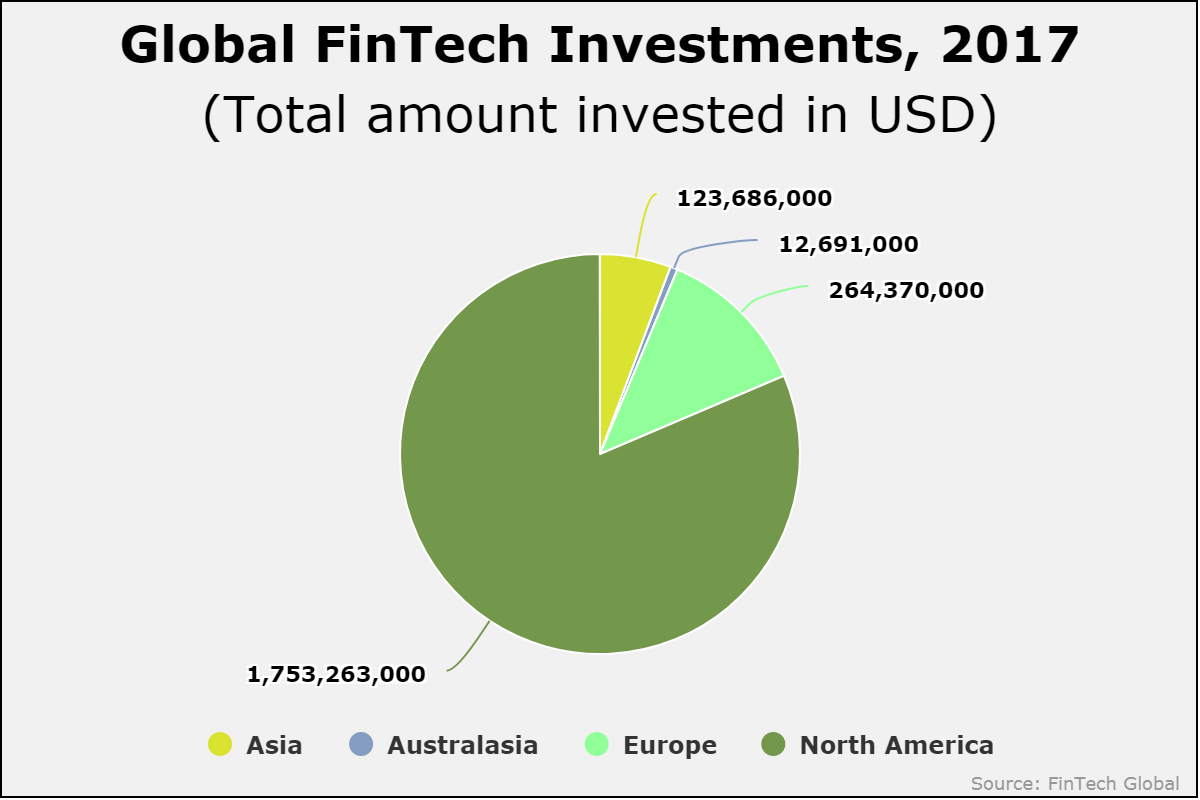

North America dominated the data and analytics sector last year, accounting for 80 per cent of total equity deployed.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global