Personal finance platform Oval Money has stormed past its crowdfunding campaign target, picking up £788,340.

The company initially targeted £500k, but surpassed the target and received contributions from 1050 backers. Through the sale, which was raised at the pre-money valuation of £5m, Oval Money sold 13.63 per cent of its equity.

London-based Oval Money helps consumers to track spending, become educated on spending habits, save money and make crowd investments through a financial product marketplace. The company targets young adults that are aged between 18 and 44 years old and have a median monthly income of £1,600.

Oval has already hit 50,000 users and helps to make an average monthly savings of £110 per user, according to the company.

Earlier in the year, personal finance app IndianMoney.com secured a $3m funding round from SRI Capital and Hyderabad Angels. The company, which helps to support the financial wellbeing of consumers, hopes the capital will support its growth.

Last year, Dosh closed a $4.9m funding round led by Goodwater Capital and participation from Extol Capital and Next Coast Ventures. The company helps users to save money by searching for offers and deals on transactions they have completed, but without having to scan the receipt.

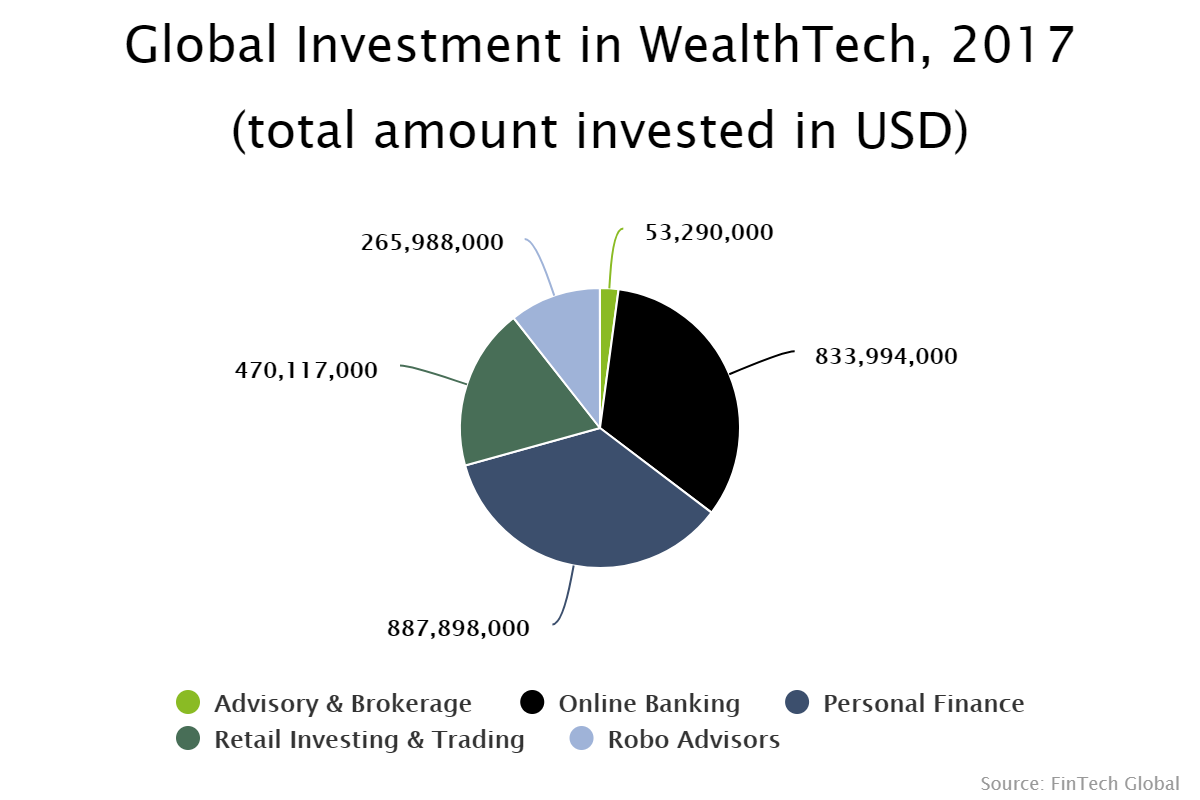

The WealthTech sector’s biggest area of funding last year was personal finance. The sub-sector received around 35 per cent of the capital investments and was followed closely by online banking which saw around 33 per cent of the capital share.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global