Cryptocurrency venture capital firm SPiCE VC has closed its pre-ICO sale on $40m, and has now launched its ICO.

The firm will invest in tokenised and blockchain projects with its cryptocurrency capital pool. The company will also allow co-investment from backers in the company, through the use of its regulatory compliant SPiCE token.

SPiCE is looking to back primary and secondary issuing and trading platforms, tokenised platforms, financial, banking, marketing, management and operations solutions, and automated legal, compliance and regulatory solutions, according to the company. Investments will be made to companies that are in-between seed investments and Series As and ICOs.

In a blog post, SPiCE VC co-founder Carlos Domingo said, “When we started this project we wanted to build the best tokenized VC fund on the blockchain everaging this exciting technology to provide liquidity, inclusivity and transparency to the world of venture capital and to demonstrate that you can also execute a legal and properly regulated security token sale.”

SPiCE has already made its first investment, backing regulation compliant security token company Securitize. The company helps to process investors and the issuance of the secure tokens throughout the lifetime of the asset.

Last year, Bitwise Asset Management raised a $4m seed round from investors including Khosla Ventures’ Keith Rabois, General Catalyst’s Hemant Taneja, and Blockchain Capital, among others. Alongside the funding, the company launched HOLD 10 Private Index Fund which is a cryptocurrency investment fund focused on acquiring various tokens.

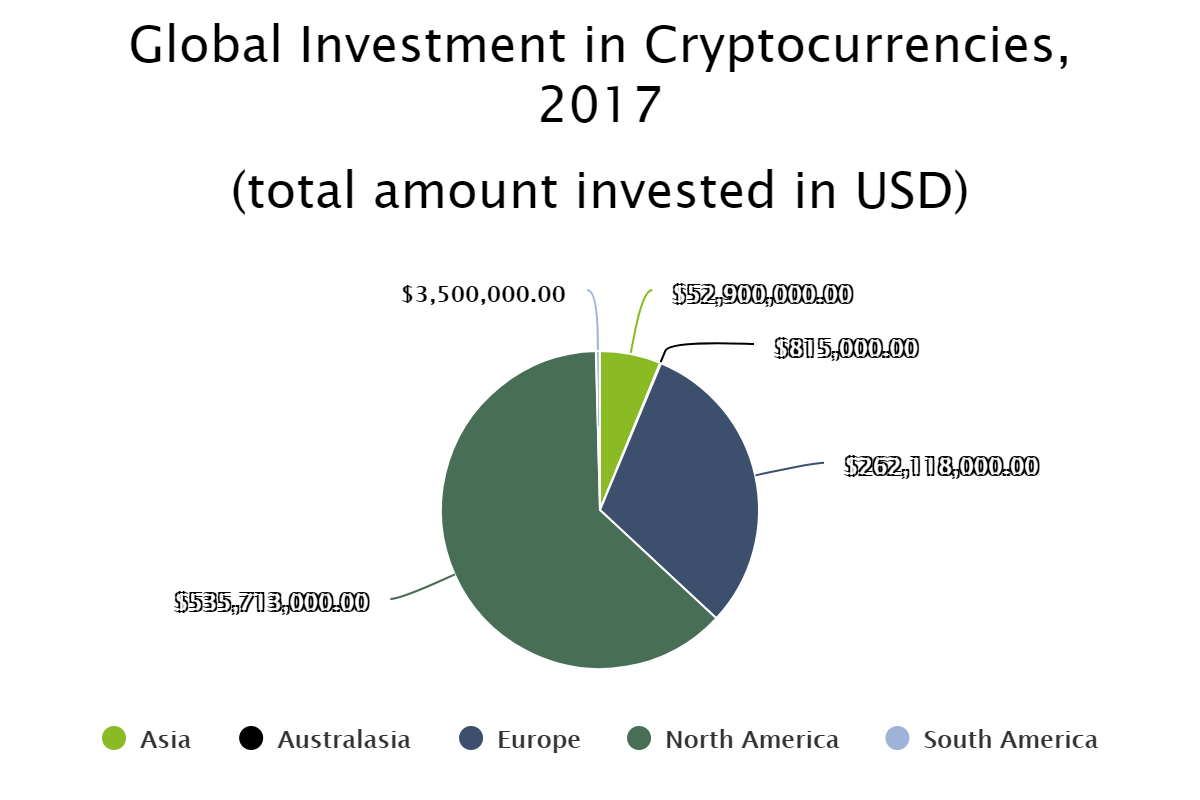

Around 63 per cent of the capital deployed in to cryptocurrency companies last year went to ones based in North America. The next biggest market was Europe, which received around 30 per cent of the activity.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global