CoinMetro closed its pre-ICO on €7m after contributions from 5,000 participants.

The token sale finished after 12 hours, and ended more than a week earlier than initially planned. CoinMetro, which is set to launch its ICO next week, has a hardcap of $300m and will have an initial price of €0.01.

CoinMetro is a blockchain-based financial platform that enables users to buy and sell cryptocurrencies and access to a decentralised exchange for trading. The company will also offer instant withdrawals on cryptos, and the ability to lend cryptos to others and earn interest.

Based in Hong Kong, the company is also looking to offers investment opportunities, by helping users build portfolios and manage their assets or even access to a vetted ICO marketplace.

Following the ICO, the company will look to launch a beta of its exchange, expand its licensing and launch its debit card, according to CoinMetro’s roadmap. The proceeds from the sale will be split between HR and development, marketing, held for potential acquisitions, and for legal, compliance and regulatory processes.

Earlier in the month, online crypto-marketplace Storiqa closed its ICO on $25m from 55,000 backers across 170 countries. The platform aims to help SMEs with their global trading and e-commerce efforts by accepting most cryptos and fiat money.

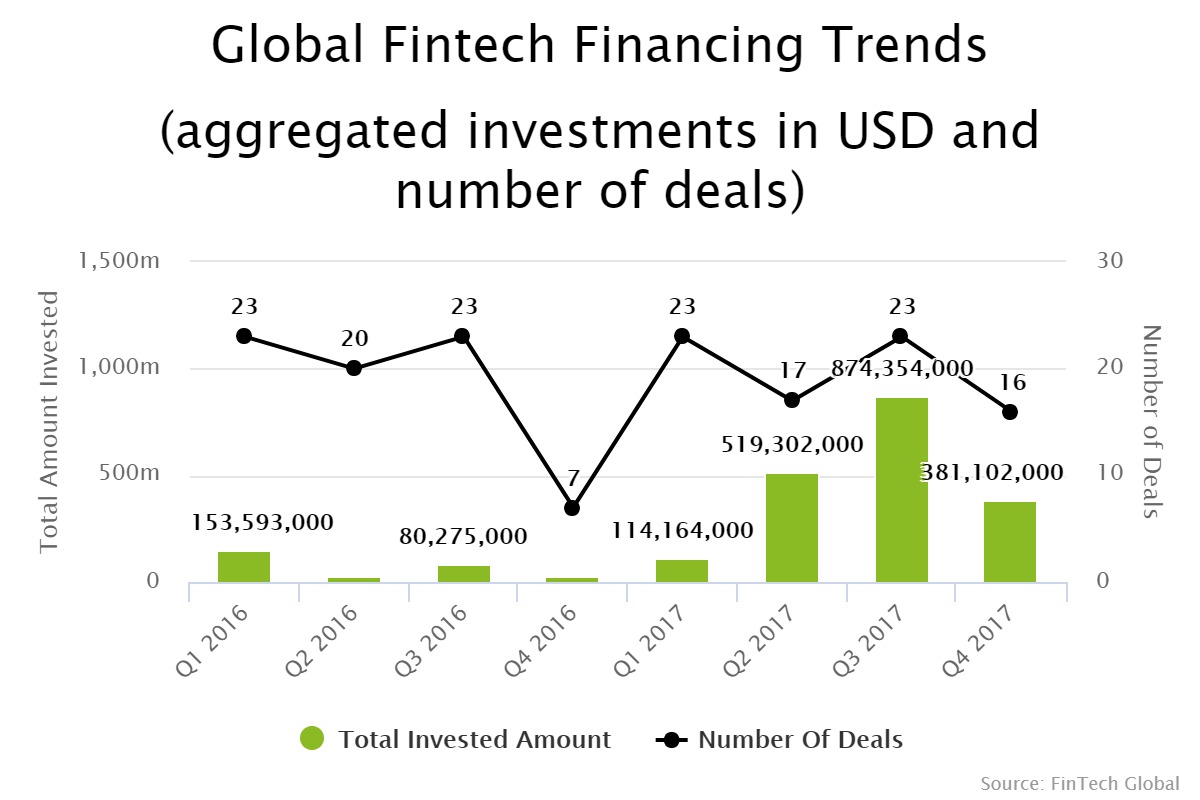

There was a huge rise in funding into cryptocurrency and blockchain companies last year, compared to 2016. The sector saw six-times more capital invested last year, than in 2016, with $1.8bn being invested to the space.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global