SALI Fund Management, a turn-key solution developer for insurance dedicated funds, has received an undisclosed growth capital investment from Long Ridge Equity Partners affiliates.

Founded in 2002, the company administers IDFs for alternative asset managers across hedge funds, credit funds, and private equity funds. The solution provides firms with a streamlined and cost-effective IDF platform which can support development, administration and marketing.

Sali, which administers more than 100 IDFs and partnered with 28 insurance companies, helps to create tax compliant IDFs which can be used by investment firms, insurance companies and brokers to distribute in various markets. The company supports investments and money management in, corporate-owned life insurance, insurance company‐owned life insurance, bank‐owned life insurance, pensions, endowments, and foundations.

Proceeds from the investment will be used to further its growth initiatives, as well as providing partial liquidity to retired shareholders.

SALI principal Eric Naison‐Phillips said, “Our partnership with Long Ridge will allow SALI to continue its pace of investment in our infrastructure and people, so we can continue to provide world‐class product and service offerings to our clients. We are pleased Long Ridge has a shared vision alongside the SALI management team, and we look forward to a fruitful partnership.”

Last month, blockchain-based record-keeping platform for EU mutual funds IZNES secured an undisclosed strategic investment from a group of investors.

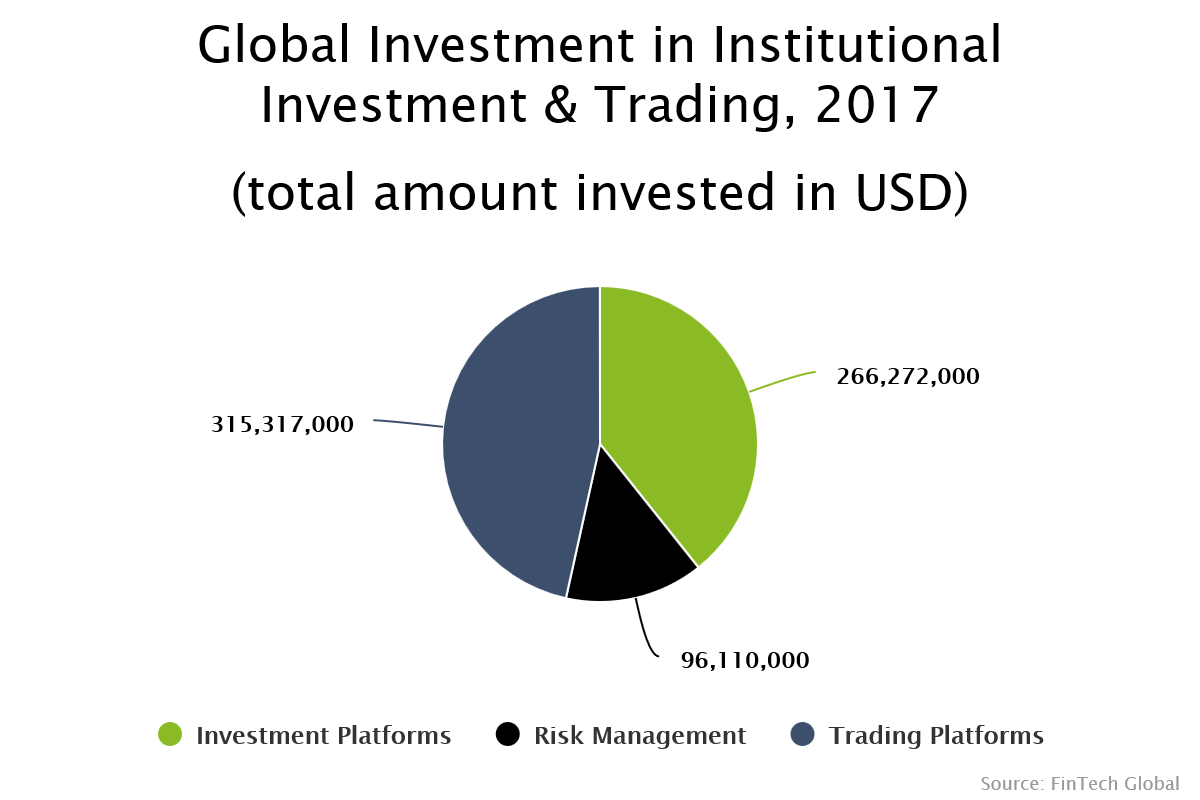

The institutional investing and trading sector raised $677m in funding last year, of which 47 per cent went to the trading platform sub-sector, according to data by FinTech Global. Investment platforms picked up the second highest deal value, representing around 40 per cent.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global